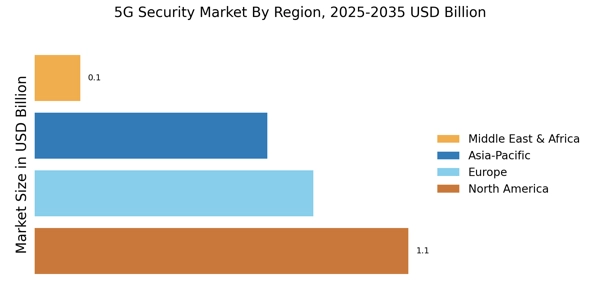

North America : Leading Innovation and Adoption

North America is the largest market for 5G security, holding approximately 40% of the global share. North America leads the global market due to early adoption of advanced 5G and security solutions, supported by strong regulatory enforcement and enterprise demand. The region's growth is driven by increasing cybersecurity threats, regulatory requirements, and the rapid deployment of 5G networks. Government initiatives and investments in digital infrastructure further catalyze demand for advanced security solutions. The U.S. and Canada are the primary contributors, with significant investments in technology and innovation.

The competitive landscape in North America is robust, featuring key players like Cisco Systems, Fortinet, and Palo Alto Networks. These companies are at the forefront of developing cutting-edge security solutions tailored for 5G networks. The presence of major telecommunications providers and technology firms fosters a dynamic environment for collaboration and innovation, ensuring that North America remains a leader in the 5G security market.

Europe : Regulatory Framework and Growth

Europe is the second-largest market for 5G security, accounting for approximately 30% of the global share. The region's growth is propelled by stringent regulatory frameworks aimed at enhancing cybersecurity measures. The European Union's initiatives, such as the Cybersecurity Act, are pivotal in shaping the market landscape. Countries like Germany and the UK are leading the charge, focusing on robust security protocols to protect critical infrastructure. The competitive landscape in Europe includes major players like Nokia and Ericsson, who are actively developing security solutions for 5G networks. The presence of various startups and established firms fosters innovation, while collaborations between governments and private sectors enhance the overall security framework. This dynamic environment positions Europe as a key player in the global 5G security market.

Asia-Pacific : Emerging Markets and Opportunities

Asia-Pacific is witnessing rapid growth in the 5G security market, holding approximately 25% of the global share. The region's expansion is driven by increasing mobile data consumption, urbanization, and government initiatives to enhance digital infrastructure. Countries like China and Japan are at the forefront, investing heavily in 5G technology and associated security measures to safeguard their networks against emerging threats. The competitive landscape in Asia-Pacific is diverse, with key players such as Huawei and ZTE Corporation leading the market. The presence of numerous telecom operators and technology firms fosters a competitive environment, encouraging innovation in security solutions. As the region continues to embrace 5G technology, the demand for robust security measures is expected to rise significantly, making Asia-Pacific a critical player in the global market.

Middle East and Africa : Growing Demand for Security Solutions

The Middle East and Africa region is gradually emerging in the 5G security market, holding about 5% of the global share. The growth is driven by increasing investments in telecommunications infrastructure and a rising awareness of cybersecurity threats. Countries like the UAE and South Africa are leading the way, implementing policies to enhance their digital security frameworks and attract foreign investments in technology. The competitive landscape in this region is evolving, with local and international players vying for market share. Companies are focusing on developing tailored security solutions to meet the unique challenges faced by the region. As governments prioritize cybersecurity in their national agendas, the demand for 5G security solutions is expected to grow, positioning the Middle East and Africa as an emerging market in the global landscape.