Market Share

Introduction: Navigating the Competitive Landscape of Degaussing Systems

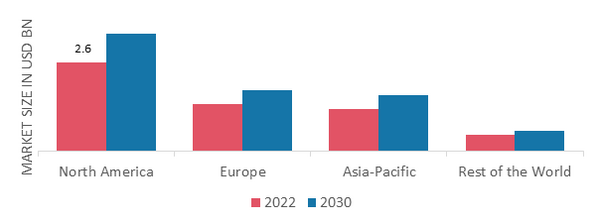

In an era defined by rapid technological advancement and shifting regulatory landscapes, the competitive momentum within the degaussing system market is intensifying. Key players, including OEMs, IT integrators, and infrastructure providers, are vying for dominance by leveraging innovative solutions that meet evolving passenger and consumer expectations. Notably, AI-driven analytics and automation are becoming critical differentiators, enabling companies to enhance operational efficiency and security. Additionally, the integration of IoT and biometrics is reshaping product offerings, allowing for more sophisticated and responsive systems. As we look towards 2024-2025, regional growth opportunities are emerging, particularly in Asia-Pacific and North America, where strategic deployment trends are focused on sustainable and green infrastructure solutions. This dynamic environment presents both challenges and opportunities for C-level executives and strategic planners aiming to navigate the complexities of market share in the degaussing system sector.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions that integrate various technologies for degaussing systems.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| L3 Technologies Inc | Advanced integration capabilities | Defense and security systems | North America, Europe |

| Wärtsilä | Marine industry expertise | Marine degaussing systems | Global |

Specialized Technology Vendors

These companies focus on niche technologies and innovations within the degaussing system market.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| American Superconductor | High-performance superconducting technology | Power electronics and degaussing | North America, Asia |

| Polyamp AB | Customizable solutions for specific needs | Power supply systems | Europe, Asia |

| Ultra Electronics | Innovative electronic solutions | Defense and security applications | Global |

Infrastructure & Equipment Providers

These vendors supply the necessary infrastructure and equipment for effective degaussing operations.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Groupe Gorgé | Robust engineering capabilities | Industrial degaussing systems | Europe, North America |

| Surma Ltd | Specialized in marine applications | Marine degaussing equipment | Europe |

| LARSEN & TOUBRO LIMITED | Diverse engineering solutions | Heavy engineering and degaussing | India, Middle East |

| STL Systems AG | Focus on system integration | Integrated degaussing solutions | Europe |

| IFEN SpA | Expertise in electronic systems | Electronic degaussing systems | Europe, Asia |

Emerging Players & Regional Champions

- DegaussTech Solutions (USA): Specializes in advanced digital degaussing systems for naval applications, recently secured a contract with the US Navy for retrofitting existing vessels, challenging established vendors by offering more cost-effective and efficient solutions.

- Magnetic Shielding Corp (Canada): Focuses on custom degaussing systems for industrial applications, recently implemented a system for a major manufacturing plant, complements established vendors by providing tailored solutions that meet specific client needs.

- Aegis Degaussing Systems (UK): Offers innovative portable degaussing units for small vessels, recently launched a pilot program with several maritime security firms, challenges larger vendors by targeting niche markets with flexible and scalable solutions.

- DegaussPro (Germany): Develops eco-friendly degaussing systems utilizing renewable energy sources, recently partnered with a European shipping company for a fleet-wide upgrade, complements traditional vendors by introducing sustainability into the degaussing process.

Regional Trends: In 2023, there is a noticeable trend towards the adoption of eco-friendly and customizable degaussing solutions, particularly in North America and Europe. Companies are increasingly focusing on integrating digital technologies and renewable energy into their systems, which is driving innovation and competition in the market. Additionally, there is a growing demand for portable and scalable solutions, especially among smaller maritime operators and industrial users.

Collaborations & M&A Movements

- General Dynamics and BAE Systems entered into a partnership to develop next-generation degaussing systems aimed at enhancing naval vessel protection against magnetic mines, thereby strengthening their competitive positioning in the defense sector.

- Northrop Grumman acquired the degaussing technology division of L3Harris Technologies to expand its capabilities in maritime defense systems, significantly increasing its market share in the naval defense segment.

- Thales and Saab collaborated to integrate advanced degaussing systems into their joint naval platforms, enhancing operational effectiveness and addressing increasing regulatory demands for maritime safety.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Data Erasure Efficiency | Vendor A, Vendor B | Vendor A utilizes advanced algorithms for rapid data erasure, achieving compliance with international standards. Vendor B has a patented technology that enhances the speed of degaussing, demonstrated in a case study where a major financial institution reduced data erasure time by 50%. |

| Environmental Compliance | Vendor C, Vendor D | Vendor C has implemented eco-friendly materials in their degaussing systems, receiving certifications from environmental agencies. Vendor D's systems are designed to minimize electronic waste, with a recycling program that has successfully processed over 10,000 units in the past year. |

| User-Friendly Interface | Vendor E, Vendor F | Vendor E's systems feature an intuitive touchscreen interface that simplifies operation, leading to a 30% reduction in training time for new users. Vendor F offers customizable dashboards that allow users to monitor multiple degaussing processes simultaneously. |

| Integration with IT Systems | Vendor G, Vendor H | Vendor G provides APIs that allow seamless integration with existing IT infrastructure, enhancing operational efficiency. Vendor H has partnered with major IT service providers to ensure compatibility and ease of deployment in enterprise environments. |

| Security Features | Vendor I, Vendor J | Vendor I incorporates multi-layered security protocols, including biometric access controls, which have been adopted by government agencies. Vendor J's systems feature real-time monitoring and alerts for unauthorized access attempts, significantly improving security posture. |

Conclusion: Navigating Degaussing System Market Dynamics

The Degaussing System market in 2023 is characterized by intense competitive dynamics and significant fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a growing demand in Asia-Pacific and North America, prompting vendors to tailor their strategies accordingly. Legacy players are leveraging established reputations and extensive distribution networks, while emerging companies are focusing on innovative capabilities such as AI, automation, and sustainability to differentiate themselves. As the market evolves, the ability to offer flexible solutions that meet diverse customer needs will be crucial for leadership. Vendors must prioritize investments in technology and sustainable practices to stay competitive and capture emerging opportunities.

Leave a Comment