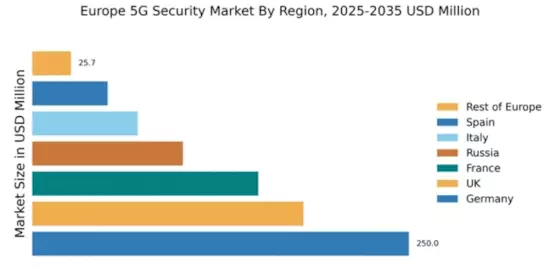

Germany : Strong Infrastructure and Innovation

Germany holds a dominant position in the European 5G security market, with a market value of $250.0 million, representing a significant share. Key growth drivers include robust government initiatives promoting digitalization, stringent data protection regulations, and increasing demand for secure communication networks. The country is witnessing a surge in investments in 5G infrastructure, particularly in urban centers like Berlin and Munich, which are becoming hubs for technological innovation and development.

UK : Innovation and Regulatory Support

The UK boasts a market value of $180.0 million in the 5G security sector, driven by increasing mobile data consumption and the need for enhanced security measures. Government initiatives, such as the National Cyber Security Strategy, are fostering a favorable environment for 5G adoption. The demand for secure networks is particularly high in financial hubs like London and Manchester, where businesses are increasingly reliant on digital services and cloud solutions.

France : Focus on Cyber Resilience

France's 5G security market is valued at $150.0 million, supported by government policies aimed at enhancing cybersecurity frameworks. The French government has launched initiatives to bolster the security of critical infrastructure, which is driving demand for advanced 5G security solutions. Cities like Paris and Lyon are at the forefront of this transformation, with significant investments in smart city projects and digital infrastructure.

Russia : Government-Driven Initiatives

With a market value of $100.0 million, Russia's 5G security sector is gaining traction, driven by state-sponsored initiatives to enhance national cybersecurity. The government is prioritizing the development of secure communication networks, particularly in major cities like Moscow and St. Petersburg. The competitive landscape includes local players and international firms, focusing on sectors such as telecommunications and defense.

Italy : Focus on Telecommunications Security

Italy's 5G security market is valued at $70.0 million, with increasing demand for secure telecommunications solutions. The Italian government is implementing policies to enhance cybersecurity, particularly in critical sectors like finance and healthcare. Key markets include Milan and Rome, where businesses are investing in secure 5G infrastructure to support digital transformation and innovation.

Spain : Investment in Digital Infrastructure

Spain's 5G security market is valued at $50.0 million, driven by a growing emphasis on cybersecurity in digital services. The Spanish government is actively promoting initiatives to secure 5G networks, particularly in urban areas like Barcelona and Madrid. The competitive landscape features both local and international players, focusing on sectors such as e-commerce and public services.

Rest of Europe : Varied Market Dynamics

The Rest of Europe holds a market value of $25.69 million in the 5G security sector, characterized by diverse regulatory environments and market dynamics. Countries in this region are at different stages of 5G adoption, with varying levels of government support and infrastructure development. Key players include both local firms and international giants, focusing on niche applications across various industries.