Market Trends

Key Emerging Trends in the Europe Solar PV Mounting System Market

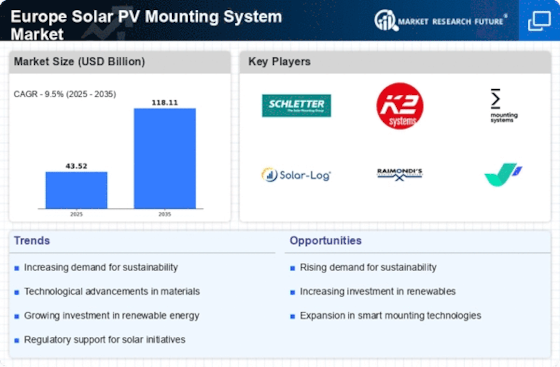

The European solar PV mounting system market has witnessed significant growth in recent years, driven by various market trends and factors. One prominent trend is the increasing adoption of renewable energy sources, particularly solar power, to reduce carbon emissions and combat climate change. Governments across Europe have been implementing supportive policies and incentives to promote the use of solar energy, leading to a surge in installations of solar PV systems.

Moreover, technological advancements in solar PV mounting systems have contributed to the market's growth. Innovations such as lightweight and durable materials, adjustable tilt angles, and easy installation processes have made solar PV systems more efficient and cost-effective. These advancements have attracted both residential and commercial customers, further boosting market demand.

Additionally, the declining costs of solar PV components, including modules, inverters, and mounting systems, have made solar energy more affordable and accessible to a wider range of consumers. This cost reduction has been driven by economies of scale, improved manufacturing processes, and increased competition among suppliers. As a result, the upfront investment required for installing solar PV systems has decreased, making them a more attractive option for consumers seeking renewable energy solutions.

Another key trend in the European solar PV mounting system market is the growing popularity of rooftop solar installations. With limited available land and increasing urbanization, rooftop solar PV systems offer a practical solution for generating renewable energy in densely populated areas. Homeowners, businesses, and public institutions are increasingly turning to rooftop solar installations to harness solar energy and reduce their dependence on traditional grid electricity.

Furthermore, the rise of energy storage solutions, such as batteries, is influencing the European solar PV mounting system market. Battery storage allows consumers to store excess solar energy generated during the day for use during periods of low sunlight or high electricity demand. This technology enhances the reliability and self-consumption of solar PV systems, making them more attractive to consumers looking to achieve energy independence.

The European solar PV mounting system market is also witnessing a shift towards more sustainable and environmentally friendly products. Manufacturers are focusing on developing mounting systems made from recycled materials or those with minimal environmental impact. This trend aligns with the growing emphasis on sustainability and corporate responsibility among consumers and businesses.

Moreover, market players are increasingly offering integrated solutions that combine solar PV modules, mounting systems, inverters, and energy management systems. These comprehensive solutions simplify the installation process and optimize the performance of solar PV systems, driving demand for integrated packages.

The European solar PV mounting system market is experiencing significant growth fueled by various market trends, including the increasing adoption of solar energy, technological advancements, declining costs, the popularity of rooftop installations, the rise of energy storage solutions, and a focus on sustainability. These trends are expected to continue shaping the market landscape and driving further growth in the coming years.

Leave a Comment