Rising Focus on Industrial Automation

The busbar systems market in Canada is influenced by the rising focus on industrial automation. As industries strive for increased efficiency and productivity, the integration of automated systems becomes essential. Busbar systems, with their ability to support high-density power requirements, are increasingly being adopted in automated manufacturing processes. The market is expected to witness a growth rate of around 5.8% annually, driven by the need for reliable power distribution in automated environments. This trend indicates that the busbar systems market is aligning with the broader industrial automation movement, as manufacturers seek to enhance operational efficiency and reduce downtime. Consequently, the demand for advanced busbar solutions is likely to rise, reflecting the ongoing transformation within the industrial sector.

Investment in Infrastructure Development

Infrastructure development in Canada plays a crucial role in propelling the busbar systems market. The government has initiated various projects aimed at modernizing electrical grids and enhancing energy distribution networks. With an estimated investment of $180 billion allocated for infrastructure over the next decade, the busbar systems market stands to gain significantly. These investments are expected to focus on upgrading existing facilities and constructing new ones, which will require advanced power distribution solutions. As a result, the demand for busbar systems is likely to increase, as they provide a compact and efficient means of distributing electricity across large facilities. This trend suggests a robust future for the busbar systems market, as infrastructure projects continue to unfold across the nation.

Technological Advancements in Busbar Design

Technological advancements are significantly impacting the busbar systems market in Canada. Innovations in materials and design are leading to the development of more efficient and compact busbar solutions. These advancements allow for higher current ratings and improved thermal management, which are critical in modern electrical systems. The market is projected to grow as manufacturers adopt cutting-edge technologies to enhance the performance of busbar systems. This trend suggests that the busbar systems market is on the cusp of a transformation, driven by the need for more efficient power distribution solutions. As technology continues to evolve, the demand for advanced busbar systems is likely to increase, reflecting the industry's commitment to innovation and efficiency.

Emphasis on Safety and Reliability Standards

Safety and reliability are paramount in the busbar systems market, particularly in Canada, where stringent regulations govern electrical installations. The increasing emphasis on safety standards is driving the adoption of advanced busbar systems that comply with these regulations. The market is witnessing a shift towards products that not only meet but exceed safety requirements, ensuring minimal risk of electrical failures. This trend is likely to propel the busbar systems market, as manufacturers innovate to create safer and more reliable solutions. With the potential for increased regulatory scrutiny, companies are investing in high-quality busbar systems that enhance safety and operational reliability. This focus on compliance and safety standards is expected to shape the future landscape of the busbar systems market.

Growing Demand for Efficient Power Distribution

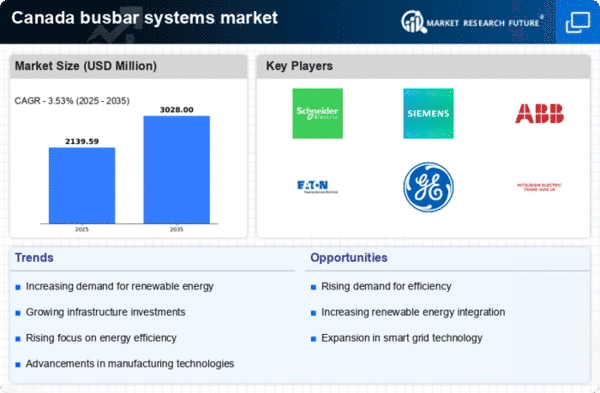

The busbar systems market in Canada experiences a notable surge in demand due to the increasing need for efficient power distribution solutions. As urbanization accelerates, the requirement for reliable electrical infrastructure becomes paramount. Busbar systems, known for their ability to handle high current loads with minimal losses, are becoming essential in commercial and industrial applications. The market is projected to grow at a CAGR of approximately 6.5% from 2025 to 2030, driven by the expansion of data centers and manufacturing facilities. This growth indicates a shift towards centralized power distribution systems, which are more efficient and cost-effective. Consequently, the busbar systems market is poised to benefit from this trend, as businesses seek to optimize their energy consumption and reduce operational costs.