Rising Demand for Efficiency

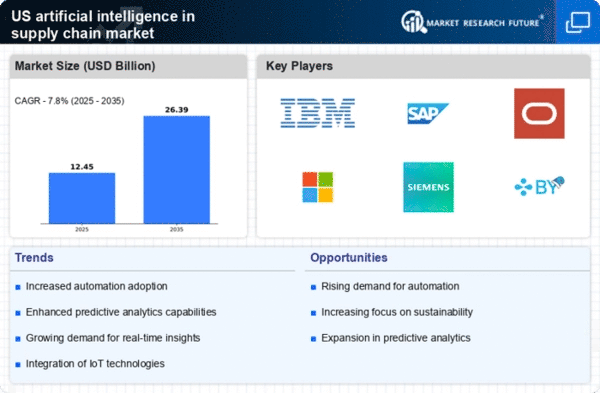

The artificial intelligence-in-supply-chain market is experiencing a notable surge in demand for enhanced operational efficiency. Companies are increasingly seeking to streamline their supply chain processes to reduce costs and improve service delivery. According to recent data, organizations that implement AI-driven solutions can achieve up to 30% reductions in operational costs. This drive towards efficiency is compelling businesses to adopt AI technologies that optimize inventory management, demand forecasting, and logistics. As a result, The US artificial intelligence-in-supply-chain market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. The focus on efficiency not only enhances profitability but also improves customer satisfaction, making it a critical driver in the artificial intelligence-in-supply-chain market.

Advancements in Machine Learning

Recent advancements in machine learning technologies are playing a pivotal role in shaping the artificial intelligence-in-supply-chain market. These innovations enable more accurate data analysis and predictive modeling, which are essential for effective supply chain management. Machine learning algorithms can analyze vast amounts of data to identify patterns and trends, allowing companies to make informed decisions. For instance, businesses utilizing machine learning for demand forecasting have reported accuracy improvements of up to 25%. This capability to predict market fluctuations and consumer behavior is increasingly vital in a competitive landscape, driving the adoption of AI solutions. As machine learning continues to evolve, its integration into supply chain operations is expected to enhance efficiency and responsiveness, further propelling the growth of the artificial intelligence-in-supply-chain market.

Increased Investment in Technology

Investment in technology is a significant driver of growth in the artificial intelligence-in-supply-chain market. Companies are allocating substantial budgets to integrate AI solutions into their supply chain operations. Recent reports indicate that businesses in the US are expected to invest over $15 billion in AI technologies by 2026, reflecting a strong commitment to digital transformation. This influx of capital is facilitating the development of innovative AI applications that enhance supply chain visibility, optimize logistics, and improve inventory management. As organizations recognize the potential return on investment from AI-driven solutions, the trend of increased technology investment is likely to continue, fostering further advancements in the artificial intelligence-in-supply-chain market.

Growing Need for Real-Time Data Analysis

The growing need for real-time data analysis is emerging as a crucial driver in the artificial intelligence-in-supply-chain market. In an era where consumer expectations are rapidly evolving, businesses require immediate insights to make timely decisions. AI technologies enable organizations to process and analyze data in real-time, facilitating quicker responses to market changes. This capability is particularly important for managing supply chain disruptions and optimizing inventory levels. Companies leveraging real-time analytics can enhance their operational agility, leading to improved customer satisfaction and reduced costs. As the demand for real-time insights continues to rise, the artificial intelligence-in-supply-chain market is likely to expand, driven by the need for responsive and adaptive supply chain strategies.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are increasingly influencing the artificial intelligence-in-supply-chain market. As supply chains become more complex, organizations face heightened scrutiny regarding compliance with various regulations. AI technologies can assist in monitoring compliance and identifying potential risks within the supply chain. By automating compliance checks and risk assessments, companies can mitigate potential disruptions and avoid costly penalties. The market is witnessing a growing trend where businesses invest in AI solutions to enhance their compliance frameworks and risk management strategies. This focus on regulatory adherence not only protects organizations but also fosters trust among stakeholders, thereby driving the growth of the artificial intelligence-in-supply-chain market.