Research Methodology on Military Surveillance Drones Market

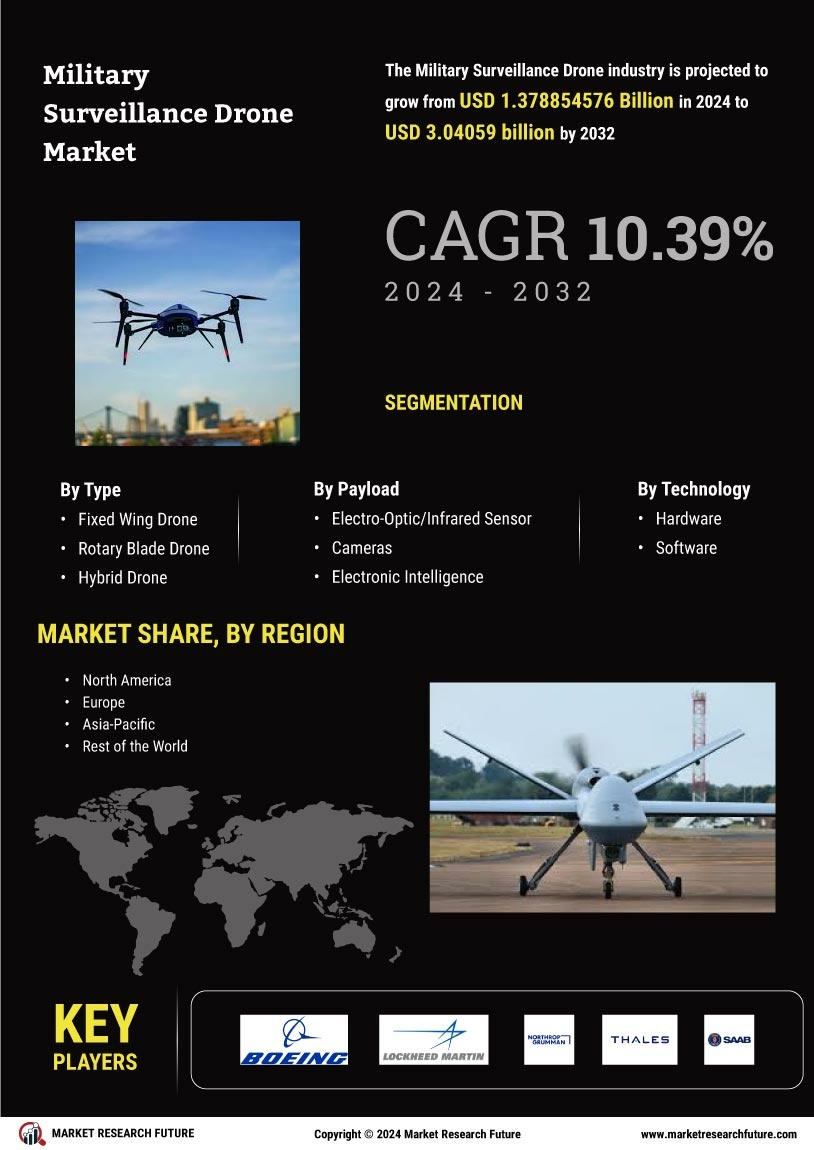

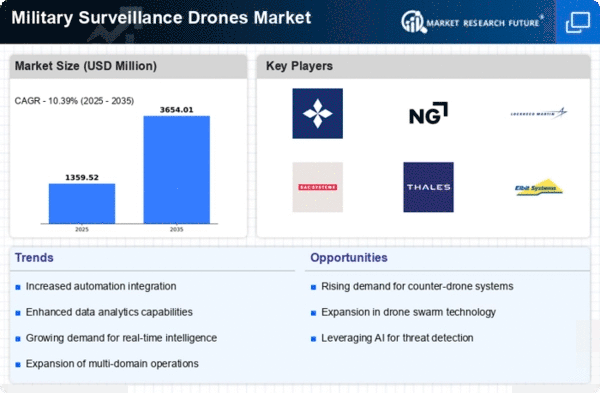

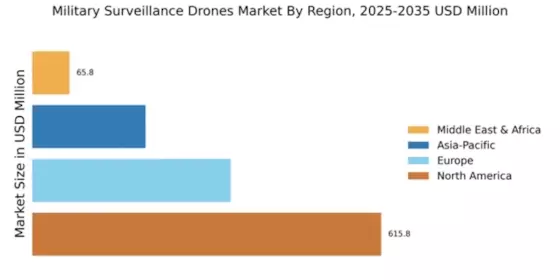

Market Research Future (MRFR) conducted a comprehensive study on the Global Military Surveillance Drones market for the review period 2023-2030. The primary objective of this study was to understand the market drivers, growth dynamics, technologies, market size and trends, competitive landscape, and various other growth opportunities for market participants. To facilitate a comprehensive and in-depth analysis, our market research and analysis create the need to understand the underlying trends in the market to identify potential investments and new products and services.

A two-phase research methodology was used to compile the data and information necessary to assess the Global Military Surveillance Drone market in terms of current market size, market share, value chain, expected market share, competitive landscape, and other associated trends.

The first phase of the research involves an extensive collection of primary and secondary data with the help of industry experts, specialized data sources and an in-depth analysis of market players, regional market trends and developments, competitive landscape, and other market-related attributes. Secondly, a comprehensive analysis was conducted on the collected data which include the survey responses from the industry's leading players and those in the competitive landscape. In addition, the research examines the economic, competitive, and technological environment to provide a comprehensive understanding of the market ecosystem.

Publicly available financial statements, market research reports, whitepapers and industry reviews have been used to collect information for this market. Various government, industry, and trade-related sources have also been used to obtain market-specific information and current market trends. Market analysis was further supported by a SWOT analysis of market players and extraction from audio analysis, earning calls and other events with market participants.

The research team used Porter's Five Force Model and PESTLE analysis in conjunction with advanced secondary research and data points in the form of surveys and interviews. Porter's Five Force Model provides an analysis of the bargaining power of buyers and suppliers in the market and the degree of competition among the players. The PESTLE analysis helps to assess the political, economic, social, technological, legal and environmental aspects of the industry. This analysis further enables a systematic and organized view of the current and future market prospects.

To assess market size, qualitative and quantitative aspects of the industry have been considered. To provide an in-depth analysis and a complete overview of the market, data from both primary and secondary sources have been integrated, which has included analysis of various documents, publications, websites and presentations. Different market sizes have been used for various applications and products which are the result of data collected from in-depth interviews.

The report also includes a detailed analysis of the key vendors in the Global Military Surveillance Drone Market. The timeline of the study begins in 2023 and progresses to the year 2030.

Finally, the research concluded with the conclusion that the market is expected to witness steady growth during the review period owing to increasing demand for advanced surveillance capabilities in military applications, rising technological advancements in UAV technology, and the growing market for commercial applications. To get further detailed information, please refer to the full report.