Growth in Renewable Energy Projects

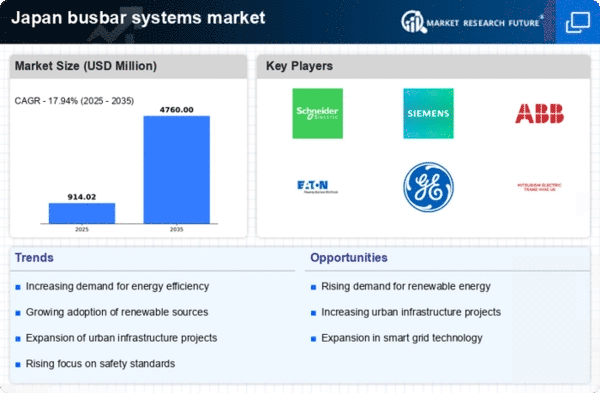

The busbar systems market in Japan is significantly influenced by the expansion of renewable energy projects. With the government's commitment to increasing the share of renewables in the energy mix, there is a growing need for efficient power distribution systems. Busbar systems are particularly suited for solar and wind energy applications, where they facilitate the connection of multiple energy sources to the grid. The market data suggests that investments in renewable energy infrastructure are projected to reach $100 billion by 2030, creating substantial opportunities for the busbar systems market. This growth is likely to be driven by both public and private sector initiatives aimed at enhancing energy security and sustainability.

Rising Demand for Energy Efficiency

The busbar systems market in Japan experiences a notable surge in demand driven by the increasing emphasis on energy efficiency. As industries and commercial establishments strive to reduce operational costs, the adoption of busbar systems, which offer lower energy losses compared to traditional wiring, becomes more prevalent. Reports indicate that energy-efficient solutions can reduce energy consumption by up to 30%, making busbars an attractive option. Furthermore, the Japanese government has set ambitious targets for energy conservation, which further propels the market. The busbar systems market is thus positioned to benefit from this trend, as businesses seek to comply with regulations and enhance their sustainability profiles.

Urban Infrastructure Development Initiatives

The ongoing urban infrastructure development initiatives in Japan significantly impact the busbar systems market. As cities expand and modernize, there is a heightened need for efficient electrical distribution systems to support new buildings and facilities. The government has allocated substantial funding for urban development projects, which includes upgrading electrical infrastructure. The busbar systems market stands to gain from these initiatives, as they provide a compact and efficient solution for high-density urban environments. With urbanization rates projected to reach 90% by 2030, the demand for busbar systems is likely to increase, driven by the need for reliable and efficient power distribution.

Technological Innovations in Power Distribution

Technological advancements play a crucial role in shaping the busbar systems market in Japan. Innovations such as smart busbars, which integrate monitoring and control systems, enhance the efficiency and reliability of power distribution. These systems allow for real-time data analysis, enabling operators to optimize energy usage and reduce downtime. The busbar systems market is witnessing a shift towards these advanced solutions, as they align with the increasing demand for automation and smart grid technologies. Market analysts project that the adoption of smart technologies could lead to a 20% increase in operational efficiency, further driving the growth of the busbar systems market.

Regulatory Support for Electrical Safety Standards

Regulatory frameworks in Japan are increasingly focusing on electrical safety standards, which directly influence the busbar systems market. The government has implemented stringent regulations to ensure the safety and reliability of electrical installations, prompting industries to adopt compliant solutions. Busbar systems, known for their robust design and safety features, are becoming a preferred choice among manufacturers and contractors. The busbar systems market is likely to benefit from this regulatory environment, as compliance with safety standards not only mitigates risks but also enhances the overall efficiency of electrical systems. This trend is expected to drive market growth as companies prioritize safety in their operations.