Rising Focus on Industrial Automation

The GCC region is witnessing a significant shift towards industrial automation, which is expected to bolster the busbar systems market. Industries are increasingly adopting automated solutions to enhance productivity and reduce operational costs. The integration of busbar systems in automated environments allows for streamlined power distribution, minimizing energy losses. According to industry reports, the automation market in the GCC is projected to grow at a CAGR of 8% from 2025 to 2030. This growth is likely to create substantial opportunities for the busbar systems market, as manufacturers seek reliable and efficient power solutions to support their automated processes. The demand for high-performance busbar systems is anticipated to rise, driven by the need for enhanced operational efficiency in various industrial sectors.

Technological Innovations in Power Distribution

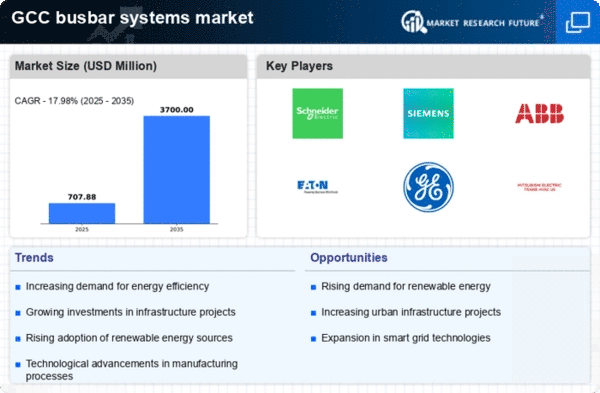

Technological advancements in power distribution are reshaping the landscape of the busbar systems market. Innovations such as smart busbars, which incorporate monitoring and control features, are becoming increasingly prevalent. These systems enhance operational efficiency and provide real-time data for better decision-making. The GCC region is witnessing a surge in demand for smart grid technologies, with investments projected to reach $20 billion by 2027. This trend is likely to drive the adoption of advanced busbar systems that can seamlessly integrate with smart grid infrastructure. As utilities and industries seek to modernize their power distribution networks, the busbar systems market is poised for growth, driven by the need for enhanced reliability and efficiency in energy management.

Government Initiatives for Energy Diversification

In the GCC, governments are actively pursuing energy diversification strategies to reduce reliance on fossil fuels. This shift is likely to have a profound impact on the busbar systems market. Initiatives aimed at increasing the share of renewable energy sources in the energy mix are gaining momentum. For instance, the UAE aims to generate 50% of its energy from clean sources by 2050. Such policies necessitate the implementation of advanced electrical systems, including busbar technology, to manage the integration of renewable energy into existing grids. The busbar systems market is expected to thrive as utilities and energy providers seek efficient solutions to accommodate the fluctuating nature of renewable energy generation. This trend indicates a promising future for the busbar systems market as it aligns with national energy goals.

Growing Urbanization and Infrastructure Development

The rapid urbanization in the GCC region is driving the demand for efficient power distribution systems, including the busbar systems market. As cities expand, the need for robust electrical infrastructure becomes paramount. The GCC governments are investing heavily in infrastructure projects, with an estimated $1 trillion allocated for development by 2030. This surge in construction activities necessitates the integration of advanced electrical systems, where busbar technology plays a crucial role. The busbar systems market is likely to benefit from this trend, as they offer compact solutions that can handle high power loads efficiently. Furthermore, the increasing population density in urban areas amplifies the need for reliable power distribution, further propelling the growth of the busbar systems market in the region.

Increasing Demand for Compact and Lightweight Solutions

The busbar systems market is experiencing a shift towards compact and lightweight solutions, driven by the need for space optimization in various applications. As urban areas become more congested, the demand for electrical systems that occupy less physical space is rising. Busbar systems offer a solution by providing high power capacity in a smaller footprint compared to traditional wiring methods. This trend is particularly relevant in sectors such as commercial buildings and data centers, where space is at a premium. The GCC region is likely to see an increase in the adoption of these compact solutions, as businesses seek to maximize their operational efficiency while minimizing their environmental impact. The busbar systems market is expected to benefit from this growing preference for space-efficient electrical distribution solutions.