Investment in Smart Grid Technologies

Investment in smart grid technologies significantly influences the busbar systems market in France. The transition towards smart grids necessitates the implementation of advanced electrical distribution systems that can efficiently manage energy flow. Busbar systems play a crucial role in this transformation, as they facilitate the integration of various energy sources and improve overall grid reliability. The French government has allocated substantial funding towards modernizing the electrical grid, with an estimated €5 billion earmarked for smart grid initiatives over the next five years. This investment is likely to spur demand for sophisticated busbar systems that can support real-time monitoring and control. Consequently, the busbar systems market is poised for growth as utilities and energy providers adapt to the evolving technological landscape.

Focus on Energy Efficiency and Cost Reduction

The emphasis on energy efficiency and cost reduction is a significant driver for the busbar systems market in France. Businesses and organizations are increasingly seeking ways to lower operational costs while enhancing energy performance. Busbar systems offer a viable solution by reducing energy losses and improving overall system efficiency. According to recent studies, implementing advanced busbar solutions can lead to energy savings of up to 20%, making them an attractive option for various sectors. This focus on efficiency aligns with France's broader energy policies aimed at reducing carbon emissions and promoting sustainable practices. Consequently, the busbar systems market is likely to see heightened interest from industries looking to optimize their energy consumption and reduce costs, thereby fostering market growth.

Rising Demand for Efficient Power Distribution

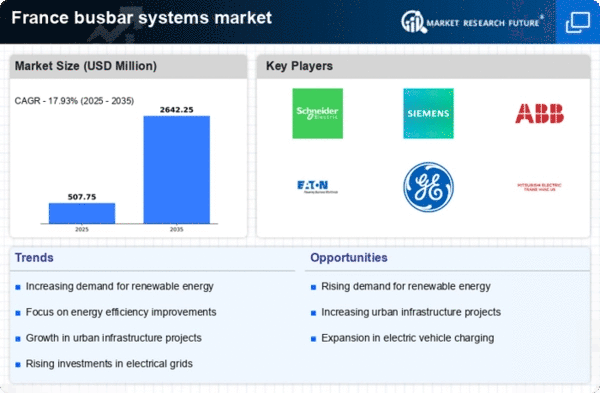

The busbar systems market in France experienced a notable increase in demand for efficient power distribution solutions. This trend is driven by the growing need for reliable and effective electrical infrastructure across various sectors, including commercial, industrial, and residential. As energy consumption rises, the necessity for systems that can handle high loads while minimizing energy losses becomes paramount. The market is projected to grow at a CAGR of approximately 6% from 2025 to 2030, indicating a robust expansion. Furthermore, the integration of renewable energy sources into the grid necessitates advanced busbar systems that can accommodate fluctuating power inputs. This evolving landscape suggests that the busbar systems market will continue to thrive as stakeholders seek innovative solutions to enhance energy efficiency.

Growing Urbanization and Infrastructure Development

The rapid urbanization and infrastructure development in France are pivotal drivers of the busbar systems market. As cities expand, the demand for robust electrical systems to support new buildings, transportation networks, and public facilities increases. The French government has initiated several large-scale infrastructure projects, with an investment of approximately €10 billion planned for urban development over the next decade. This surge in construction activities necessitates the deployment of efficient busbar systems to ensure reliable power distribution. Additionally, the trend towards high-rise buildings and complex electrical networks further emphasizes the need for advanced busbar solutions. As a result, the busbar systems market is likely to benefit from the ongoing urbanization efforts, positioning itself as a key player in the evolving landscape of electrical infrastructure.

Regulatory Framework Supporting Electrical Infrastructure

The regulatory framework in France plays a crucial role in shaping the busbar systems market. Government policies aimed at enhancing electrical infrastructure reliability and safety create a conducive environment for market growth. Recent regulations have mandated the adoption of advanced electrical systems in new constructions, which includes the integration of busbar solutions. This regulatory support is expected to drive the market, as compliance with safety standards and efficiency requirements becomes increasingly important. Furthermore, the French government is actively promoting initiatives that encourage the modernization of electrical grids, which further bolsters the demand for busbar systems. As a result, the busbar systems market is likely to benefit from these regulatory developments, positioning itself for sustained growth in the coming years.