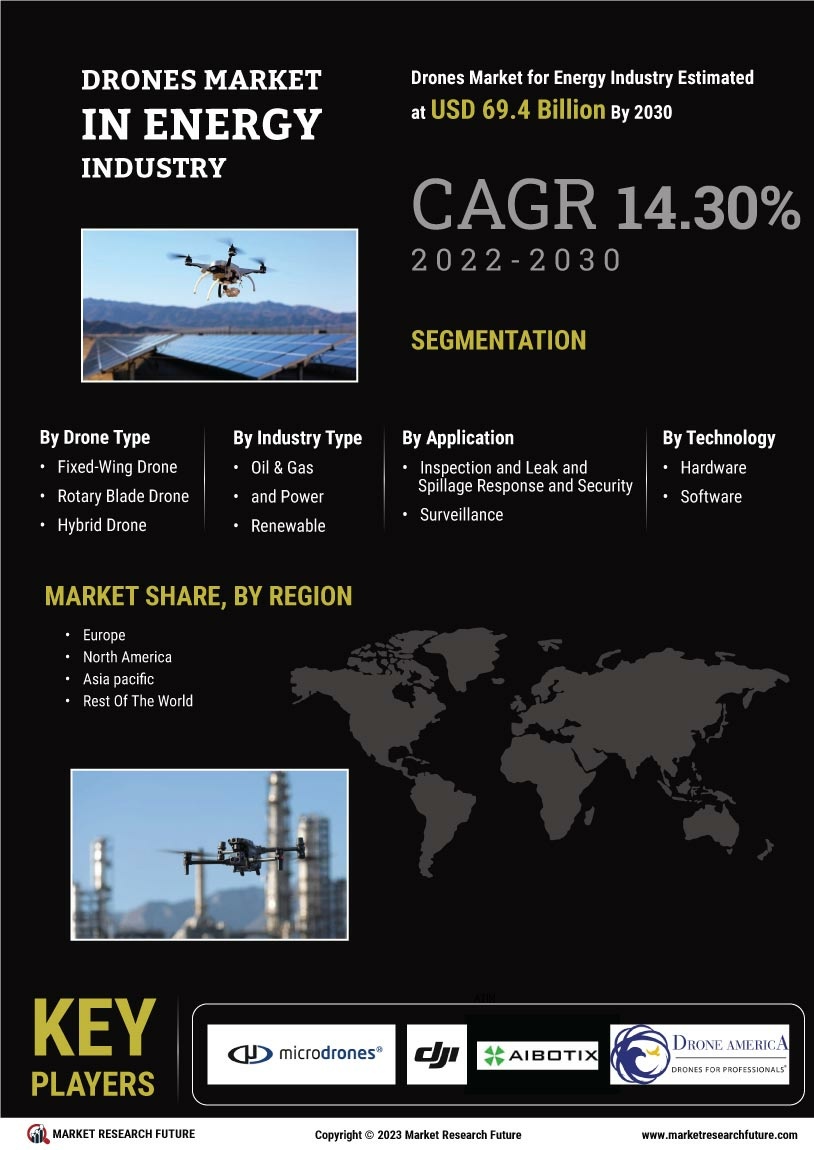

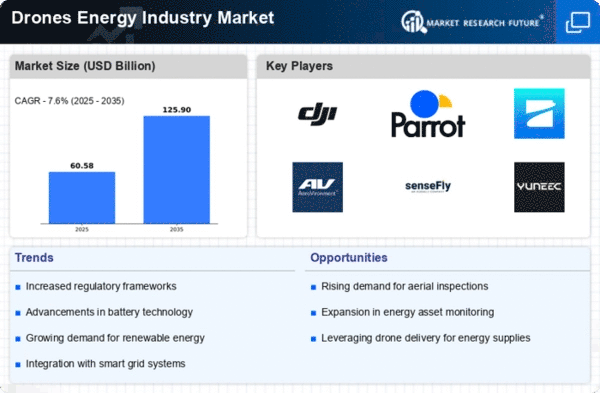

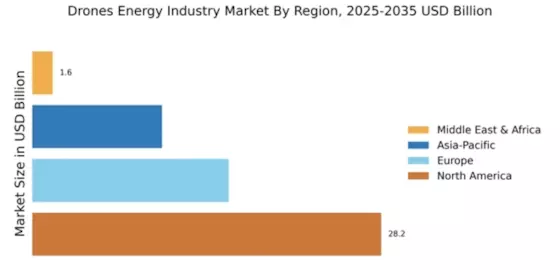

Drones Market for Energy Industry

The research methodology utilized in this project follows a detailed and organized approach to arrive at meaningful insights. The research will use both primary and secondary sources to gain the required information. The research process also includes an extensive review of databases and industry literature for potential sources and other related products and services that could help in understanding the energy industry drone market.

A. Secondary research-

Secondary research was conducted to gain an understanding of the global drones market for energy industry. The secondary research was further used to identify potential databases and industry-specific publications or periodicals. Additionally, research was also conducted to identify and gather publicly available information related to the market and the related applications and economic conditions. This includes information available from private and government sources as well as various industry-specific and related literature.

B. Primary Data Collection and Analysis-

Primary data collection and analysis were conducted as part of the research to gain a comprehensive understanding of the market size and dynamics. All primary sources were cross-validated against the data provided from in-depth secondary research. The primary data obtained is then further analyzed to gain insights into the market size and dynamics. This allowed for the identification of the major trends and developments in the market and the related macro and micro-economic factors driving the market.

• Market Surveys-

Online surveys were conducted to gain insight into the market size, value and dynamics. The survey was conducted using a combination of structured and unstructured questions. The structured questions focused primarily on understanding the customer behaviour, preferences and opinions in selecting the appropriate drone services. The unstructured questions focused on understanding the market drivers, challenges and opportunities.

• Interviews-

Interviews were conducted to gain in-depth insights into the market. The interviews were conducted with industry experts and market participants with their experience and insights. The interviews were conducted in person, by phone or through video conferencing platforms to gain detailed insights into the market.

• Focus Group Discussions-

Focus group discussions were conducted to gain insights into the customer needs and opinions on the current market scenario. The focus groups included appropriate segments such as market participants, industry experts and customers. These sessions offered insight into the current issues faced in the market and any potential business opportunities.

C. Demand Side and Supply Side Data Triangulation-

To gain a comprehensive understanding of the market and to establish significant insights, a combination of demand-side and supply-side data was used. Demand-side data mainly focused on understanding customer preferences and their purchasing behaviour in the market. This included information related to the customer, budget and other preferences.

The supply-side data is mainly focused on understanding the market players and the offerings and services offered in the market. This information is used to gain insights into the various products and services provided by the market players and the trends from them.

D. Factor Analysis and Time-Series Analysis-

Factor analysis and time-series analysis were used to identify the major trends and developments in the global drones market for energy industry. These methods were used to identify the external influences affecting the market and to provide insight into the market dynamics. These methods were mainly used to gain insight into the historical information related to the market and to better understand the trend of the market over a period of time.

E. Top-Down and Bottom-Up Approach-

The top-down and bottom-up approach was used to develop the market forecast for the global drones market for energy industry. The top-down approach was used to understand the market size based on various parameters and the bottom-up approach was used to identify the total market size through a gradual analysis of the various segments. This allowed for a comprehensive understanding of the market size and dynamics.

F. Forecast Model-

The market forecast model was used to arrive at the forecast for the global drones market for energy industry. This model includes the application of a combination of the various factors and parameters affecting the market. The model further involves the incorporation of historical data related to the market for the past few years. This is combined with the current market conditions to arrive at the forecast from 20231 to 2030. The model utilizes inputs such as demand-side data, supply-side data, industry analysis, market data and macro-economic data to enable a more accurate forecast. This helps in arriving at an accurate forecast for the market.