Rising Water Scarcity

Increasing water scarcity in various regions of the United States is a critical driver for the water treatment-polymers market. As freshwater resources become more limited, the need for efficient water treatment solutions intensifies. This situation is exacerbated by factors such as population growth and industrial demands. Consequently, industries are investing in advanced water treatment technologies, including specialized polymers that enhance filtration and purification processes. The market is anticipated to grow at a CAGR of around 6% over the next five years, reflecting the urgent need for effective water management solutions in response to scarcity challenges.

Industrial Growth and Urbanization

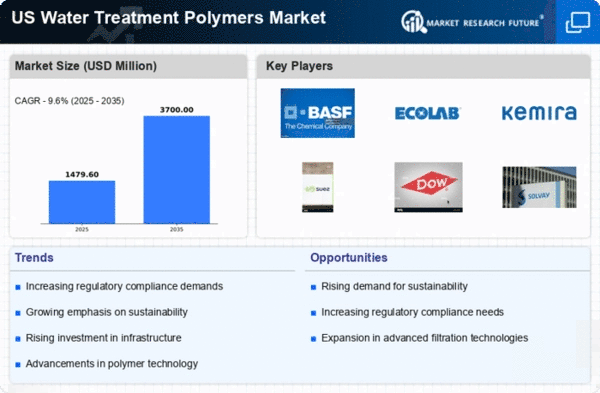

The rapid industrial growth and urbanization in the United States are pivotal factors propelling the water treatment-polymers market. As urban areas expand, the demand for clean water increases, necessitating advanced treatment solutions. Industries such as manufacturing, pharmaceuticals, and food processing require high-quality water treatment to meet operational standards. This trend is likely to drive the market value, which is expected to exceed $2.5 billion by 2025. The integration of polymers in water treatment processes enhances efficiency and effectiveness, making them indispensable in urban water management strategies.

Regulatory Compliance and Standards

The water treatment-polymers market is significantly influenced by stringent regulatory frameworks established by government agencies. These regulations aim to ensure safe drinking water and protect environmental resources. Compliance with standards such as the Safe Drinking Water Act (SDWA) necessitates the use of advanced polymers that can effectively remove contaminants. As a result, the demand for high-performance water treatment polymers is expected to rise, with the market projected to reach approximately $3 billion by 2026. This regulatory landscape compels manufacturers to innovate and develop new polymer formulations that meet evolving standards, thereby driving growth in the water treatment-polymers market.

Increased Awareness of Water Quality

Growing public awareness regarding water quality and safety is a significant driver for the water treatment-polymers market. Consumers are increasingly concerned about contaminants in drinking water, leading to heightened demand for effective treatment solutions. This awareness is prompting both residential and commercial sectors to invest in advanced water treatment systems that utilize high-quality polymers. As a result, the market is projected to grow steadily, with an estimated increase of 5% annually over the next few years. The emphasis on water quality is likely to encourage manufacturers to innovate and improve their polymer offerings, further stimulating market growth.

Technological Innovations in Polymer Chemistry

Innovations in polymer chemistry are transforming the water treatment-polymers market. The development of new polymer types, such as biopolymers and nanopolymers, offers enhanced performance in water purification and contaminant removal. These advancements not only improve the efficiency of treatment processes but also reduce environmental impact. The market is witnessing a shift towards sustainable polymer solutions, which are anticipated to capture a larger share of the market. As research and development continue to evolve, the water treatment-polymers market is likely to experience substantial growth, driven by the demand for innovative and effective treatment solutions.