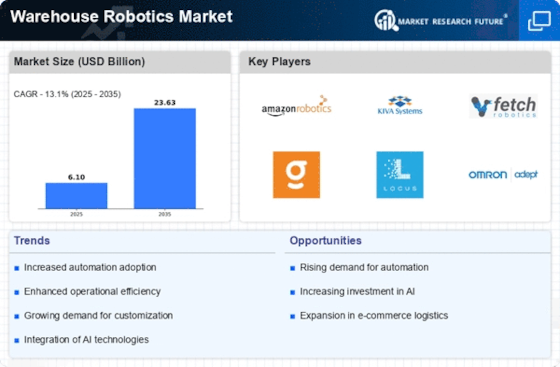

The Warehouse Robotics Market is currently characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for automation in logistics and supply chain operations. Warehouse robotics companies are investing heavily in advanced AI-driven systems to enhance operational efficiency. Key players such as Amazon Robotics (US), GreyOrange (IN), and Locus Robotics (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Amazon Robotics (US) continues to leverage its extensive logistics network, focusing on integrating advanced AI and machine learning capabilities into its robotic systems, thereby improving operational efficiency. Meanwhile, GreyOrange (IN) emphasizes innovation through its AI-driven robotics solutions, which are designed to optimize warehouse operations and reduce labor costs. Locus Robotics (US) is strategically expanding its partnerships with major retailers, enhancing its collaborative robot offerings to meet the growing demand for flexible automation solutions. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological innovation and operational efficiency. Expanding applications of robotics in warehousing are enhancing productivity across retail, manufacturing, and third-party logistics sectors. The convergence of AI, IoT, and cloud platforms is strengthening warehouse robotics technology adoption.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance responsiveness and reduce costs. The use of robots in warehouse operations has become a strategic priority for logistics and distribution centers. The Warehouse Robotics Market appears moderately fragmented, with a mix of established players and emerging startups. This structure allows for a diverse range of solutions, catering to various customer needs. The collective influence of key players is significant, as they drive advancements in technology and set industry standards that smaller companies often follow. The increasing use of robots warehouse systems is improving accuracy in picking, packing, and sorting operations. As automation maturity increases, the warehouse robotics market is emerging as a critical component of next-generation logistics networks.

In August 2025, Amazon Robotics (US) announced the launch of its new AI-powered robotic system designed to streamline order fulfillment processes. This strategic move is likely to enhance Amazon's operational capabilities, allowing for faster processing times and improved accuracy in order handling. The introduction of such advanced technology not only reinforces Amazon's leadership position but also sets a benchmark for competitors in the market.

In September GreyOrange (IN) unveiled its latest robotic solution aimed at enhancing warehouse automation through improved machine learning algorithms. This development is crucial as it positions GreyOrange to better meet the evolving demands of the logistics sector, particularly in terms of scalability and adaptability. By focusing on cutting-edge technology, GreyOrange is likely to attract a broader customer base seeking innovative solutions.

In October Locus Robotics (US) secured a strategic partnership with a leading e-commerce platform to integrate its autonomous mobile robots into their fulfillment centers. This collaboration is indicative of Locus's commitment to expanding its market reach and enhancing its service offerings. Such partnerships are essential in a competitive landscape, as they enable companies to leverage each other's strengths and drive mutual growth.

As of October the Warehouse Robotics Market is witnessing significant trends such as digitalization, sustainability, and the integration of artificial intelligence. These trends are reshaping the competitive landscape, with companies increasingly forming strategic alliances to enhance their technological capabilities and market presence. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is becoming more pronounced. Moving forward, competitive differentiation will likely hinge on the ability to innovate and adapt to changing market demands, positioning companies that prioritize these aspects for sustained success..webp