Geopolitical Influences

Geopolitical influences play a crucial role in shaping the Fixed Wing Military Drone Market. As tensions rise in various regions, countries are increasingly investing in military capabilities, including drone technology. The need for enhanced surveillance and reconnaissance in conflict zones has led to a surge in demand for fixed wing military drones. For example, nations facing territorial disputes are likely to prioritize the acquisition of advanced drone systems to bolster their defense strategies. This trend is reflected in defense budgets, where allocations for unmanned aerial vehicles have seen significant increases. The Fixed Wing Military Drone Market is thus expected to expand as countries seek to maintain strategic advantages in an evolving geopolitical landscape.

Technological Advancements

The Fixed Wing Military Drone Market is experiencing rapid technological advancements that enhance operational capabilities. Innovations in artificial intelligence, sensor technology, and data analytics are transforming how military drones are utilized. For instance, the integration of advanced imaging systems allows for real-time reconnaissance and surveillance, significantly improving mission effectiveness. According to recent data, the market for military drones is projected to grow at a compound annual growth rate of approximately 12% over the next five years, driven by these technological improvements. Furthermore, the development of autonomous flight capabilities is likely to reduce the need for human intervention, thereby increasing safety and efficiency in military operations. As nations invest in these technologies, the Fixed Wing Military Drone Market is poised for substantial growth.

Focus on Cost-Effectiveness

Cost-effectiveness is a driving factor in the Fixed Wing Military Drone Market, as military organizations seek to optimize their budgets while enhancing operational capabilities. The deployment of fixed wing drones offers a more economical alternative to traditional manned aircraft, reducing operational costs associated with fuel, maintenance, and personnel. Recent analyses indicate that the lifecycle costs of military drones can be significantly lower than those of manned systems, making them an attractive option for defense forces. Additionally, the ability to conduct missions without risking human lives further underscores the cost-effectiveness of these systems. As defense budgets tighten, the Fixed Wing Military Drone Market is likely to see increased adoption of these cost-efficient solutions.

Increased Demand for Surveillance

The demand for surveillance capabilities is a prominent driver in the Fixed Wing Military Drone Market. As security concerns escalate, military forces are increasingly relying on drones for intelligence, surveillance, and reconnaissance (ISR) missions. Fixed wing drones, with their extended flight ranges and endurance, are particularly suited for long-duration surveillance operations. Recent reports suggest that the ISR segment of the military drone market is expected to account for a substantial share, driven by the need for real-time data collection and analysis. This trend is further supported by advancements in sensor technology, which enhance the drones' ability to gather critical information. Consequently, the Fixed Wing Military Drone Market is likely to witness robust growth as military organizations prioritize surveillance capabilities.

Emerging Markets and Defense Spending

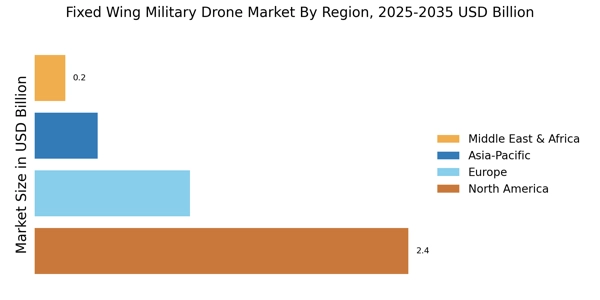

Emerging markets are increasingly contributing to the growth of the Fixed Wing Military Drone Market. As nations in regions such as Asia and the Middle East enhance their defense spending, the demand for advanced military technologies, including fixed wing drones, is on the rise. These countries are recognizing the strategic advantages offered by unmanned aerial systems, leading to increased investments in drone capabilities. For instance, defense budgets in several emerging economies have seen double-digit growth, reflecting a commitment to modernizing military assets. This trend is expected to continue, with emerging markets playing a pivotal role in shaping the future of the Fixed Wing Military Drone Market.