Increased Regulatory Standards

The Protective Packaging Market is significantly influenced by the rise in regulatory standards aimed at ensuring product safety and environmental sustainability. Governments across various regions are implementing stringent regulations regarding packaging materials, particularly in sectors such as food and pharmaceuticals. These regulations often mandate the use of recyclable or biodegradable materials, pushing companies to innovate and comply. As a result, the Protective Packaging Market is likely to witness a shift towards sustainable packaging solutions, which could enhance brand reputation and consumer trust. The financial implications of non-compliance may also drive companies to invest in advanced protective packaging technologies, further shaping the market landscape.

Growth in the Food and Beverage Sector

The Protective Packaging Market is experiencing growth driven by the expanding food and beverage sector. As consumer preferences shift towards convenience and ready-to-eat meals, the demand for effective protective packaging solutions is on the rise. In 2025, the food and beverage industry is projected to contribute significantly to the overall packaging market, necessitating innovative designs that preserve freshness and extend shelf life. This trend compels manufacturers to develop packaging that not only protects products but also aligns with consumer expectations for sustainability. The Protective Packaging Market must adapt to these changes, potentially leading to new opportunities for growth and collaboration within the sector.

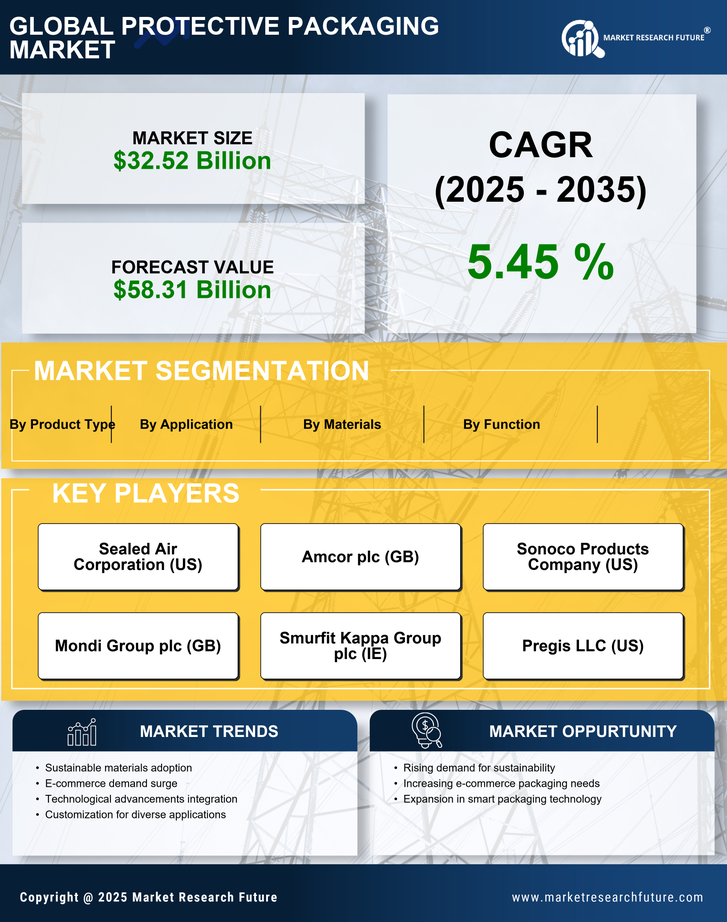

Rising Demand for E-commerce Solutions

The Protective Packaging Market experiences a notable surge in demand due to the rapid expansion of e-commerce. As online shopping continues to gain traction, businesses are increasingly seeking effective packaging solutions to ensure product safety during transit. In 2025, the e-commerce sector is projected to account for a substantial portion of retail sales, necessitating innovative protective packaging. This trend compels manufacturers to develop materials that not only safeguard products but also enhance the unboxing experience for consumers. The Protective Packaging Market must adapt to these evolving consumer expectations, leading to a potential increase in market share for companies that prioritize quality and sustainability in their packaging solutions.

Technological Innovations in Packaging

Technological advancements play a crucial role in shaping the Protective Packaging Market. Innovations such as smart packaging, which incorporates sensors and tracking technologies, are becoming increasingly prevalent. These technologies not only enhance product safety but also provide valuable data on shipping conditions and product integrity. In 2025, the market for smart packaging is expected to grow significantly, driven by consumer demand for transparency and traceability. Companies that leverage these technologies can differentiate themselves in a competitive landscape, potentially leading to increased market share. The Protective Packaging Market must remain agile to incorporate these advancements, ensuring that they meet the evolving needs of consumers and businesses alike.

Rising Consumer Awareness of Sustainability

Consumer awareness regarding sustainability is increasingly influencing the Protective Packaging Market. As individuals become more environmentally conscious, they are actively seeking products that utilize eco-friendly packaging solutions. This shift in consumer behavior is prompting companies to reevaluate their packaging strategies, leading to a greater emphasis on recyclable and biodegradable materials. In 2025, it is anticipated that a significant portion of consumers will prioritize sustainability when making purchasing decisions, compelling businesses to align their practices accordingly. The Protective Packaging Market must respond to this trend by innovating and offering sustainable packaging options, which could enhance brand loyalty and attract a broader customer base.