Automotive Display Market Summary

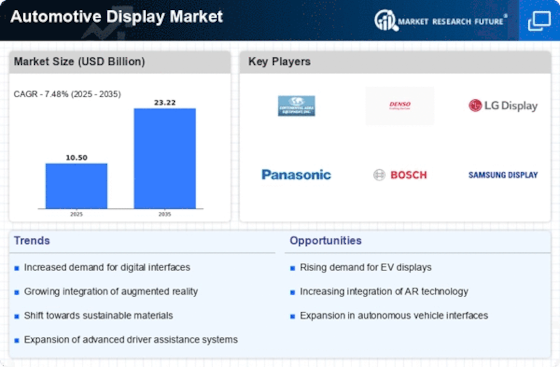

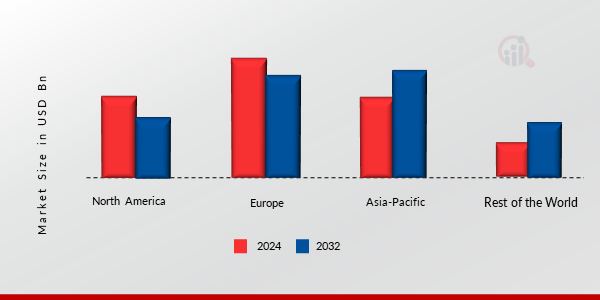

As per Market Research Future Analysis, the Automotive Display Market was valued at USD 8.21 Billion in 2021 and is projected to grow from USD 9.09 Billion in 2022 to USD 16.2 Billion by 2030, with a CAGR of 7.48% during the forecast period (2024 - 2030). The growth is driven by the increasing demand for connected vehicles, navigation systems, and advanced infotainment features. The Infotainment segment dominated the market in 2021, supported by the rising consumer demand for sophisticated in-car entertainment systems. The market is also witnessing innovations in display technologies, including TFT LCD, PMOLED, and AMOLED, with the 6"-10" display size segment expected to grow rapidly due to the demand for larger screens in vehicles. Regionally, Europe holds the largest market share, while Asia-Pacific is anticipated to show faster growth due to the presence of major telecommunication industries.

Key Market Trends & Highlights

The Automotive Display Market is experiencing significant growth driven by technological advancements and consumer preferences.

- Market Size in 2021: USD 8.21 Billion

- Projected Market Size by 2030: USD 16.2 Billion

- CAGR from 2024 to 2030: 7.48%

- Infotainment segment held majority share in 2021

Market Size & Forecast

| 2021 Market Size | USD 8.21 Billion |

| 2022 Market Size | USD 9.09 Billion |

| 2030 Market Size | USD 16.2 Billion |

| CAGR (2024-2030) | 7.48% |

Major Players

Key players include LG Display Co. Ltd, Panasonic Corporation, Delphi Technologies, Robert Bosch GmbH, Visteon Corporation, Continental AG, 3M Company, Nippon Seiki Co. Ltd, Magneti Marelli S.p.A, and Qualcomm Technologies Inc.