Market Growth Projections

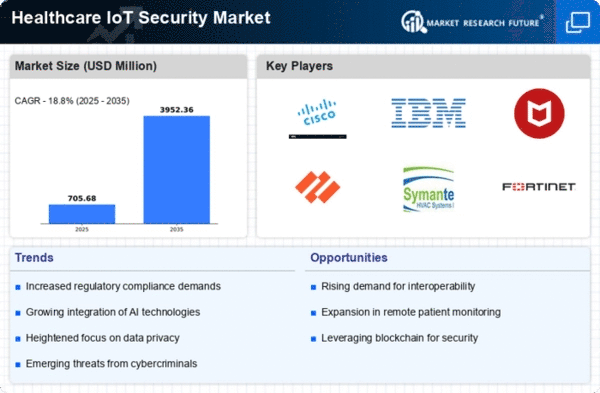

The Global Healthcare IoT Security Market Industry is projected to experience substantial growth over the coming years. In 2024, the market is valued at 0.59 USD Billion, with expectations to reach approximately 3.96 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 18.89% from 2025 to 2035. Factors contributing to this growth include the increasing prevalence of cyber threats, regulatory compliance demands, and the rising adoption of IoT devices in healthcare. As organizations prioritize the security of their IoT ecosystems, the market is likely to expand significantly, reflecting the critical importance of safeguarding patient data and healthcare systems.

Rising Cybersecurity Threats

The Global Healthcare IoT Security Market Industry is increasingly driven by the rising threats of cyberattacks targeting healthcare systems. As healthcare organizations adopt IoT devices for patient monitoring and data management, the potential for breaches escalates. In 2024, the market is valued at 0.59 USD Billion, reflecting the urgent need for robust security measures. Cybersecurity incidents can lead to significant financial losses and compromise patient safety, prompting healthcare providers to invest in advanced security solutions. This trend is expected to continue, as the industry anticipates a compound annual growth rate of 18.89% from 2025 to 2035, reaching an estimated 3.96 USD Billion by 2035.

Increased Adoption of IoT Devices

The Global Healthcare IoT Security Market Industry is experiencing substantial growth due to the increased adoption of IoT devices in healthcare settings. These devices, ranging from wearable health monitors to smart medical equipment, facilitate real-time patient monitoring and data collection. However, the proliferation of these devices also raises security concerns, as they can be vulnerable to cyber threats. Consequently, healthcare providers are compelled to invest in IoT security solutions to safeguard sensitive patient information. This trend is expected to contribute to the market's expansion, with projections indicating a rise from 0.59 USD Billion in 2024 to 3.96 USD Billion by 2035.

Regulatory Compliance Requirements

The Global Healthcare IoT Security Market Industry is significantly influenced by stringent regulatory compliance requirements. Governments worldwide are implementing regulations to ensure the security of patient data and the integrity of healthcare systems. For instance, regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States mandate strict data protection measures. Compliance with these regulations necessitates the adoption of advanced IoT security solutions, thereby driving market growth. As healthcare organizations strive to meet these regulatory standards, the demand for comprehensive security frameworks is likely to increase, further propelling the market forward.

Emerging Technologies in Healthcare

The Global Healthcare IoT Security Market Industry is influenced by the emergence of innovative technologies such as artificial intelligence and machine learning. These technologies are being integrated into IoT security solutions to enhance threat detection and response capabilities. By leveraging AI and machine learning, healthcare organizations can analyze vast amounts of data to identify potential security breaches in real-time. This proactive approach to security is becoming essential as the complexity of cyber threats evolves. The integration of these technologies is expected to bolster the market, as organizations seek to adopt cutting-edge solutions to safeguard their IoT infrastructures.

Growing Demand for Remote Patient Monitoring

The Global Healthcare IoT Security Market Industry is further propelled by the growing demand for remote patient monitoring solutions. As healthcare providers seek to enhance patient care and reduce hospital visits, IoT devices play a crucial role in enabling continuous monitoring of patients' health conditions. However, this shift towards remote monitoring introduces new security challenges, as sensitive health data is transmitted over networks. To address these challenges, healthcare organizations are increasingly investing in IoT security measures to protect patient data from unauthorized access. This trend is likely to drive market growth, with an anticipated CAGR of 18.89% from 2025 to 2035.