Increasing Water Scarcity

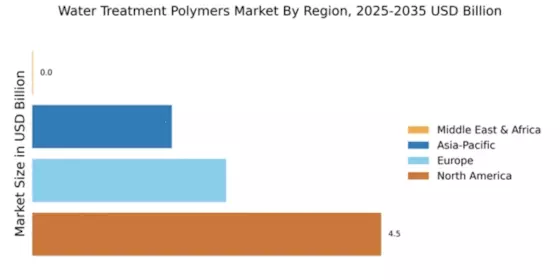

The Global Water Treatment Polymers Market Industry is experiencing growth due to the escalating issue of water scarcity. As populations expand and industrial activities intensify, the demand for effective water treatment solutions rises. In regions where freshwater resources are dwindling, such as parts of Africa and the Middle East, the need for polymers that enhance water purification processes becomes critical. This trend is expected to drive the market's value, projected to reach 46.1 USD Billion in 2024. The urgency to address water scarcity issues is likely to propel innovations in polymer technologies, thereby enhancing their application in various treatment processes.

Market Trends and Projections

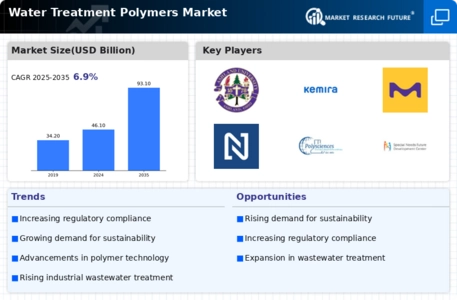

The Global Water Treatment Polymers Market Industry is projected to experience substantial growth over the next decade. The market is anticipated to reach a value of 46.1 USD Billion in 2024, with expectations to double by 2035, reaching 93.1 USD Billion. This growth trajectory suggests a robust demand for water treatment polymers driven by various factors, including regulatory compliance, technological advancements, and increasing water scarcity. The projected CAGR of 6.59% from 2025 to 2035 indicates a sustained interest in innovative polymer solutions that enhance water treatment processes across various sectors.

Growing Awareness of Water Quality

The Global Water Treatment Polymers Market Industry is also influenced by the rising awareness of water quality among consumers and industries. With increasing information regarding the health impacts of contaminated water, there is a growing demand for effective water treatment solutions. This awareness drives both residential and commercial sectors to invest in advanced water treatment technologies, including polymers. As consumers prioritize safe drinking water, the market for water treatment polymers is expected to expand significantly. This trend is indicative of a broader shift towards health-conscious practices, which is likely to sustain growth in the industry.

Rising Industrialization and Urbanization

The Global Water Treatment Polymers Market Industry is closely linked to the trends of industrialization and urbanization. As countries develop, the demand for clean water in industrial processes and urban areas escalates. Industries such as manufacturing, food and beverage, and pharmaceuticals require effective water treatment solutions to ensure compliance with health and safety standards. This growing industrial demand is likely to drive the market forward, as companies seek reliable polymer solutions to manage their water resources efficiently. The increasing urban population, particularly in developing nations, further exacerbates this demand, positioning the market for substantial growth in the coming years.

Technological Advancements in Polymer Chemistry

The Global Water Treatment Polymers Market Industry is benefiting from ongoing advancements in polymer chemistry. Innovations in the development of new polymer formulations enhance the efficiency of water treatment processes, making them more effective in removing contaminants. For example, the introduction of bio-based polymers is gaining traction due to their environmental benefits. These advancements not only improve treatment efficacy but also align with sustainability goals, appealing to environmentally conscious consumers and industries. As a result, the market is projected to grow at a CAGR of 6.59% from 2025 to 2035, reflecting the increasing adoption of advanced polymer technologies.

Regulatory Compliance and Environmental Standards

The Global Water Treatment Polymers Market Industry is significantly influenced by stringent regulatory frameworks aimed at ensuring safe and clean water. Governments worldwide are implementing regulations that necessitate the use of advanced water treatment technologies, which include polymers. For instance, the European Union's Water Framework Directive mandates member states to achieve good water quality. Compliance with such regulations often requires the adoption of innovative polymer solutions, thereby expanding the market. As industries strive to meet these standards, the demand for water treatment polymers is expected to grow, contributing to an anticipated market value of 93.1 USD Billion by 2035.