Market Analysis

In-depth Analysis of Europe Solar PV Mounting System Market Industry Landscape

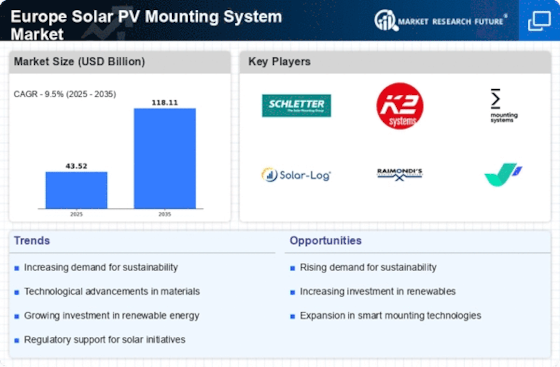

The European solar PV mounting system market has experienced dynamic shifts in recent years, driven by various factors shaping its landscape. One key driver is the increasing adoption of solar energy as a sustainable power source across Europe, fueled by ambitious renewable energy targets set by governments and the European Union. These targets, coupled with supportive policies and incentives, have propelled the demand for solar PV installations, thus stimulating growth in the mounting system market.

Moreover, advancements in solar technology and manufacturing processes have led to the development of more efficient and cost-effective PV modules, driving down the overall cost of solar installations. This reduction in costs has made solar energy more competitive with conventional energy sources, further boosting its attractiveness to consumers, businesses, and investors alike. As a result, the demand for high-quality, durable, and easy-to-install mounting systems has surged, creating opportunities for manufacturers and suppliers operating in the market.

Furthermore, the evolving regulatory landscape and market dynamics within Europe have influenced the competitive environment of the solar PV mounting system market. Policies such as net metering, feed-in tariffs, and renewable energy quotas vary across different European countries, impacting the economics of solar energy projects and the preferences of consumers and businesses. Consequently, market players must navigate these regulatory complexities and tailor their product offerings and business strategies to meet the specific requirements of each market segment.

In addition, the emergence of new trends and technologies is shaping the future trajectory of the European solar PV mounting system market. For instance, there is a growing emphasis on sustainability and environmental responsibility, driving demand for mounting systems made from recycled materials or with minimal environmental impact. Similarly, innovations in mounting system design, such as integrated racking solutions and smart mounting systems equipped with monitoring and tracking capabilities, are gaining traction among installers and project developers seeking to optimize the performance and efficiency of solar installations.

Moreover, the competitive landscape of the European solar PV mounting system market is characterized by the presence of both established players and new entrants vying for market share. Established manufacturers with a strong track record and extensive distribution networks have a competitive advantage in terms of brand recognition, product reliability, and customer trust. However, new entrants and innovative startups are disrupting the market with novel technologies, agile business models, and niche product offerings, challenging the dominance of incumbents and driving innovation and competition.

Furthermore, the increasing emphasis on energy transition and decarbonization initiatives across Europe is expected to drive sustained growth in the solar PV mounting system market in the coming years. Governments, utilities, and corporations are ramping up investments in renewable energy infrastructure and transitioning away from fossil fuels, creating a favorable market environment for solar energy and its supporting industries. Additionally, the growing awareness of the benefits of solar energy in reducing carbon emissions, enhancing energy security, and mitigating climate change is driving public support and political momentum for further solar deployment, which bodes well for the long-term growth prospects of the European solar PV mounting system market.

The European solar PV mounting system market is characterized by dynamic forces shaping its evolution and growth trajectory. From policy incentives and technological advancements to changing consumer preferences and competitive dynamics, a multitude of factors influence the market dynamics and present opportunities and challenges for industry stakeholders. By staying attuned to these market dynamics and adapting their strategies accordingly, manufacturers, suppliers, installers, and investors can capitalize on the growing demand for solar energy and contribute to the transition towards a more sustainable and resilient energy future in Europe.

Leave a Comment