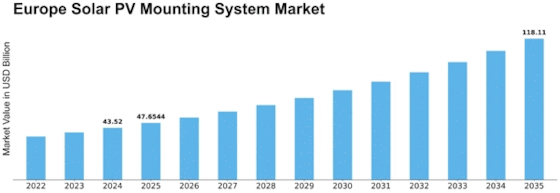

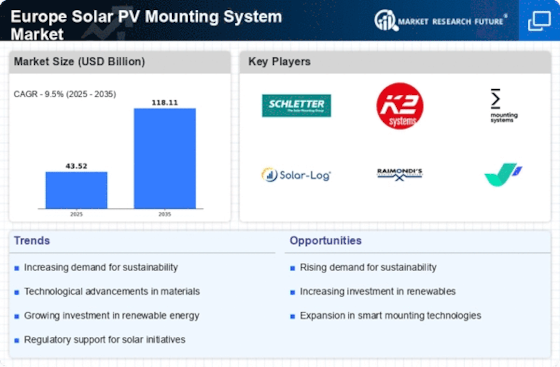

Europe Solar Pv Mounting System Size

Europe Solar PV Mounting System Market Growth Projections and Opportunities

The European solar PV mounting system market is influenced by various market factors that shape its growth and dynamics. One significant factor driving the market is the increasing adoption of renewable energy sources, particularly solar power, to mitigate climate change and reduce dependence on fossil fuels. Government policies and regulations play a crucial role in promoting solar energy deployment, with many European countries offering incentives such as feed-in tariffs, tax credits, and subsidies to encourage investment in solar PV systems. These policies create a favorable environment for market growth by making solar energy more economically viable for consumers and businesses.

Technological advancements also contribute to the growth of the European solar PV mounting system market. Innovations in mounting system designs, materials, and installation techniques improve the efficiency, durability, and aesthetics of solar PV installations. For instance, the development of lightweight and durable mounting systems reduces installation time and costs while increasing the flexibility of solar PV deployment. Additionally, advancements in tracking systems enhance the energy yield of solar PV installations by optimizing the orientation of solar panels to maximize sunlight exposure throughout the day.

Market demand and consumer preferences also drive the evolution of the European solar PV mounting system market. As the cost of solar PV technology continues to decline, more consumers are investing in solar energy systems to lower their electricity bills and reduce their carbon footprint. Additionally, growing awareness of environmental issues and the benefits of renewable energy motivates consumers to choose solar power as a sustainable alternative to traditional energy sources. Consequently, there is a growing demand for high-quality, reliable, and aesthetically pleasing solar PV mounting systems that meet the diverse needs and preferences of consumers.

Moreover, the competitive landscape of the European solar PV mounting system market influences market dynamics and pricing strategies. The presence of numerous manufacturers, suppliers, and installers fosters competition, driving innovation and product differentiation. Market players strive to differentiate themselves by offering superior quality products, exceptional customer service, and competitive pricing to gain a competitive edge in the market. Strategic partnerships, mergers, and acquisitions also shape the competitive landscape, allowing companies to expand their market presence and diversify their product offerings.

Furthermore, macroeconomic factors such as economic growth, inflation rates, and currency fluctuations impact the European solar PV mounting system market. Economic stability and favorable investment climates encourage infrastructure development and investment in renewable energy projects, driving market growth. Conversely, economic downturns and financial uncertainties may lead to project delays, reduced investment, and fluctuating demand for solar PV mounting systems. Additionally, currency exchange rates influence the cost of imported materials and components, affecting the pricing competitiveness of solar PV mounting systems in the European market.

Lastly, environmental and regulatory factors, such as land availability, environmental permitting processes, and sustainability goals, influence the development and deployment of solar PV mounting systems in Europe. Land scarcity and land-use regulations may limit the availability of suitable sites for large-scale solar PV installations, leading to the adoption of innovative mounting solutions such as rooftop and floating solar PV systems. Environmental permitting processes ensure that solar PV projects comply with environmental regulations and mitigate potential environmental impacts, promoting sustainable development. Moreover, European Union directives and climate targets drive the adoption of renewable energy technologies, including solar PV, to achieve carbon reduction goals and transition towards a low-carbon economy.

The European solar PV mounting system market is influenced by a complex interplay of market factors, including government policies, technological advancements, market demand, competitive landscape, macroeconomic conditions, and environmental and regulatory factors. Understanding these market dynamics is essential for stakeholders to navigate the evolving landscape and capitalize on emerging opportunities in the European solar PV mounting system market.

Leave a Comment