Rise of Smart Manufacturing

The 5G Service Market is witnessing a notable shift towards smart manufacturing, driven by the need for increased efficiency and automation. Manufacturers are increasingly adopting IoT devices and sensors to monitor production processes in real-time. The implementation of 5G technology enables seamless connectivity between machines, allowing for enhanced data analytics and predictive maintenance. Reports indicate that the smart manufacturing market is expected to grow to over 400 billion by 2025, with 5G serving as a backbone for these innovations. This trend not only enhances operational efficiency but also reduces downtime, thereby propelling the growth of the 5G Service Market.

Growth of Autonomous Vehicles

The advent of autonomous vehicles is poised to significantly impact the 5G Service Market. These vehicles require real-time data exchange and ultra-reliable low-latency communication to operate safely and efficiently. The integration of 5G technology is essential for enabling vehicle-to-everything (V2X) communication, which facilitates interactions between vehicles, infrastructure, and pedestrians. Industry analysts suggest that the autonomous vehicle market could reach a valuation of over 500 billion by 2030, with 5G technology playing a crucial role in this transformation. As automotive manufacturers increasingly adopt 5G capabilities, the demand for related services within the 5G Service Market is likely to escalate.

Enhanced Mobile Broadband Demand

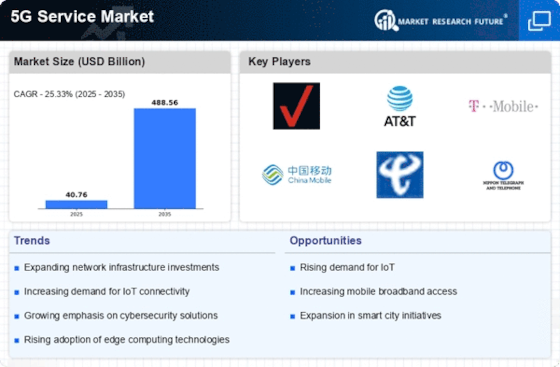

The 5G Service Market is experiencing a surge in demand for enhanced mobile broadband services. As consumers increasingly rely on high-speed internet for streaming, gaming, and remote work, the need for faster and more reliable connectivity becomes paramount. According to recent data, the number of mobile broadband subscriptions is projected to reach over 7 billion by 2026, indicating a robust growth trajectory. This demand is further fueled by the proliferation of 4K and 8K video content, which necessitates higher bandwidth. Consequently, telecommunications companies are investing heavily in 5G infrastructure to meet these consumer expectations, thereby driving the growth of the 5G Service Market.

Expansion of Telehealth Services

The 5G Service Market is significantly influenced by the expansion of telehealth services. As healthcare providers increasingly adopt digital solutions for remote patient monitoring and consultations, the demand for high-speed, reliable connectivity becomes critical. 5G technology facilitates high-definition video consultations and real-time data transmission, which are essential for effective telehealth services. Recent studies indicate that the telehealth market could exceed 250 billion by 2026, with 5G technology being a key enabler. This growth not only enhances patient care but also drives the demand for 5G services, thereby contributing to the overall expansion of the 5G Service Market.

Increased Focus on Cybersecurity

The 5G Service Market is also shaped by an increased focus on cybersecurity. As more devices connect to the internet through 5G networks, the potential for cyber threats escalates. Organizations are prioritizing the implementation of robust security measures to protect sensitive data and maintain consumer trust. The cybersecurity market is projected to grow significantly, with estimates suggesting it could reach over 300 billion by 2024. This heightened emphasis on security is likely to drive demand for advanced 5G services that incorporate enhanced security protocols, thereby influencing the trajectory of the 5G Service Market.