Rising Energy Costs

The Building Applied Photovoltaic Market is being driven by the rising costs of traditional energy sources. As energy prices continue to escalate, consumers and businesses are seeking alternative solutions to mitigate their energy expenses. The integration of building applied photovoltaics offers a viable pathway to achieve energy independence and reduce reliance on fossil fuels. Reports indicate that the levelized cost of electricity from solar energy has decreased significantly over the past decade, making it a competitive option compared to conventional energy sources. This trend is expected to continue, as advancements in technology and economies of scale further lower costs. Consequently, the increasing financial burden of energy bills is likely to accelerate the adoption of photovoltaic systems in buildings, thereby enhancing the market's growth prospects.

Technological Advancements

Technological advancements play a pivotal role in shaping the Building Applied Photovoltaic Market. Innovations in photovoltaic materials, such as the development of thin-film solar cells and building-integrated photovoltaics, are enhancing efficiency and reducing costs. Recent studies indicate that the efficiency of solar panels has improved significantly, with some products achieving efficiencies exceeding 25%. These advancements not only make solar energy more accessible but also allow for greater integration into building designs without compromising aesthetics. Furthermore, the emergence of smart technologies, such as energy management systems, is facilitating better energy utilization in buildings equipped with photovoltaic systems. This synergy between technology and design is likely to propel the market forward, as consumers increasingly seek energy-efficient solutions.

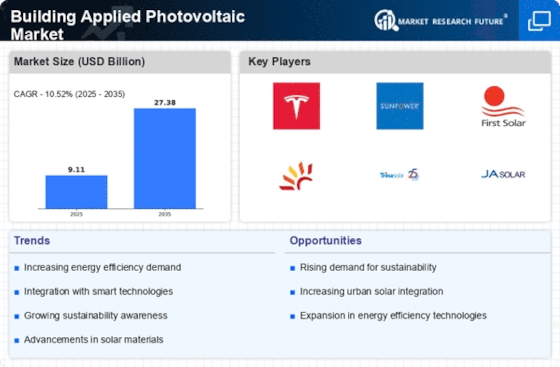

Government Incentives and Policies

The Building Applied Photovoltaic Market is experiencing a surge in growth due to favorable government incentives and policies. Various governments are implementing tax credits, rebates, and grants to encourage the adoption of renewable energy technologies. For instance, in several regions, policies are being established to mandate the integration of solar technologies in new buildings. This regulatory support not only reduces the initial investment costs for consumers but also enhances the overall attractiveness of building applied photovoltaics. As a result, the market is projected to expand significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. Such initiatives are crucial in driving the transition towards sustainable energy solutions, thereby fostering a more resilient energy infrastructure.

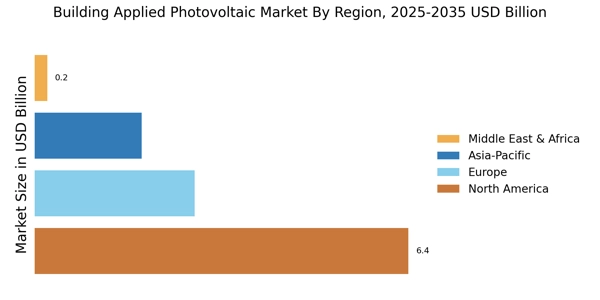

Urbanization and Infrastructure Development

Urbanization and infrastructure development are key factors propelling the Building Applied Photovoltaic Market. As urban areas expand, the demand for energy-efficient buildings is becoming increasingly critical. The integration of photovoltaic systems into new construction projects is seen as a strategic approach to meet energy demands while minimizing environmental impact. Recent data suggests that urban centers are responsible for a significant portion of global energy consumption, highlighting the urgent need for sustainable solutions. Moreover, many cities are implementing building codes that require or incentivize the use of renewable energy technologies in new developments. This trend is likely to continue, as urban planners and architects increasingly recognize the importance of integrating solar energy solutions into the fabric of urban infrastructure.

Consumer Awareness and Demand for Sustainability

Consumer awareness regarding environmental issues is significantly influencing the Building Applied Photovoltaic Market. As individuals become more conscious of their carbon footprints, there is a growing demand for sustainable energy solutions. This shift in consumer behavior is prompting builders and developers to incorporate photovoltaic systems into their projects. Surveys indicate that a substantial percentage of homebuyers are willing to pay a premium for properties equipped with solar energy systems, reflecting a clear preference for sustainable living. Additionally, educational campaigns and community initiatives are further promoting the benefits of solar energy, thereby increasing public interest. This heightened awareness is expected to drive market growth, as more consumers actively seek out energy-efficient and environmentally friendly building options.