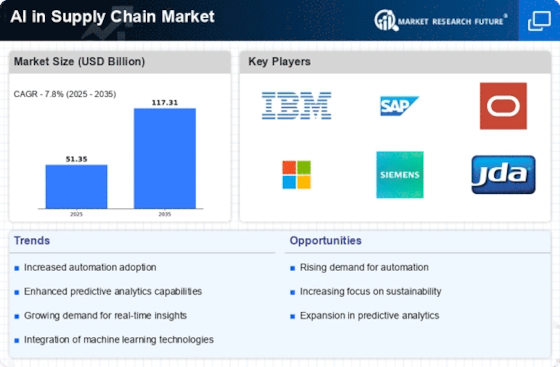

Leading market players are investing heavily in research and development to expand their product lines, which will help the AI in Supply Chain market grow even more. Recent AI in supply chain examples, including conversational platforms and decision-support tools, highlight emerging ChatGPT supply chain use cases such as demand scenario analysis, supplier communication automation, and logistics exception handling. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the AI in Supply Chain industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the AI in Supply Chain industry to benefit clients and increase the market sector. The AI in Supply Chain industry has recently offered some of the most significant medical advantages. Major players in the AI in Supply Chain market, including Nvidia Corporation, IBM Corporation, Intel Corporation, Xilinx Inc., Samsung Electronics, Microsoft Corporation, Micron Technology, SAP SE, Oracle Corporation, Logility Inc., Amazon, LLamasoft and others are attempting to increase market demand by investing in research and development operations.

Nvidia Corporation NVIDIA pioneered accelerated computing to solve problems no one else could. Our work in artificial intelligence and the metaverse transforms the world's largest industries and profoundly impacts society. The metaverse, or 3D internet, promises a world where virtual collaboration is simple and industrial behemoths can reap the benefits of digital twins. NVIDIA OmniverseTM is a tool for creating and managing metaverse applications.

IBM Corporation, bring together all of the necessary technology and services, regardless of source, to assist clients in solving the most pressing business problems. Transformation is evolving from one-time project to an urgent, purpose-driven imperative. Modern businesses must move faster while also exhibiting greater empathy and openness. IBM Consulting is a new partner for modern business's new rules. We embrace an open way of working by bringing together a diverse set of voices and technologies. We work closely together, freely ideate, and quickly apply breakthrough innovations that exponentially impact how business is done.

We believe that open ecosystems, technologies, innovation, and cultures are critical to creating opportunities and charting the course for modern business and society.