Growing Demand for High-Speed Connectivity

The 5g service market in the UK is experiencing a surge in demand for high-speed connectivity, driven by the increasing reliance on digital services. As businesses and consumers seek faster internet speeds, the market is projected to grow significantly. According to recent data, the demand for mobile data is expected to increase by over 50% by 2026. This trend is likely to push telecom providers to enhance their infrastructure, thereby expanding the 5g service market. Enhanced connectivity is essential for various applications, including streaming, online gaming, and remote work, which are becoming integral to daily life. The growing demand for high-speed connectivity is thus a crucial driver for the 5g service market, as it compels service providers to innovate and invest in advanced technologies.

Rise of Mobile Gaming and Streaming Services

The rise of mobile gaming and streaming services is significantly influencing the 5g service market in the UK. As consumers increasingly turn to mobile platforms for entertainment, the demand for high-speed, low-latency connections has intensified. The mobile gaming sector alone is projected to generate revenues exceeding £2 billion by 2025, while streaming services continue to expand their user base. This trend necessitates robust 5g networks capable of supporting high-definition content and real-time interactions. Consequently, telecom providers are likely to prioritize the development of 5g infrastructure to meet the needs of this burgeoning market. The growth of mobile gaming and streaming services thus serves as a vital driver for the 5g service market, pushing for advancements in technology and service delivery.

Government Initiatives and Regulatory Support

Government initiatives and regulatory support play a crucial role in shaping the 5g service market in the UK. The UK government has established various policies aimed at accelerating the deployment of 5g technology, including funding for research and development. Recent initiatives have focused on reducing barriers to infrastructure development, such as streamlining planning processes and promoting public-private partnerships. These efforts are expected to enhance the competitive landscape of the 5g service market, encouraging innovation and investment. Furthermore, regulatory support ensures that the market operates efficiently, fostering an environment conducive to growth. As a result, government initiatives and regulatory support are likely to be significant drivers of the 5g service market, facilitating its expansion and adoption across various sectors.

Investment in Telecommunications Infrastructure

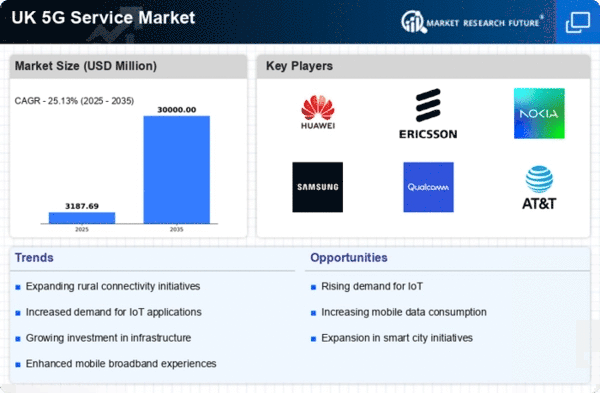

Investment in telecommunications infrastructure is a pivotal driver for the 5g service market in the UK. The government and private sector are allocating substantial funds to upgrade existing networks and deploy new 5g technology. Recent reports indicate that investments in 5g infrastructure could reach £30 billion by 2025. This influx of capital is expected to facilitate the rollout of 5g networks across urban and rural areas, ensuring broader access to high-speed internet. Enhanced infrastructure not only supports consumer demand but also enables businesses to leverage advanced technologies such as AI and machine learning. Consequently, the ongoing investment in telecommunications infrastructure is likely to propel the growth of the 5g service market, fostering innovation and economic development.

Support for Remote Work and Digital Transformation

Support for remote work and digital transformation is emerging as a key driver for the 5g service market in the UK. As businesses adapt to new operational models, the demand for reliable and fast internet connectivity has become paramount. The shift towards remote work has led to an increased reliance on cloud-based applications and collaboration tools, which require robust network capabilities. Recent studies suggest that over 70% of UK businesses are investing in digital transformation initiatives, further underscoring the need for advanced connectivity solutions. The 5g service market is poised to benefit from this trend, as it offers the necessary infrastructure to support seamless communication and data transfer. Thus, the support for remote work and digital transformation is likely to catalyse growth in the 5g service market.