Market Growth Projections

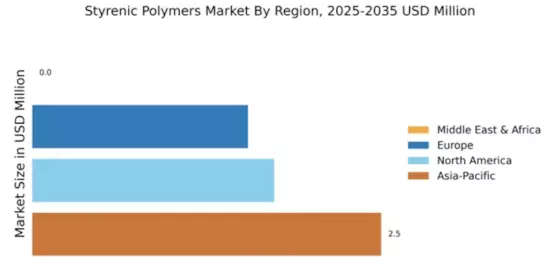

The Global Styrenic Market Overview Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 235.94 USD Billion in 2024 and an impressive increase to 541.32 USD Billion by 2035, the industry is poised for a transformative period. The compound annual growth rate of 7.84% from 2025 to 2035 indicates a robust upward trajectory, driven by various factors including technological advancements, increased demand in construction, and a shift towards sustainable materials. These projections highlight the dynamic nature of the styrenic market and its potential for future expansion.

Growth in Construction Activities

The Global Styrenic Market Overview Industry is significantly influenced by the expansion of construction activities worldwide. Styrenic materials, such as polystyrene and acrylonitrile butadiene styrene, are widely used in insulation, piping, and structural components. The increasing urbanization and infrastructure development in emerging economies are likely to propel the demand for these materials. As a result, the market is anticipated to witness robust growth, with projections indicating a rise to 541.32 USD Billion by 2035. This growth is indicative of the essential role styrenic materials play in modern construction practices.

Increased Application in Consumer Goods

The Global Styrenic Market Overview Industry is witnessing increased application of styrenic materials in consumer goods, including packaging, electronics, and household products. The versatility of styrenic polymers allows for customization in design and functionality, making them ideal for various consumer applications. As consumer preferences shift towards durable and aesthetically pleasing products, the demand for styrenic materials is expected to rise. This trend is likely to contribute to the overall market growth, reinforcing the importance of styrenic materials in meeting consumer demands and preferences in a competitive landscape.

Rising Demand for Lightweight Materials

The Global Styrenic Market Overview Industry is experiencing a surge in demand for lightweight materials across various sectors, particularly in automotive and aerospace applications. As manufacturers strive to enhance fuel efficiency and reduce emissions, styrenic polymers, known for their lightweight properties, are increasingly favored. For instance, the automotive industry is projected to utilize styrenic materials extensively, contributing to the market's growth. This trend is expected to drive the market value to approximately 235.94 USD Billion in 2024, reflecting a significant shift towards sustainable and efficient material solutions.

Technological Advancements in Polymer Production

Technological innovations in polymer production are reshaping the Global Styrenic Market Overview Industry. Advances in manufacturing processes, such as improved polymerization techniques and recycling methods, enhance the efficiency and sustainability of styrenic materials. These innovations not only reduce production costs but also minimize environmental impact, aligning with global sustainability goals. As a consequence, the market is likely to expand, driven by the increasing adoption of eco-friendly production practices. The anticipated compound annual growth rate of 7.84% from 2025 to 2035 underscores the potential for growth fueled by these technological advancements.

Environmental Regulations and Sustainability Initiatives

The Global Styrenic Market Overview Industry is also shaped by stringent environmental regulations and sustainability initiatives. Governments worldwide are implementing policies aimed at reducing plastic waste and promoting the use of recyclable materials. Styrenic polymers, particularly those designed for recyclability, are becoming increasingly relevant in this context. As industries adapt to these regulations, the demand for sustainable styrenic solutions is expected to grow. This shift not only aligns with regulatory requirements but also caters to the rising consumer demand for environmentally friendly products, further driving the market's expansion.