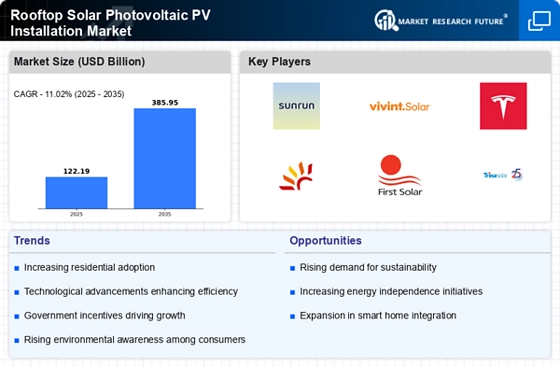

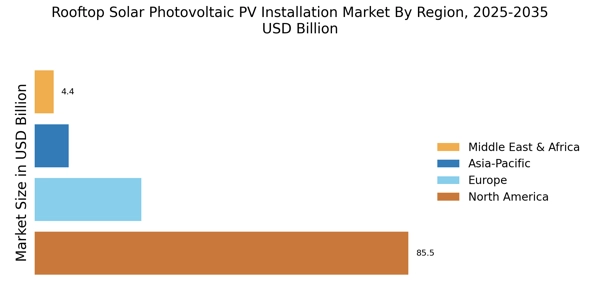

North America : Solar Innovation Leader

North America is witnessing a robust growth in the rooftop solar photovoltaic (PV) installation market, driven by favorable government policies, technological advancements, and increasing consumer awareness. The United States holds the largest market share at approximately 70%, followed by Canada at around 15%. Regulatory incentives, such as the Investment Tax Credit (ITC), are pivotal in boosting demand for solar installations across residential and commercial sectors. The competitive landscape is dominated by key players like Sunrun, Vivint Solar, and Tesla, which are leading the charge in residential solar installations. The presence of established companies, along with emerging startups, fosters innovation and competition. Additionally, states like California and New York are at the forefront, implementing ambitious renewable energy targets that further stimulate market growth. The increasing adoption of energy storage solutions is also enhancing the appeal of rooftop solar systems.

Europe : Sustainable Energy Transition

Europe is rapidly advancing in the rooftop solar photovoltaic (PV) installation market, driven by stringent climate policies and a strong commitment to renewable energy. Germany and France are the largest markets, holding approximately 30% and 20% of the market share, respectively. The European Union's Green Deal and national incentives are crucial in promoting solar energy adoption, aiming for a significant reduction in carbon emissions by 2030. Leading countries like Germany, Spain, and Italy are witnessing a surge in solar installations, supported by a competitive landscape featuring companies such as Trina Solar and JinkoSolar. The presence of innovative financing models and community solar initiatives is enhancing accessibility for consumers. Furthermore, the EU's regulatory framework encourages cross-border cooperation, facilitating technology transfer and investment in solar infrastructure, thereby solidifying Europe's position as a leader in renewable energy.

Asia-Pacific : Emerging Solar Powerhouse

The Asia-Pacific region is emerging as a powerhouse in the rooftop solar photovoltaic (PV) installation market, driven by rapid urbanization, government incentives, and declining technology costs. China leads the market with a staggering share of approximately 60%, followed by Japan at around 15%. The Chinese government's commitment to renewable energy and ambitious targets for solar capacity are key drivers of this growth, fostering a competitive environment for innovation and investment. Countries like India and Australia are also making significant strides in solar adoption, supported by favorable policies and increasing public awareness. The competitive landscape features major players such as Canadian Solar and Enphase Energy, which are expanding their operations in the region. Additionally, the rise of decentralized energy systems and energy storage solutions is enhancing the attractiveness of rooftop solar installations, making them a viable option for both residential and commercial sectors.

Middle East and Africa : Resource-Rich Solar Potential

The Middle East and Africa region is witnessing a burgeoning rooftop solar photovoltaic (PV) installation market, driven by abundant sunlight and increasing energy demands. Countries like South Africa and the United Arab Emirates (UAE) are leading the charge, with the UAE holding approximately 25% of the market share, followed closely by South Africa at around 20%. Government initiatives and investments in renewable energy projects are pivotal in fostering market growth, aiming to diversify energy sources and reduce reliance on fossil fuels. The competitive landscape is characterized by a mix of local and international players, including companies like Sungevity and First Solar. The region's unique challenges, such as regulatory hurdles and financing issues, are being addressed through innovative solutions and partnerships. Furthermore, the growing interest in sustainable energy solutions among consumers is driving demand for rooftop solar installations, positioning the region for significant growth in the coming years.