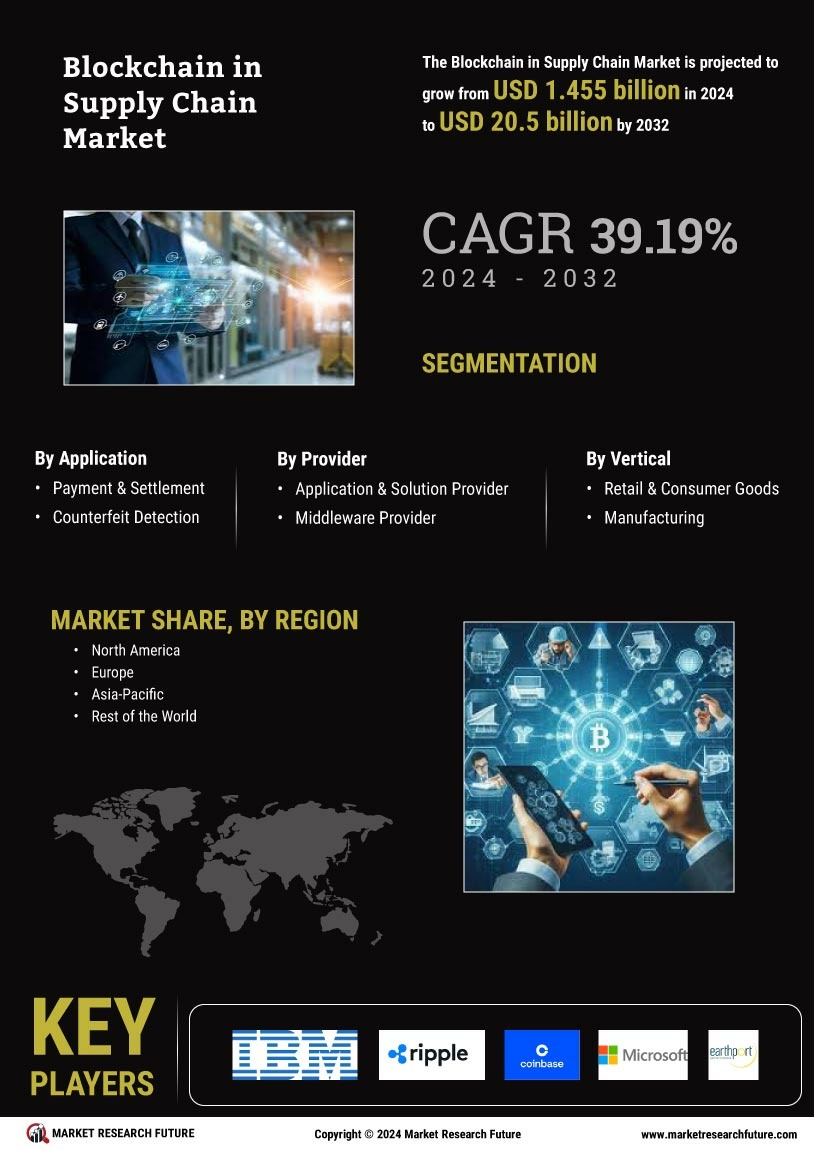

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Blockchain in Supply Chain Market, grow even more. Blockchain in Supply Chain Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising Blockchain in Supply Chain Market climate, Blockchain in Supply Chainindustry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Blockchain in Supply Chain industry to benefit clients and increase the market sector. In recent years, the Blockchain in Supply Chain industry has offered some of the most significant advantages to medicine. Major players in the Blockchain in Supply Chain Market, including IBM Corporation, Ripple, Chain Inc, Microsoft Corporation, Coinbase, Blockchain Tech Ltd, Earthport PLC, Abra Inc, and others, are attempting to increase Blockchain in Supply Chain Market demand by investing in research and development operations.

The International Business Machines business (IBM), also known as Big Blue, is a multinational technology business headquartered in Armonk, New York, with operations in more than 175 countries. It specializes in computer hardware, middleware, and software, as well as hosting and consulting services spanning from mainframe computers to nanotechnology. IBM is the world's largest industrial research organization, with 19 research labs in a dozen countries. In 2021, IBM collaborated with Chainyard to create Trust Your Supplier, a blockchain-based supply chain management tool.

The platform's goal is to make supplier management easier by offering a safe and transparent platform for tracking supplier information including certifications and compliance.

Maersk A/S is a Danish shipping and logistics firm founded by Peter Mrsk Mller and Arnold Peter Mller in 1904. Shipping, port operations, supply chain management, and warehousing are all part of Maersk's business. In 2022, the corporation will be headquartered in Copenhagen, Denmark, with subsidiaries and offices in 130 countries and over 110,000 workers worldwide.In 2020,Maersk, the world's largest container shipping firm, collaborated with IBM to build TradeLens, a blockchain-based platform. The platform's goal is to digitize the supply chain and provide a secure and transparent platform for tracking cross-border commodities movement.