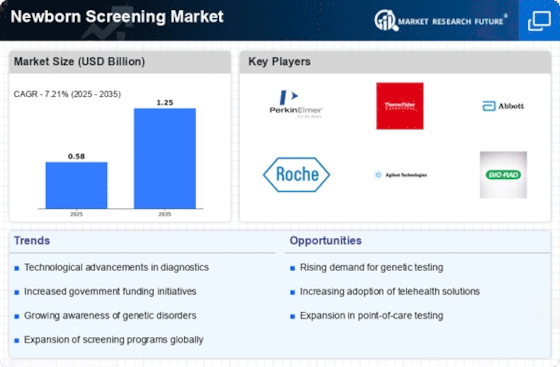

Expansion of Screening Panels

The expansion of newborn screening panels is a notable trend influencing the Newborn Screening Market. Many healthcare systems are broadening their screening panels to include a wider range of disorders, driven by advancements in technology and increased understanding of genetic conditions. This expansion allows for the early detection of conditions that were previously undetectable, thus improving health outcomes for affected infants. As more disorders are added to screening panels, the market is likely to see a surge in demand for testing services and related technologies. This trend not only enhances the efficacy of newborn screening but also underscores the evolving nature of the Newborn Screening Market.

Government Initiatives and Funding

Government initiatives aimed at improving public health outcomes significantly influence the Newborn Screening Market. Many countries have implemented policies mandating newborn screening for specific disorders, thereby increasing the number of infants screened annually. For instance, funding programs and grants are often allocated to support the development and implementation of screening programs. This financial backing not only facilitates the expansion of existing programs but also encourages research into new screening technologies. As a result, the market is likely to experience sustained growth, driven by these supportive governmental actions that prioritize early detection and intervention.

Growing Parental Awareness and Education

Parental awareness regarding the importance of newborn screening is a vital driver for the Newborn Screening Market. As parents become more informed about the potential benefits of early detection of congenital disorders, they are more likely to advocate for comprehensive screening for their newborns. Educational campaigns and advocacy groups play a significant role in disseminating information about the advantages of newborn screening, which can lead to timely interventions and improved health outcomes. This heightened awareness is expected to increase the demand for screening services, thereby contributing to the overall growth of the Newborn Screening Market.

Rising Incidence of Congenital Disorders

The increasing prevalence of congenital disorders is a primary driver for the Newborn Screening Market. Statistics indicate that approximately 1 in 33 infants is born with a congenital disorder, necessitating early detection and intervention. This rising incidence compels healthcare systems to adopt comprehensive screening programs to identify conditions such as metabolic disorders, genetic syndromes, and endocrine disorders. As awareness grows regarding the benefits of early diagnosis, healthcare providers are likely to expand their screening capabilities. Consequently, this trend is expected to bolster the demand for advanced screening technologies and services, thereby propelling the Newborn Screening Market forward.

Technological Innovations in Screening Methods

Technological advancements play a crucial role in shaping the Newborn Screening Market. Innovations such as tandem mass spectrometry and genetic sequencing have revolutionized the ability to detect a wide array of disorders from a single blood sample. These technologies not only enhance the accuracy and efficiency of screenings but also reduce the time required for results. As a result, healthcare providers are increasingly adopting these advanced methods, leading to a projected growth rate of around 10% in the market. The integration of artificial intelligence and machine learning in data analysis further augments the potential of these technologies, making them indispensable in the Newborn Screening Market.