Rising Demand for Crop Monitoring

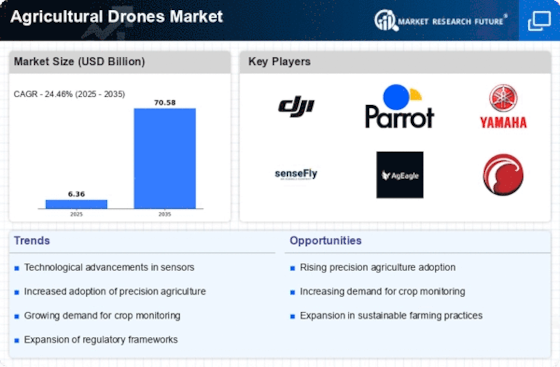

The Agriculture Drone Market is experiencing a surge in demand for crop monitoring solutions. Farmers are increasingly recognizing the value of drones in assessing crop health, optimizing yields, and managing resources efficiently. The ability to capture high-resolution images and data allows for precise analysis of crop conditions, which can lead to better decision-making. According to recent estimates, the market for agricultural drones is projected to reach USD 6 billion by 2026, driven by the need for enhanced agricultural productivity. This trend indicates a shift towards data-driven farming practices, where drones play a pivotal role in monitoring and managing agricultural operations.

Cost Reduction in Farming Operations

Cost efficiency is a critical driver in the Agricultural Drones Market. Drones facilitate various farming operations, such as planting, spraying, and monitoring, which can significantly reduce labor costs and time. By automating these processes, farmers can achieve higher efficiency and lower operational expenses. Reports suggest that the use of drones can reduce costs by up to 30% in certain agricultural practices. This financial incentive encourages more farmers to adopt drone technology, thereby expanding the market. As the agricultural sector seeks to improve profitability, the integration of drones into farming practices appears to be a viable solution.

Sustainability and Environmental Concerns

Sustainability is becoming increasingly important in the agriculture drones Market. Drones offer a means to implement environmentally friendly practices by minimizing chemical usage and optimizing resource allocation. For instance, precision spraying technology allows for targeted application of fertilizers and pesticides, reducing waste and environmental impact. This aligns with the growing consumer demand for sustainable agricultural practices. As regulations and consumer preferences shift towards sustainability, the adoption of drones is likely to increase, further driving market growth. The potential for drones to contribute to sustainable farming practices positions them as a key player in the future of agriculture.

Growing Investment in Agricultural Technology

Investment in agricultural technology is a major driver of the Agriculture Drone Market. Venture capital and government funding are increasingly directed towards innovative agricultural solutions, including drone technology. This influx of capital supports research and development, leading to advancements in drone capabilities and applications. As more stakeholders recognize the potential of drones to revolutionize farming practices, the market is likely to expand. Reports indicate that investment in agri-tech could exceed USD 10 billion in the coming years, highlighting the growing interest in technologies that enhance agricultural efficiency and sustainability.

Integration of Artificial Intelligence and Data Analytics

The integration of artificial intelligence (AI) and data analytics into the agriculture drones Market is transforming how farmers approach crop management. Drones equipped with AI capabilities can analyze vast amounts of data in real-time, providing actionable insights for farmers. This technology enables predictive analytics, which can forecast crop yields and identify potential issues before they escalate. The market for AI in agriculture is expected to grow significantly, with drones being a primary tool for data collection and analysis. This trend suggests that the future of farming will increasingly rely on intelligent systems, enhancing productivity and decision-making.