Rising E-commerce Demand

The Global Warehouse as a Service Market Industry experiences a surge in demand driven by the rapid expansion of e-commerce. As online shopping continues to grow, businesses require flexible warehousing solutions to manage inventory efficiently. In 2024, the market is valued at approximately 816.9 USD Billion, reflecting the increasing need for scalable storage options. Companies are increasingly adopting Warehouse as a Service to enhance their logistics capabilities, allowing them to respond swiftly to changing consumer preferences. This trend is expected to persist, as e-commerce sales are projected to rise, necessitating innovative warehousing strategies to accommodate fluctuating demand.

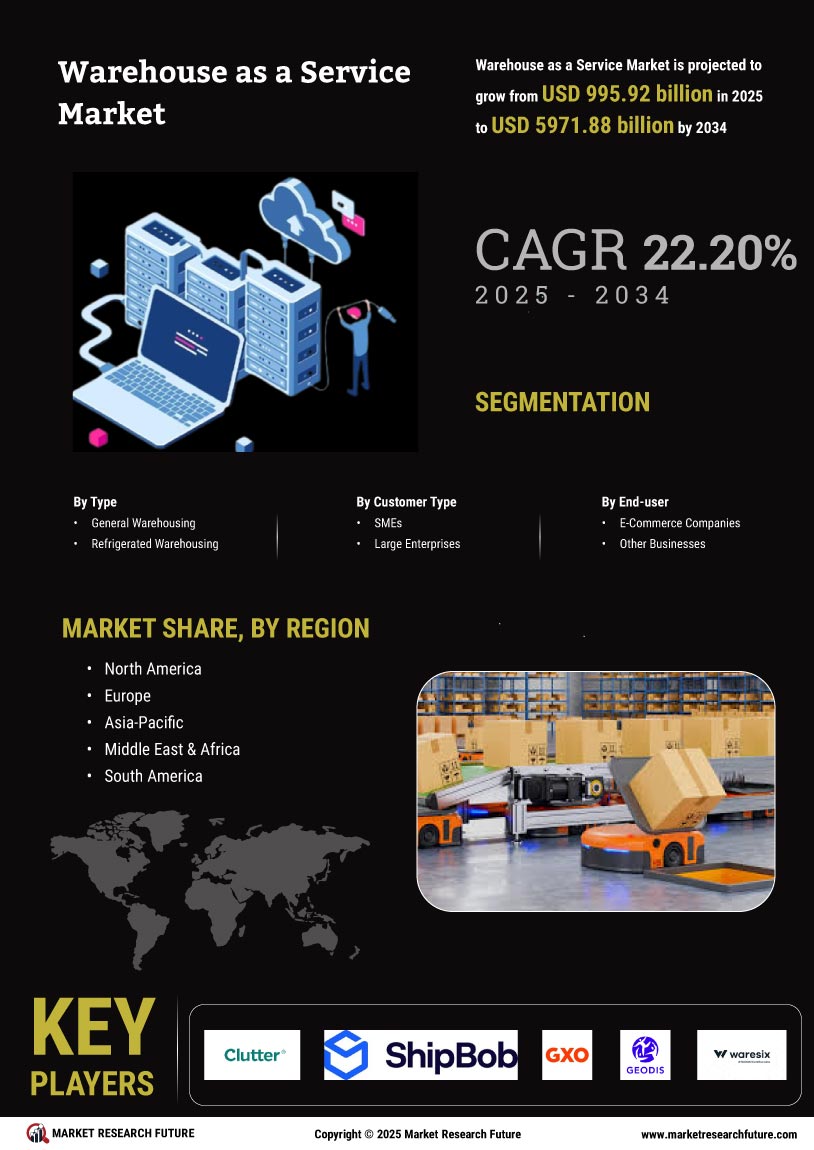

Market Growth Projections

The Global Warehouse as a Service Market Industry is poised for remarkable growth, with projections indicating a market value of 7297.6 USD Billion by 2035. This anticipated growth reflects the increasing adoption of flexible warehousing solutions across various sectors. The market's expansion is driven by the need for efficient logistics, cost-effective operations, and the ability to adapt to changing consumer demands. As businesses continue to embrace Warehouse as a Service, the industry is likely to witness transformative changes that enhance operational efficiency and customer satisfaction. The projected growth underscores the significant role of warehousing solutions in the evolving global economy.

Sustainability Initiatives

Sustainability initiatives are increasingly shaping the Global Warehouse as a Service Market Industry. Companies are recognizing the importance of environmentally friendly practices in their operations. Warehouse as a Service providers are adopting green technologies and sustainable practices to meet the growing demand for eco-friendly logistics solutions. This includes energy-efficient facilities, waste reduction strategies, and sustainable packaging options. As consumers become more environmentally conscious, businesses are compelled to align their operations with sustainability goals. The emphasis on sustainability not only enhances brand reputation but also positions companies favorably in a competitive market, driving the adoption of Warehouse as a Service.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Warehouse as a Service Market Industry. Automation, artificial intelligence, and the Internet of Things are transforming traditional warehousing into smart facilities. These technologies enhance operational efficiency, reduce costs, and improve inventory management. For instance, automated storage and retrieval systems streamline processes, allowing companies to optimize space utilization. As businesses increasingly adopt these technologies, the market is likely to witness substantial growth. The integration of advanced technologies not only boosts productivity but also aligns with the evolving consumer expectations for faster delivery and improved service quality.

Cost Efficiency and Flexibility

Cost efficiency and flexibility are critical drivers in the Global Warehouse as a Service Market Industry. Companies are increasingly seeking solutions that minimize overhead costs while providing the agility to scale operations according to demand fluctuations. Warehouse as a Service offers a pay-as-you-go model, enabling businesses to avoid long-term leases and capital expenditures. This flexibility is particularly advantageous for startups and small to medium-sized enterprises that may not have the resources for traditional warehousing. As the market evolves, the ability to adapt quickly to changing market conditions will likely become a key competitive advantage for businesses.

Global Supply Chain Optimization

The optimization of global supply chains significantly influences the Global Warehouse as a Service Market Industry. As companies expand their operations internationally, the need for efficient warehousing solutions becomes paramount. Warehouse as a Service provides businesses with the ability to strategically position inventory closer to customers, thereby reducing shipping times and costs. This approach enhances overall supply chain efficiency, allowing companies to respond promptly to market demands. With the market projected to grow at a CAGR of 22.03% from 2025 to 2035, the focus on supply chain optimization is expected to drive further adoption of flexible warehousing solutions.