Market Trends

Key Emerging Trends in the Water Treatment Polymers Market

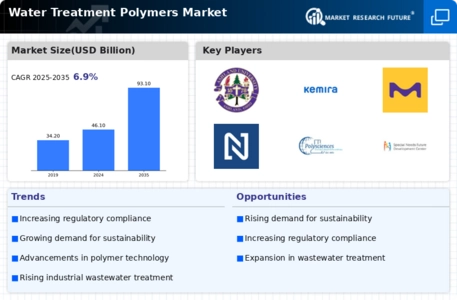

One notable trend in this sector is the rising demand for water treatment polymers for tackling issues related to scarcity as well as quality of clean water. There is increasing strain on water resources because of population growth and urbanization resulting from industrial activities, thus escalating consumer demand for efficient polymer-based solutions for treating effluents. This trend complements efforts globally to enhance water sustainability with a view to guaranteeing access to sanitary water by communities and industries. Additionally, there has been an increased uptake of municipal wastewater treatments using water treatment polymers. Municipal authorities have embraced advanced polymeric technologies aimed at enhancing separation efficiency during wastewater purification from impurities, suspended solids, contaminants among others found in drinking waters or dirty waters respectively. Using them could maximize coagulation and flocculation processes while adhering to set standards for drinking water qualities. Also new polymer formulations and applications have influenced the market for Water Treatment Polymers . Manufacturers however target at developing customized polyme solutions which can handle specific challenges facing a particular company such as handling industrial waste , managing sludge , addressing emerging contaminants among others. Advanced polymer technology’s including cationic, anionic and non ionic polymers provide better performance and versatility over a broad spectrum of water treatment applications. Additionally, the market for water treatment polymers is increasingly growing within industrial sectors. Efficient water management and treatment for sustainable operations are deemed important by industries such as chemicals, petrochemicals, power generation among others. For instance, when it comes to cooling towers, boiler systems as well as wastewater treatment plants in industries should be treated with water chemicals to help optimize these processes. It also indicates wider industry´s commitment towards environmental stewardship, resource conservation and regulatory compliance.

Government regulations and standards pertaining to water quality, environmental protection and wastewater disposal have become some of the key drivers that shape market trends of Water Treatment Polymers. Worldwide regulatory bodies are setting stringent guidelines aimed at ensuring that water treatment polymers used across different applications deliver on effectiveness and safety guarantees. Adhering to such laws is important for manufacturers so as to meet market trends while still maintaining their product’s safety values thereby promoting responsible use of this particular substance in its application.

Leave a Comment