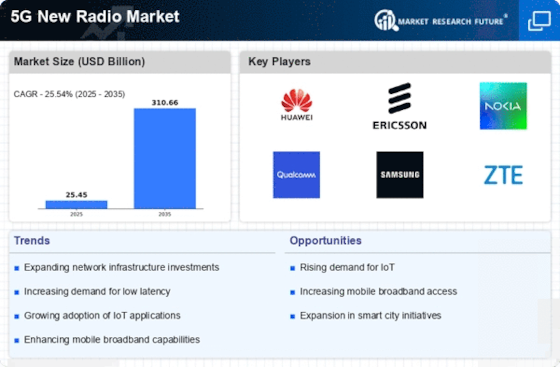

Enhanced Mobile Broadband Demand

The demand for enhanced mobile broadband services is a primary driver of the 5G New Radio Market. As consumers increasingly rely on high-speed internet for streaming, gaming, and remote work, the need for faster and more reliable connectivity becomes paramount. According to recent data, mobile data traffic is projected to grow exponentially, with estimates suggesting a tenfold increase by 2025. This surge in demand compels telecom operators to invest in 5G infrastructure, thereby propelling the 5G New Radio Market forward. Enhanced mobile broadband not only improves user experience but also supports the proliferation of smart devices, further driving the need for advanced network capabilities.

Government Initiatives and Policies

Government initiatives and policies play a crucial role in shaping the 5G New Radio Market. Many countries are actively promoting the deployment of 5G networks through regulatory frameworks and funding programs. These initiatives aim to foster innovation, enhance connectivity, and stimulate economic growth. For instance, various governments have allocated significant budgets to support research and development in telecommunications, which is likely to accelerate the rollout of 5G infrastructure. Additionally, favorable policies regarding spectrum allocation and investment incentives are expected to attract private sector participation, further propelling the 5G New Radio Market.

Advancements in Network Slicing Technology

Advancements in network slicing technology represent a pivotal driver for the 5G New Radio Market. Network slicing enables operators to create multiple virtual networks on a single physical infrastructure, tailored to specific applications or customer needs. This flexibility is particularly beneficial for industries such as healthcare, automotive, and entertainment, which require distinct network characteristics. As organizations seek to optimize their operations and enhance service delivery, the ability to customize network resources becomes increasingly valuable. The implementation of network slicing is expected to enhance operational efficiency and reduce costs, thereby stimulating growth within the 5G New Radio Market.

Growing Demand for Low Latency Applications

The growing demand for low latency applications is a significant driver of the 5G New Radio Market. Applications such as autonomous vehicles, remote surgery, and augmented reality require ultra-reliable low latency communication to function effectively. As industries increasingly adopt these technologies, the need for networks that can deliver sub-millisecond latency becomes critical. The 5G technology is specifically designed to meet these requirements, offering capabilities that far exceed those of previous generations. This demand for low latency is likely to spur investments in the 5G New Radio Market, as service providers seek to enhance their offerings and remain competitive.

Support for Massive Machine-Type Communications

The 5G New Radio Market is significantly influenced by the support for massive machine-type communications. This capability allows for the simultaneous connection of a vast number of devices, which is essential for the Internet of Things (IoT) ecosystem. With projections indicating that there could be over 75 billion connected devices by 2025, the demand for networks that can handle such scale is critical. The 5G technology is designed to accommodate this growth, offering low latency and high reliability, which are essential for applications such as smart cities and industrial automation. Consequently, the expansion of machine-type communications is likely to drive investments in the 5G New Radio Market.