Integration of Big Data Analytics

The integration of big data analytics into agriculture is transforming the Crop Monitoring Market. By harnessing vast amounts of data from various sources, farmers can make informed decisions that enhance productivity and efficiency. The ability to analyze weather patterns, soil conditions, and crop performance in real-time allows for precision farming techniques that optimize yields. Reports suggest that the agricultural big data market is expected to grow at a CAGR of 25% over the next five years. This trend indicates a strong potential for growth within the Crop Monitoring Market, as stakeholders increasingly rely on data-driven insights to improve agricultural outcomes.

Government Initiatives and Support

Government initiatives aimed at promoting agricultural efficiency and sustainability are pivotal drivers in the Crop Monitoring Market. Various countries have implemented policies and funding programs to encourage the adoption of precision agriculture technologies. For instance, initiatives that provide financial incentives for farmers to invest in crop monitoring systems can significantly enhance market penetration. In recent years, several governments have allocated substantial budgets to support agricultural innovation, which has resulted in increased adoption rates of monitoring technologies. This supportive environment fosters growth within the Crop Monitoring Market, as stakeholders recognize the benefits of integrating advanced monitoring solutions into their operations.

Increasing Demand for Food Security

The rising global population has led to an increasing demand for food security, which significantly impacts the Crop Monitoring Market. As agricultural practices evolve, farmers are compelled to adopt advanced monitoring technologies to enhance crop yields and ensure sustainable production. According to recent data, the world population is projected to reach approximately 9.7 billion by 2050, necessitating a 70% increase in food production. This scenario creates a pressing need for effective crop monitoring solutions that can optimize resource use and minimize waste. Consequently, the Crop Monitoring Market is likely to experience substantial growth as stakeholders seek innovative ways to meet these food security challenges.

Technological Advancements in Agriculture

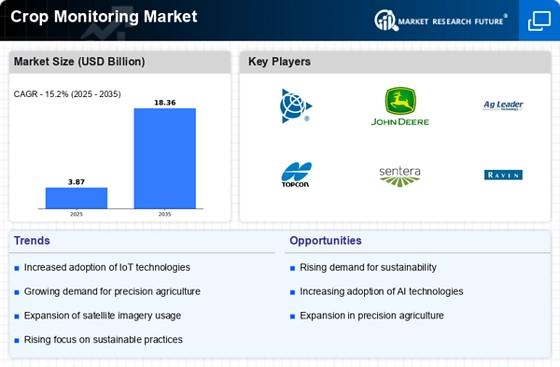

Technological advancements play a crucial role in shaping the Crop Monitoring Market. Innovations such as remote sensing, drones, and IoT devices have revolutionized the way farmers monitor crop health and manage resources. These technologies enable real-time data collection and analysis, allowing for timely interventions that can enhance crop productivity. The market for agricultural drones alone is expected to reach USD 4.8 billion by 2025, reflecting the growing interest in precision agriculture. As these technologies become more accessible and affordable, the Crop Monitoring Market is poised for significant expansion, driven by the need for efficient and effective farming practices.

Rising Awareness of Sustainable Agriculture

The increasing awareness of sustainable agriculture practices is a key driver in the Crop Monitoring Market. As consumers become more conscious of the environmental impact of farming, there is a growing demand for sustainable practices that minimize ecological footprints. Crop monitoring technologies facilitate sustainable farming by providing insights into resource usage, pest management, and soil health. This trend is supported by data indicating that sustainable agriculture can lead to a 20 to 30% increase in crop yields. Consequently, the Crop Monitoring Market is likely to benefit from this shift towards sustainability, as farmers seek solutions that align with environmentally friendly practices.