E-commerce Growth

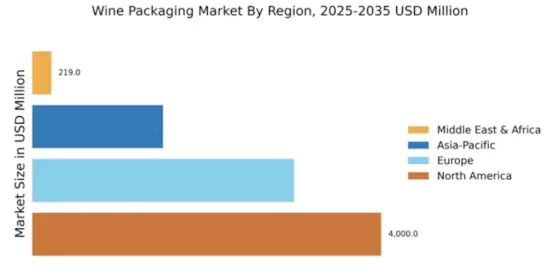

The rise of e-commerce significantly impacts the Global Wine Packaging Market Industry. With more consumers opting to purchase wine online, packaging must adapt to ensure safe and efficient delivery. This includes the development of protective packaging solutions that minimize breakage during transit. Additionally, brands are focusing on packaging that enhances the unboxing experience, thereby fostering customer loyalty. The convenience of online shopping is likely to continue driving demand for wine packaging solutions that cater to this channel. As the market evolves, the CAGR of 4.09% from 2025 to 2035 suggests a sustained growth trajectory.

Regulatory Compliance

Regulatory compliance is a critical driver in the Global Wine Packaging Market Industry. Governments worldwide impose stringent regulations regarding labeling, safety, and environmental impact, necessitating that producers adhere to these standards. Compliance not only ensures product safety but also enhances brand reputation. As regulations evolve, companies must invest in packaging that meets these requirements while still appealing to consumers. This focus on compliance can lead to increased operational costs but is essential for long-term sustainability in the market. The ongoing evolution of regulations will likely shape packaging strategies in the coming years.

Innovative Packaging Designs

In the Global Wine Packaging Market Industry, innovative packaging designs play a crucial role in attracting consumers. Unique bottle shapes, artistic labels, and functional packaging features can differentiate products in a crowded market. For instance, the introduction of lightweight bottles and convenient formats, such as wine pouches and cans, caters to the evolving preferences of younger consumers. This trend not only enhances the aesthetic appeal of wine products but also contributes to logistical efficiencies. As the market evolves, innovative packaging is expected to drive growth, with projections indicating a market value of 13.6 USD Billion by 2035.

Sustainable Packaging Solutions

The Global Wine Packaging Market Industry is increasingly influenced by the demand for sustainable packaging solutions. Consumers are becoming more environmentally conscious, prompting wine producers to adopt eco-friendly materials such as recycled glass and biodegradable alternatives. This shift not only aligns with consumer preferences but also helps brands reduce their carbon footprint. As a result, companies that invest in sustainable packaging are likely to enhance their market position. The Global Wine Packaging Market is projected to reach 8.72 USD Billion in 2024, indicating a growing recognition of sustainability in packaging practices.

Consumer Preferences for Premium Products

The Global Wine Packaging Market Industry is witnessing a shift towards premium products, driven by changing consumer preferences. As consumers increasingly seek high-quality wines, packaging plays a pivotal role in conveying luxury and value. Premium packaging materials, such as heavy glass bottles and intricate designs, enhance the perceived quality of the wine. This trend is particularly evident in the growing market for fine wines and artisanal products. As the demand for premium wines rises, packaging that reflects this quality is likely to become more prevalent, further driving growth in the market.