North America : Market Leader in Water Treatment

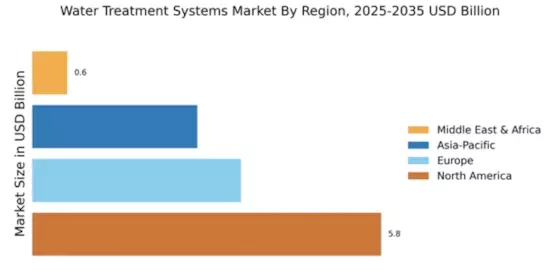

North America leads the Water Treatment Systems market with a share of 5.77 in 2024, driven by stringent regulations and increasing demand for clean water. The region's growth is fueled by investments in infrastructure and advanced technologies aimed at improving water quality and efficiency. Regulatory bodies are emphasizing sustainable practices, which further propels market expansion. The United States is the primary contributor, hosting key players like Xylem Inc., Evoqua Water Technologies, and Pentair plc. The competitive landscape is characterized by innovation and strategic partnerships among major companies. As environmental concerns rise, the focus on advanced water treatment solutions is expected to intensify, solidifying North America's market position.

Europe : Sustainable Practices Drive Growth

Europe's Water Treatment Systems market is valued at 3.45, reflecting a strong commitment to sustainability and regulatory compliance. The European Union's stringent directives on water quality and environmental protection are significant growth drivers. Increasing public awareness about water pollution and the need for efficient treatment solutions are also contributing to market expansion. Leading countries like Germany, France, and the UK are at the forefront, with major players such as Veolia Environnement and SUEZ driving innovation. The competitive landscape is marked by a focus on eco-friendly technologies and collaborative efforts among stakeholders to enhance water management practices. This trend is expected to continue, fostering a robust market environment.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region, with a market size of 2.73, is witnessing rapid growth in the Water Treatment Systems sector, driven by urbanization and industrialization. Increasing population density and rising water scarcity issues are propelling demand for advanced treatment solutions. Governments are implementing policies to enhance water quality and promote sustainable practices, which are crucial for market growth. Countries like China, India, and Japan are leading the charge, with significant investments in water infrastructure. Key players such as Kurita Water Industries and Aqua America, Inc. are expanding their presence to meet the growing demand. The competitive landscape is evolving, with a focus on innovative technologies and partnerships to address regional challenges effectively.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of 0.58, faces unique challenges in the Water Treatment Systems market, primarily due to water scarcity and infrastructure deficits. However, increasing investments in water management and treatment technologies are driving growth. Governments are prioritizing water security, leading to regulatory frameworks that support sustainable practices and investment in advanced systems. Countries like South Africa and the UAE are making strides in improving water treatment capabilities. The presence of key players is growing, with companies focusing on innovative solutions tailored to local needs. The competitive landscape is characterized by collaborations and partnerships aimed at enhancing water quality and accessibility across the region.