Loungewear Market Trends

Loungewear Market Research Report Information By Material Type (Cotton, Wool, Silk and Others), By End User (Female, Male and Kids), By Distribution Channel (Store-Based and Non-Store-Based), and By Region (North America, Europe, Asia-Pacific, And Rest Of The World) – Market Forecast Till 2035

Market Summary

As per Market Research Future Analysis, the global loungewear market was valued at USD 6.87 billion in 2024 and is projected to grow to USD 19.04 billion by 2035, with a CAGR of 9.71% from 2025 to 2035. Key drivers include the expansion of organized retail, rising disposable income, and an aging female population. The U.S. leads the market, particularly in plus-size loungewear, driven by a high obesity rate and a growing work-from-home culture. Cotton remains the dominant material due to its comfort and accessibility, while women represent the largest consumer segment, favoring stylish and premium loungewear options.

Key Market Trends & Highlights

The loungewear market is experiencing significant growth driven by fashion trends and consumer preferences.

- Loungewear Market Size in 2024: USD 6.87 billion. Projected Market Size by 2035: USD 19.04 billion. CAGR from 2025 to 2035: 9.71%. U.S. market share is the largest, with a notable demand for plus-size options.

Market Size & Forecast

| 2024 Market Size | USD 6.87 Billion |

| 2035 Market Size | USD 19.04 Billion |

| CAGR (2024-2035) | 9.71% |

| Largest Regional Market | North America. |

Major Players

<p>Key players include L Brands Inc. (U.S.), H & M (Sweden), Triumph International Holding GmBH (Germany), Authentic Brands Group LLC (U.S.), Urban Outfitters (U.S.), Nordstrom Inc. (U.S.), Hanesbrands Inc. (U.S.), Jockey International Inc. (U.S.), Marks & Spencer Group Plc (U.K.), and PVH CORPORATION (U.S.).</p>

Market Trends

Increased demand for stylish and contemporary sleepwear to boost the market growth

People are rushing to adopt current fashion trends that encourage them to buy new clothing, notably worn by celebrities and fashion influencers. The current fashion trends subtly discard outmoded clothing. These trendsetters encourage individuals to develop their innerwear or sleepwear as casual wear, which fuels the growth of the sleepwear industry. Today's fashion trends are going bold and classic, which stands out from the line. For instance, Calvin Klein by PVH has a broad selection of sleepwear in various designs, hues, and sizes.

Ordinary sleepwear and loungewear are more expensive than products with cutting-edge features and creative designs, encouraging product premiumization and line expansion. This is anticipated to accelerate the loungewear market's expansion during the projected period.

Additionally, a growing loungewear market for fashionable sleepwear motivates businesses to launch new attractive items that satisfy consumer demand. In addition, women in the adult age group are the primary consumers of these items since they select and spend more money on certain types of clothing. Additionally, the fact that this kind of clothing is both stylish and comfy aids in the loungewear market expansion. Because of this, sales of minimizer lingerie have surged, which is the foundation for other clothing.

As these goods are made in a way that appeals to their sense of fashion and looks beautiful on women with larger body proportions, plus-size sleepwear and loungewear are now becoming more popular among women who are overweight or obese.

Furthermore, Hanesbrands provides a broad selection of plus-size loungewear and sleepwear under Maidenform and Just My Size. The colors of sleepwear and loungewear vary because people choose these items depending on the situation. The U.S. has the world's largest loungewear market for sleepwear and loungewear, and plus-size options are particularly popular there. The popularity of these goods is being fueled by the over 40% obesity rate among the U.S. population in 2018, which includes all age categories. Additionally, retailers promote plus-size loungewear and sleepwear worldwide by utilizing plus-size models.

The competition to provide cozy and fashionable clothing for men, women, and children is expected to generate decent loungewear market revenue. To preserve their market share, the major manufacturers are introducing fresh styles of cozy loungewear.

<p>The global loungewear market is experiencing a notable shift towards comfort-driven apparel, reflecting changing consumer preferences for versatile and relaxed clothing options that seamlessly blend style with functionality.</p>

U.S. Department of Commerce

Loungewear Market Market Drivers

Market Growth Projections

The Global Loungewear Market Industry is on a trajectory of substantial growth, with projections indicating a market value of 21.0 USD Billion by 2035. This remarkable increase underscores the rising popularity of loungewear as a staple in modern wardrobes. The anticipated compound annual growth rate (CAGR) of 10.16% from 2025 to 2035 suggests that the market will continue to expand as consumer preferences evolve. Factors such as increased disposable income, changing lifestyle habits, and the ongoing demand for comfort-driven apparel contribute to this growth. As brands adapt to these trends, the loungewear market is likely to witness further innovations and product developments.

Rising Demand for Comfort Wear

The Global Loungewear Market Industry experiences a notable increase in demand for comfortable clothing, driven by a shift in consumer preferences towards relaxed and casual attire. This trend is particularly evident as individuals seek versatile garments suitable for both home and outdoor activities. The market is projected to reach 7.23 USD Billion in 2024, reflecting a growing inclination towards loungewear. This demand is further fueled by the rise of remote work and a more casual lifestyle, which encourages consumers to invest in comfortable yet stylish clothing options. As a result, brands are expanding their loungewear collections to cater to this evolving consumer behavior.

Expansion of E-Commerce Platforms

The Global Loungewear Market Industry benefits from the rapid expansion of e-commerce platforms, which facilitate convenient shopping experiences for consumers. Online retailing allows brands to reach a global audience, breaking geographical barriers and providing access to a wider range of loungewear options. This trend is particularly relevant as consumers increasingly prefer online shopping due to its convenience and variety. The growth of e-commerce is expected to contribute significantly to the market's expansion, with projections indicating a compound annual growth rate (CAGR) of 10.16% from 2025 to 2035. As more consumers turn to online platforms, brands are likely to enhance their digital presence to capture this growing segment.

Sustainability and Eco-Friendly Practices

Sustainability has emerged as a pivotal driver in the Global Loungewear Market Industry, as consumers increasingly prioritize eco-friendly products. Brands are responding by adopting sustainable practices, such as using organic materials and implementing ethical manufacturing processes. This shift aligns with the growing awareness of environmental issues and the demand for transparency in the fashion industry. Companies that emphasize sustainability are likely to attract a conscientious consumer base, potentially leading to increased market share. As the market evolves, the integration of sustainable practices may become a standard expectation rather than a differentiating factor, influencing purchasing decisions and brand loyalty.

Diverse Product Offerings and Customization

The Global Loungewear Market Industry is characterized by a diverse range of product offerings, catering to various consumer preferences and lifestyles. Brands are increasingly focusing on customization options, allowing consumers to personalize their loungewear choices. This trend not only enhances customer satisfaction but also fosters brand loyalty, as consumers feel a stronger connection to products that reflect their individual styles. The availability of various styles, colors, and fabrics enables consumers to select loungewear that suits their unique tastes. As the market continues to evolve, the emphasis on diversity and customization may play a crucial role in attracting and retaining customers.

Influence of Social Media and Celebrity Culture

The Global Loungewear Market Industry is significantly influenced by social media platforms and celebrity endorsements, which play a crucial role in shaping consumer preferences. Influencers and celebrities often showcase loungewear in their daily lives, creating aspirational content that resonates with their followers. This visibility drives consumer interest and encourages purchases, as individuals seek to emulate the styles of their favorite personalities. The impact of social media marketing is evident in the rapid growth of loungewear brands, which are leveraging these platforms to reach wider audiences. Consequently, this trend is likely to continue propelling the market forward, as brands invest in digital marketing strategies.

Market Segment Insights

Loungewear Material Type Insights

<p>The loungewear market segmentation based on material type is divided into <a href="https://www.marketresearchfuture.com/reports/cotton-sock-market-36439">cotton</a>, wool, silk, and other categories. Due to its high revenue share and ease of product accessibility, the cotton category is regarded as the industry leader. This market's expansion is fueled by appealing packaging and the rising popularity of the loungewear market revenue. Cotton is the most often used material for clothing in the category of loungewear due to its comfort. Additionally, it may be worn in almost every season. This factor has contributed to the growth of the loungewear market.</p>

<p>Cotton is positioned next to silk because, although being more expensive, it conveys an air of refinement and polish. Wool and other textiles are suitable for use throughout specific seasons.</p>

Loungewear End User Insights

<p>The loungewear market segmentation based on end-user divided into males, females, and children is included in the end-use part. The female segment now holds the biggest share in the market growth for loungewear, and it will keep growing steadily during the projected period. Their acceptance and appeal are driving the desire for expensive, high-quality clothes. Obese women typically prefer to wear nightwear, such as lingerie, that reduces their physical size.</p>

<p>Figure 2: Loungewear Market, by End-User, 2021 & 2030 (USD Million)Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review</p>

<p>The loungewear market data, based on distribution channels is segmented into store-based and non-store-based. The store-based market is split further into supermarkets, hypermarkets, specialty shops, and other establishments. The biggest channels in these sub-segments, which also account for the highest loungewear sales, are supermarkets and hypermarkets. The distribution of the product is greatly aided by specialized or convenience retailers.</p>

Get more detailed insights about Loungewear Market Research Report - Forecast till 2032

Regional Insights

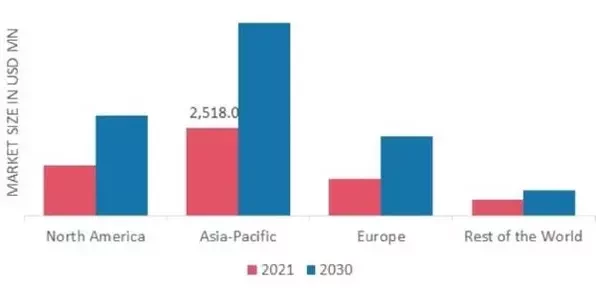

By region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. Asia Pacific loungewear market accounted for USD 2,518 million in 2021 and is expected to exhibit a significant CAGR growth during the study period. Due to the promotional efforts of the leading manufacturers, Asia Pacific now has the largest portion of the loungewear market. This element influences how well clients are informed about new product launches. Industrial companies concentrate on the local loungewear market and develop plans to gain the largest share value.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: LOUNGEWEAR MARKET SHARE BY REGION 2021 (%) Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Significant growth is seen by North America loungewear market. All these important regions will aid the expansion of the worldwide market. Because luxury loungewear is becoming increasingly well-liked in a growing and densely populated nation, shortly, these variables will accelerate the expansion of the market. Research indicates that 22% of all Americans—or 36.2 million—will work remotely by 2025. The market revenue is increasing due to the rising work-from-home culture trend, fueling demand for loungewear. Further, the U.S. loungewear market held the largest market share, and the Canada loungewear market was the fastest growing market in this region

Throughout the forecast period, the Europe loungewear market is anticipated to expand its revenue at a modest rate. The government of the United Kingdom's guidance on working from home has already altered fashion labels and purchasing practices. In 2020, when frequent Coronavirus lockdowns were enacted in the U.K. loungewear market sales surged by 1,303%. As a result of the announcement in reaction to the new Omicron Covid version, purchases of men's loungewear climbed by 50% in 2021.

Additionally, the Germany loungewear market is anticipated to continue to sustain revenue growth to some level due to the rising popularity of working from home.

Key Players and Competitive Insights

Major market players are investing a lot of money in R&D to broaden their product portfolios, which will spur further expansion of the industry. With significant industry changes, including new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market developments are also undertaking various strategic activities to expand their presence. To grow and thrive in a climate where competition is fierce, and the market is growing, competitors in the loungewear industry sector must provide affordable products.

Manufacturing locally to cut operating costs is one of the main business methods manufacturers use in the loungewear industry to benefit customers and develop the loungewear industry. The sector has recently given medicine some of the most important advantages.

The loungewear market major player such as L Brands Inc. (U.S.), H & M (Sweden), Triumph International Holding GmBH (Germany), Authentic Brands Group LLC (U.S.), Urban Outfitters (US), Nordstrom Inc. (US), Hanesbrands Inc. (U.S.), Jockey International Inc. (U.S.), Marks & Spencer Group Plc (U.K.), PVH CORPORATION (U.S.), and others are working on expanding the industry demand by investing in research and development activities.

H & M Fast-fashion clothes for men, women, teens, and kids are the main emphasis of Hennes & Mauritz AB, often known as the H&M Group or just H&M, an international apparel company with its headquarters in Sweden. As of 23 June 2022, H&M Group operated 4,801 shops under its different corporate names in 75 geographic areas. Simone Rocha, a designer from Ireland and the daughter of fashion mogul John Rocha, joined forces with another designer in March 2021.

Simone often participates in London Fashion Week and was honored with the title of "Womenswear Designer of the Year" at the 2016 British Fashion Awards. Tyler Mitchell's marketing film for H&M demonstrates the femininity of Rocha's designs, which are well known for it.

Also, American brand management firm with its main office in New York City is Authentic Brands Group LLC (ABG). Its assets include a variety of sporting, entertainment, and fashion brands, for which it collaborates with other businesses to get licensing and products. In addition to owning the likeness rights or estates of famous people like Muhammad Ali, Elvis Presley, and Marilyn Monroe, ABG also controls more than 50 consumer brands. ABG filed in July 2021 for a potential initial public offering of about US$1.5 billion.

Key Companies in the Loungewear Market market include

Industry Developments

August 2022: Introducing a range of reasonably priced period underwear is Hanes®. The new Comfort, Period, line from the company. When it comes to period comfort and confidence, even while sleeping, T.M. underwear is made to help. It provides quality period protection without the premium period underwear price tag.

May 2021: M&S stated that it planned to replace its largest location, the Marble Arch branch on Oxford Street in London, with a 10-story structure that would include two and a half levels of retail space below six floors of offices.

Future Outlook

Loungewear Market Future Outlook

<p>The Global Loungewear Market is projected to grow at a 9.71% CAGR from 2025 to 2035, driven by rising consumer demand for comfort and versatility in apparel.</p>

New opportunities lie in:

- <p>Develop eco-friendly loungewear lines to capture the sustainability market. Leverage e-commerce platforms for direct-to-consumer sales strategies. Innovate with <a href="https://www.marketresearchfuture.com/reports/smart-textiles-for-military-market-1656">smart textiles</a> to enhance comfort and functionality in loungewear.</p>

<p>By 2035, the Global Loungewear Market is expected to achieve substantial growth, reflecting evolving consumer preferences.</p>

Market Segmentation

End User Outlook

- Female

- Male

- Kids

Material Type Outlook

- Cotton

- Wool

- Silk

- Others

Loungewear Regional Outlook

- {"North America"=>["US"

- "Canada"]}

- {"Europe"=>["Germany"

- "France"

- "UK"

- "Italy"

- "Spain"

- "Rest of Europe"]}

- {"Asia-Pacific"=>["China"

- "Japan"

- "India"

- "Australia"

- "South Korea"

- "Rest of Asia-Pacific"]}

- {"Rest of the World"=>["Middle East"

- "Africa"

- "Latin America"]}

Distribution Channel Outlook

- Store-Based

- Non-Store-Based

Loungewear End User Outlook

- Female

- Male

- Kids

Loungewear Material Type Outlook

- Cotton

- Wool

- Silk

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 6.87 billion |

| Market Size 2035 | 19.04 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 9.71% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018 & 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, Operating Platforms, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S, Canada, Germany, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | L Brands Inc. (U.S.), H & M (Sweden), Triumph International Holding GmBH (Germany), Authentic Brands Group LLC (U.S.), Urban Outfitters (US), Nordstrom Inc. (US), Hanesbrands Inc. (U.S.), Jockey International Inc. (U.S.), Marks & Spencer Group Plc (U.K.), PVH CORPORATION (U.S.). |

| Key Market Opportunities | Celebrity marketing and endorsements, People favor dressing in relaxed, informal attire. |

| Key Market Dynamics | Increasing expansion of the organized retail market Foreign shops entering the market |

| Market Size 2025 | 7.54 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the loungewear market?

The loungewear market size was valued at USD 5.49 Billion in 2023.

What is the growth rate of the loungewear market?

The market is projected to grow at a CAGR of 9.71% during the forecast period, 2024-2032.

Which region held the largest market share in the market?

Asia Pacific had the largest share of the market

Who are the key players in the loungewear market?

The key players in the market are L Brands Inc. (U.S.), H & M (Sweden), Triumph International Holding GmBH (Germany), Authentic Brands Group LLC (U.S.), Urban Outfitters (US), Nordstrom Inc. (US), Hanesbrands Inc. (U.S.), Jockey International Inc. (U.S.), Marks & Spencer Group Plc (U.K.), PVH CORPORATION (U.S.).

Which Material type led the loungewear market?

The cotton loungewear category dominated the market in 2022.

Which is the major segment of distribution channel share in the market?

The store based had the largest share in the market.

-

--- |-Table of Contents1. Executive Summary2. Market Introduction2.1. Market Definition2.2. Scope of the Study2.2.1. Research Objectives2.2.2. Assumptions & Limitations2.3. Market Structure3. MARKET Research Methodology3.1. Research Process3.2. Secondary Research3.3. Primary Research3.4. Forecast Model4. MARKET LANDSCAPE4.1. Supply Chain Analysis4.1.1. Raw Material Suppliers4.1.2. Manufacturers/Producers4.1.3. Distributors/Retailers/Wholesalers/E-Commerce4.1.4. End Users4.2. Porter’s Five Forces Analysis4.2.1. Threat of New Entrants4.2.2. Bargaining Power of Buyers4.2.3. Bargaining Power of Suppliers4.2.4. Threat of Substitutes4.2.5. Internal Rivalry4.3. Impact of COVID-19 outbreak on Global Loungewear Market4.3.1. Impact on Production4.3.2. Impact on Consumer Buying Behavior4.3.3. Impact on Pricing4.3.4. Impact on Store-Based VS Non-Store-Based Sales4.3.5. Others5. MARKET DYNAMICS OF THE GLOBAL LOUNGEWEAR MARKET5.1. Introduction5.2. Drivers5.3. Restraints5.4. Opportunities5.5. Challenges6. GLOBAL LOUNGEWEAR MARKET, BY MATERIAL6.1. Introduction6.2. Cotton6.2.1. Market Estimates & Forecast, 2024-20326.2.2. Market Estimates & Forecast, by Region, 2024-20326.3. Wool6.3.1. Market Estimates & Forecast, 2024-20326.3.2. Market Estimates & Forecast, by Region, 2024-20326.4. Silk6.4.1. Market Estimates & Forecast, 2024-20326.4.2. Market Estimates & Forecast, by Region, 2024-20326.5. Others6.5.1. Market Estimates & Forecast, 2024-20326.5.2. Market Estimates & Forecast, by Region, 2024-20327. GLOBAL LOUNGEWEAR MARKET, BY END USER7.1. Introduction7.2. Female7.2.1. Market Estimates & Forecast, 2024-20327.2.2. Market Estimates & Forecast, by Region, 2024-20327.3. Male7.3.1. Market Estimates & Forecast, 2024-20327.3.2. Market Estimates & Forecast, by Region, 2024-20327.4. Kids7.4.1. Market Estimates & Forecast, 2024-20327.4.2. Market Estimates & Forecast, by Region, 2024-20328. GLOBAL LOUNGEWEAR MARKET, BY DISTRIBUTION CHANNEL8.1. Introduction8.2. Store-Based8.2.1. Market Estimates & Forecast, 2024-20328.2.2. Market Estimates & Forecast, by Region, 2024-20328.2.3. Supermarkets & Hypermarkets8.2.3.1. Market Estimates & Forecast, 2024-20328.2.3.2. Market Estimates & Forecast, by Region, 2024-20328.2.4. Specialty Stores8.2.4.1. Market Estimates & Forecast, 2024-20328.2.4.2. Market Estimates & Forecast, by Region, 2024-20328.2.5. Others8.2.5.1. Market Estimates & Forecast, 2024-20328.2.5.2. Market Estimates & Forecast, by Region, 2024-20328.3. Non-Store-Based8.3.1. Market Estimates & Forecast, 2024-20328.3.2. Market Estimates & Forecast, by Region, 2024-20329. GLOBAL LOUNGEWEAR MARKET, BY REGION9.1. Introduction9.2. North America9.2.1. Market Estimates & Forecast, 2024-20329.2.2. Market Estimates & Forecast, by Material, 2024-20329.2.3. Market Estimates & Forecast, by End User, 2024-20329.2.4. Market Estimates & Forecast, by Distribution Channel, 2024-20329.2.5. Market Estimates & Forecast, by Country, 2024-20329.2.6. US9.2.6.1. Market Estimates & Forecast, by Material, 2024-20329.2.6.2. Market Estimates & Forecast, by End User, 2024-20329.2.6.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.2.7. Canada9.2.7.1. Market Estimates & Forecast, by Material, 2024-20329.2.7.2. Market Estimates & Forecast, by End User, 2024-20329.2.7.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.2.8. Mexico9.2.8.1. Market Estimates & Forecast, by Material, 2024-20329.2.8.2. Market Estimates & Forecast, by End User, 2024-20329.2.8.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.3. Europe9.3.1. Market Estimates & Forecast, 2024-20329.3.2. Market Estimates & Forecast, by Material, 2024-20329.3.3. Market Estimates & Forecast, by End User, 2024-20329.3.4. Market Estimates & Forecast, by Distribution Channel, 2024-20329.3.5. Market Estimates & Forecast, by Country, 2024-20329.3.6. Germany9.3.6.1. Market Estimates & Forecast, by Material, 2024-20329.3.6.2. Market Estimates & Forecast, by End User, 2024-20329.3.6.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.3.7. UK9.3.7.1. Market Estimates & Forecast, by Material, 2024-20329.3.7.2. Market Estimates & Forecast, by End User, 2024-20329.3.7.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.3.8. France9.3.8.1. Market Estimates & Forecast, by Material, 2024-20329.3.8.2. Market Estimates & Forecast, by End User, 2024-20329.3.8.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.3.9. Spain9.3.9.1. Market Estimates & Forecast, by Material, 2024-20329.3.9.2. Market Estimates & Forecast, by End User, 2024-20329.3.9.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.3.10. Italy9.3.10.1. Market Estimates & Forecast, by Material, 2024-20329.3.10.2. Market Estimates & Forecast, by End User, 2024-20329.3.10.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.3.11. Rest of Europe9.3.11.1. Market Estimates & Forecast, by Material, 2024-20329.3.11.2. Market Estimates & Forecast, by End User, 2024-20329.3.11.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.4. Asia-Pacific9.4.1. Market Estimates & Forecast, 2024-20329.4.2. Market Estimates & Forecast, by Material, 2024-20329.4.3. Market Estimates & Forecast, by End User, 2024-20329.4.4. Market Estimates & Forecast, by Distribution Channel, 2024-20329.4.5. Market Estimates & Forecast, by Country, 2024-20329.4.6. China9.4.6.1. Market Estimates & Forecast, by Material, 2024-20329.4.6.2. Market Estimates & Forecast, by End User, 2024-20329.4.6.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.4.7. Japan9.4.7.1. Market Estimates & Forecast, by Material, 2024-20329.4.7.2. Market Estimates & Forecast, by End User, 2024-20329.4.7.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.4.8. India9.4.8.1. Market Estimates & Forecast, by Material, 2024-20329.4.8.2. Market Estimates & Forecast, by End User, 2024-20329.4.8.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.4.9. Australia & New Zealand9.4.9.1. Market Estimates & Forecast, by Material, 2024-20329.4.9.2. Market Estimates & Forecast, by End User, 2024-20329.4.9.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.4.10. Rest of Asia-Pacific9.4.10.1. Market Estimates & Forecast, by Material, 2024-20329.4.10.2. Market Estimates & Forecast, by End User, 2024-20329.4.10.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.5. Rest of the World9.5.1. Market Estimates & Forecast, 2024-20329.5.2. Market Estimates & Forecast, by Material, 2024-20329.5.3. Market Estimates & Forecast, by End User, 2024-20329.5.4. Market Estimates & Forecast, by Distribution Channel, 2024-20329.5.5. Market Estimates & Forecast, by Region, 2024-20329.5.6. South America9.5.6.1. Market Estimates & Forecast, by Material, 2024-20329.5.6.2. Market Estimates & Forecast, by End User, 2024-20329.5.6.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.5.7. Middle East9.5.7.1. Market Estimates & Forecast, by Material, 2024-20329.5.7.2. Market Estimates & Forecast, by End User, 2024-20329.5.7.3. Market Estimates & Forecast, by Distribution Channel, 2024-20329.5.8. Africa9.5.8.1. Market Estimates & Forecast, by Material, 2024-20329.5.8.2. Market Estimates & Forecast, by End User, 2024-20329.5.8.3. Market Estimates & Forecast, by Distribution Channel, 2024-203210. Competitive Landscape10.1. Introduction10.2. Market Strategy10.3. Key Development Analysis(Expansions/Mergers & Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments)11. COMPANY PROFILES11.1. L Brands Inc.11.1.1. Company Overview11.1.2. Financial Updates11.1.3. Product/Business Segment Overview11.1.4. Strategies11.1.5. Key Developments11.1.6. SWOT Analysis11.2. Hanesbrands Inc.11.2.1. Company Overview11.2.2. Financial Updates11.2.3. Product/Business Segment Overview11.2.4. Strategies11.2.5. Key Developments11.2.6. SWOT Analysis11.3. Jockey International Inc.11.3.1. Company Overview11.3.2. Financial Updates11.3.3. Product/Business Segment Overview11.3.4. Strategies11.3.5. Key Developments11.3.6. SWOT Analysis11.4. Marks & Spencer Group Plc11.4.1. Company Overview11.4.2. Financial Updates11.4.3. Product/Business Segment Overview11.4.4. Strategies11.4.5. Key Developments11.4.6. SWOT Analysis11.5. PVH CORPORATION11.5.1. Company Overview11.5.2. Financial Updates11.5.3. Product/Business Segment Overview11.5.4. Strategies11.5.5. Key Developments11.5.6. SWOT Analysis11.6. H & M11.6.1. Company Overview11.6.2. Financial Updates11.6.3. Product/Business Segment Overview11.6.4. Strategies11.6.5. Key Developments11.6.6. SWOT Analysis11.7. Triumph International Holding GmBH11.7.1. Company Overview11.7.2. Financial Updates11.7.3. Product/Business Segment Overview11.7.4. Strategies11.7.5. Key Developments11.7.6. SWOT Analysis11.8. Authentic Brands Group LLC11.8.1. Company Overview11.8.2. Financial Updates11.8.3. Product/Business Segment Overview11.8.4. Strategies11.8.5. Key Developments11.8.6. SWOT Analysis11.9. Urban Outfitters11.9.1. Company Overview11.9.2. Financial Updates11.9.3. Product/Business Segment Overview11.9.4. Strategies11.9.5. Key Developments11.9.6. SWOT Analysis11.10. Nordstrom, Inc.11.10.1. Company Overview11.10.2. Financial Updates11.10.3. Product/Business Segment Overview11.10.4. Strategies11.10.5. Key Developments11.10.6. SWOT Analysis12. CONCLUSIONLIST OF TABLESTABLE 1 Global Loungewear Market, by Region, 2024–2032 (USD Million)TABLE 2 Global Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 3 Global Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 4 Global Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 5 North America: Loungewear Market, by Country, 2024–2032 (USD Million)TABLE 6 North America: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 7 North America: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 8 North America: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 9 US: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 10 US: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 11 US: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 12 Canada: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 13 Canada: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 14 Canada: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 15 Mexico: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 16 Mexico: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 17 Mexico: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 18 Europe: Loungewear Market, by Country, 2024–2032 (USD Million)TABLE 19 Europe: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 20 Europe: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 21 Europe: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 22 Germany: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 23 Germany: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 24 Germany: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 25 France: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 26 France: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 27 France: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 28 Italy: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 29 Italy: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 30 Italy: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 31 Spain: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 32 Spain: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 33 Spain: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 34 UK: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 35 UK: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 36 UK: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 37 Rest of Europe: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 38 Rest of Europe: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 39 Rest of Europe: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 40 Asia-Pacific: Loungewear Market, by Country, 2024–2032 (USD Million)TABLE 41 Asia-Pacific: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 42 Asia-Pacific: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 43 Asia-Pacific: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 44 China: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 45 China: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 46 China: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 47 India: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 48 India: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 49 India: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 50 Japan: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 51 Japan: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 52 Japan: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 53 Rest of Asia-Pacific: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 54 Rest of Asia-Pacific: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 55 Rest of Asia-Pacific: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 56 Rest of the World (RoW): Loungewear Market, by Region, 2024–2032 (USD Million)TABLE 57 Rest of the World (RoW): Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 58 Rest of the World (RoW): Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 59 Rest of the World (RoW): Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 60 South America: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 61 South America: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 62 South America: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 63 Middle East: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 64 Middle East: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 65 Middle East: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)TABLE 66 Africa: Loungewear Market, by Material, 2024–2032 (USD Million)TABLE 67 Africa: Loungewear Market, by End User, 2024–2032 (USD Million)TABLE 68 Africa: Loungewear Market, by Distribution Channel, 2024–2032 (USD Million)LIST OF FIGURESFIGURE 1 Global Loungewear Market SegmentationFIGURE 2 Forecast Research MethodologyFIGURE 3 Five Forces Analysis of the Global Loungewear MarketFIGURE 4 Value Chain of the Global Loungewear MarketFIGURE 5 Share of the Global Loungewear Market in 2024, by Country (%)FIGURE 6 Global Loungewear Market, by Region, 2024–2032,FIGURE 7 Global Loungewear Market Size, by Material, 2024FIGURE 8 Share of the Global Loungewear Market, by Material, 2024–2032 (%)FIGURE 9 Global Loungewear Market Size, by End User, 2024FIGURE 10 Share of the Global Loungewear Market, by End User, 2024–2032 (%)FIGURE 11 Global Loungewear Market Size, by Distribution Channel, 2024FIGURE 12 Share of the Global Loungewear Market, by Distribution Channel, 2024–2032 (%)

Market Segmentation

Loungewear Type Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Loungewear End User Outlook (USD Million, 2018-2032)

Female

Male

Kids

Loungewear Distribution Channel Outlook (USD Million, 2018-2032)

Store-Based

Non-Store-Based

Loungewear Regional Outlook (USD Million, 2018-2032)

North America Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

North America Loungewear by End UserFemale

Male

Kids

North America Loungewear by Distribution ChannelStore-Based

Non-Store-Based

US Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

US Loungewear by End UserFemale

Male

Kids

US Loungewear by Distribution ChannelStore-Based

Non-Store-Based

CANADA Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

CANADA Loungewear by End UserFemale

Male

Kids

CANADA Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Europe Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Europe Loungewear by End UserFemale

Male

Kids

Europe Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Germany Outlook (USD Million, 2018-2032)

Germany Loungewear by TypeCotton

Wool

Silk

Others

Germany Loungewear by End UserFemale

Male

Kids

Germany Loungewear by Distribution ChannelStore-Based

Non-Store-Based

France Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

France Loungewear by End UserFemale

Male

Kids

France Loungewear by Distribution ChannelStore-Based

Non-Store-Based

UK Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

UK Loungewear by End UserFemale

Male

Kids

UK Loungewear by Distribution ChannelStore-Based

Non-Store-Based

ITALY Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

ITALY Loungewear by End UserFemale

Male

Kids

ITALY Loungewear by Distribution ChannelStore-Based

Non-Store-Based

SPAIN Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Spain Loungewear by End UserFemale

Male

Kids

Spain Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Rest Of Europe Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

REST OF EUROPE Loungewear by End UserFemale

Male

Kids

REST OF EUROPE Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Asia-Pacific Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Asia-Pacific Loungewear by End UserFemale

Male

Kids

Asia-Pacific Loungewear by Distribution ChannelStore-Based

Non-Store-Based

China Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

China Loungewear by End UserFemale

Male

Kids

China Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Japan Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Japan Loungewear by End UserFemale

Male

Kids

Japan Loungewear by Distribution ChannelStore-Based

Non-Store-Based

India Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

India Loungewear by End UserFemale

Male

Kids

India Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Australia Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Australia Loungewear by End UserFemale

Male

Kids

Australia Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Rest of Asia-Pacific Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Rest of Asia-Pacific Loungewear by End UserFemale

Male

Kids

Rest of Asia-Pacific Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Rest of the World Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Rest of the World Loungewear by End UserFemale

Male

Kids

Rest of the World Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Middle East Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Middle East Loungewear by End UserFemale

Male

Kids

Middle East Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Africa Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Africa Loungewear by End UserFemale

Male

Kids

Africa Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Latin America Outlook (USD Million, 2018-2032)

Cotton

Wool

Silk

Others

Latin America Loungewear by End UserFemale

Male

Kids

Latin America Loungewear by Distribution ChannelStore-Based

Non-Store-Based

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment