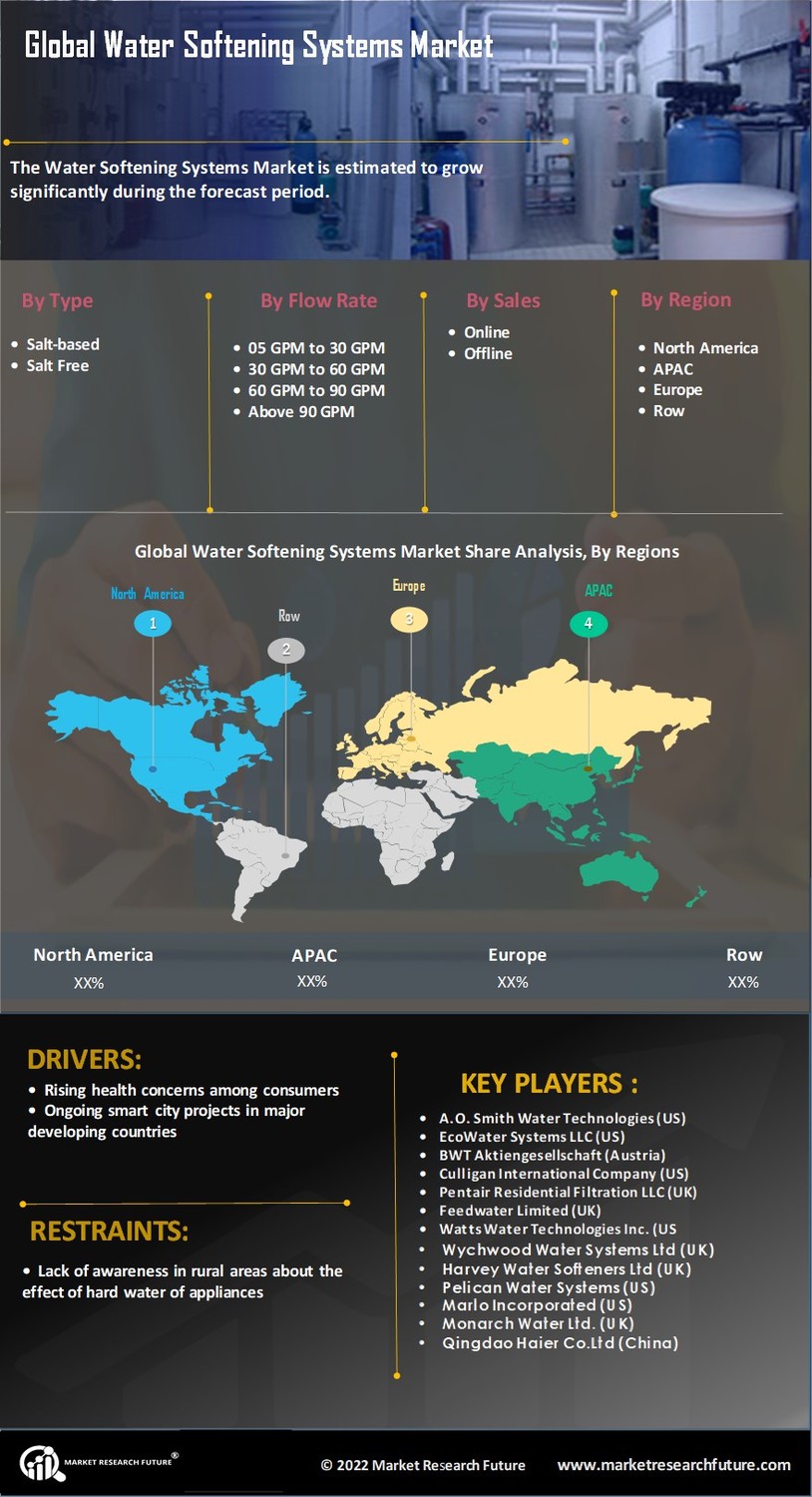

Health and Wellness Trends

The growing emphasis on health and wellness is impacting the Water Softening Systems Market. Consumers are increasingly aware of the potential health implications associated with hard water, including skin irritations and the effects on hair quality. As a result, there is a rising demand for water softening systems that can provide softer water, which is perceived as beneficial for personal care and overall well-being, including the growing relevance of Industrial water softening systems across broader applications. Market Research Future indicates that households are willing to invest in water treatment solutions that promise improved health outcomes. This trend is likely to encourage manufacturers to innovate and market their products more effectively, thereby expanding their reach in the health-conscious consumer segment.

Rising Construction Activities

The surge in construction activities across residential and commercial sectors is significantly influencing the Water Softening Systems Market. As new buildings are constructed, the demand for water softening systems is expected to rise, particularly in areas known for hard water. The construction of new homes and commercial establishments often includes the installation of water treatment systems as a standard practice. Market data suggests that the construction industry is projected to grow at a steady rate, which will likely lead to an increased adoption of water softening solutions. This trend indicates a robust opportunity for manufacturers to cater to the evolving needs of the construction sector.

Increasing Water Quality Concerns

The rising concerns regarding water quality are driving the Water Softening Systems Market. As consumers become more aware of the adverse effects of hard water, such as scale buildup and its impact on appliances, the demand for water softening solutions is likely to increase. Reports indicate that approximately 85% of households in certain regions experience hard water issues, which can lead to significant costs in maintenance and repairs. This awareness is prompting consumers to invest in water softening systems to enhance their water quality and protect their plumbing infrastructure. Consequently, manufacturers are responding by developing more efficient and user-friendly systems, further propelling the market forward.

Government Regulations and Incentives

Government regulations and incentives aimed at promoting water conservation and quality are influencing the Water Softening Systems Industry. Many regions are implementing stricter guidelines regarding water usage and treatment, which encourages consumers to adopt water softening systems. Additionally, some governments offer financial incentives for households that install water-efficient appliances, including water softeners. This regulatory environment is likely to stimulate market growth as consumers seek to comply with new standards while benefiting from potential cost savings. The interplay between regulation and consumer behavior suggests a favorable landscape for the water softening systems .

Technological Advancements in Water Softening

Technological advancements are playing a pivotal role in shaping the Water Softening Systems Industry. Innovations such as smart water softeners, which utilize IoT technology for monitoring and control, are becoming increasingly prevalent. These systems not only provide convenience but also optimize salt usage, thereby reducing operational costs. The market is witnessing a shift towards more sustainable solutions, with some systems designed to minimize water waste and energy consumption. As consumers seek more efficient and eco-friendly options, the integration of advanced technologies is likely to enhance the appeal of water softening systems Market, driving market growth.