As of September 2024, Siemens has developed a new platform that enables proper warehouse automation. This platform would facilitate optimal real time tracking alongside effective management of inventory.

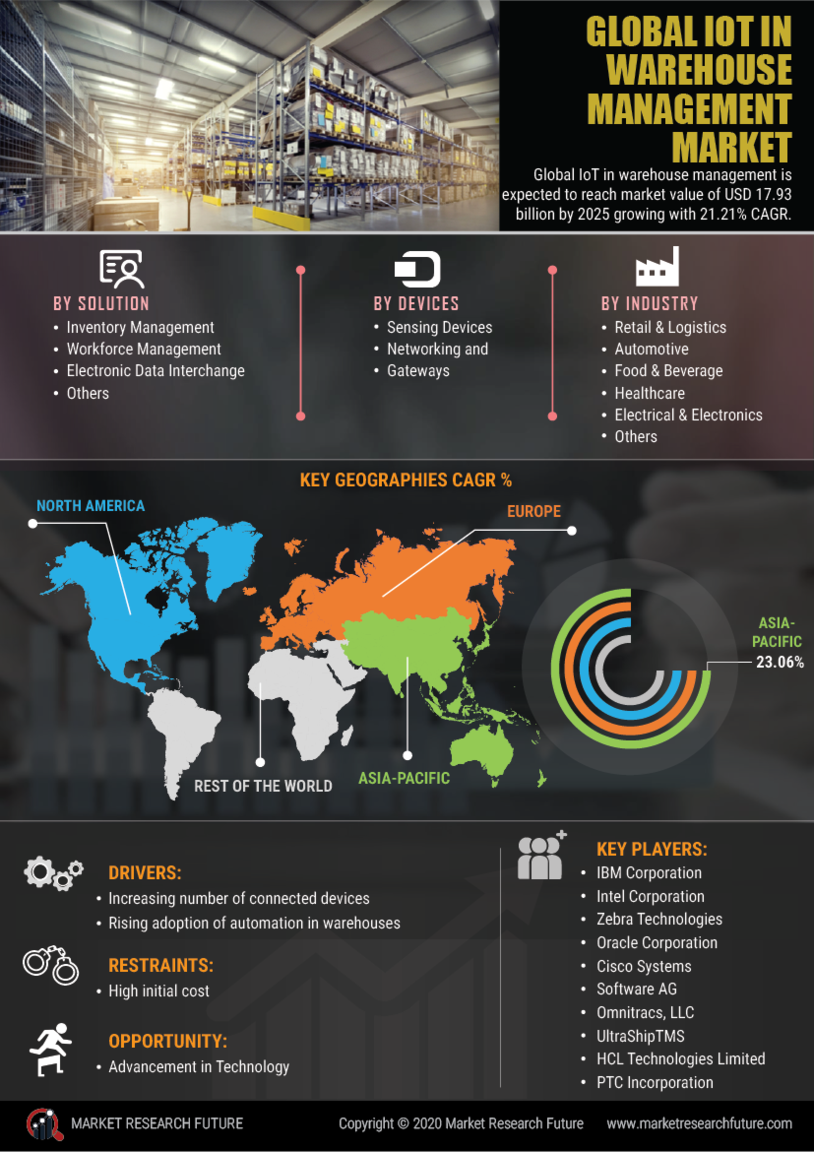

As of August 2024, Zebra Technologies has deployed new RFID technology which is aimed at increasing the visibility of inventory while at the same time decreasing stock discrepancies within the warehouse.

As of July 2024, Honeywell has integrated an upgrade with its warehouse management system in which the use of AI-smart analytics is made to ensure an increase in both the efficiency of operations as well as a decrease in the overall expenditures.

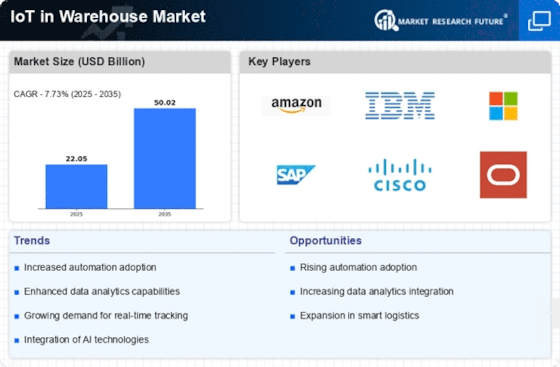

In June 2023, HCL Technologies Limited announced its partnership with Microsoft to boost innovation and the adoption of generative AI with Microsoft’s Azure OpenAI service.

In June 2023, Cisco Systems Inc. will unveil the next generation of solutions that will leverage large language models (LLMs) and integrate generative AI into its security and productivity features within its Webex Suite.

In June 2023, Intel Corporation intention to partner with universities and federal research institutions in order to grow the quantum computing research community and has announced that it is developing a new qubit chip, Tunnel Falls, a 12-qubit silicon chip.

In the headlines of the Global and Dutch newspapers, it was highlighted in October of 2022, with a focus on the environment sector, how the Solar Bazooka took the place of a natural gas-fueled heater in one of the warehouses; this was set up by one of the Dutch Bitcoiners. Both Europe and the Bitcoin miner economize on the need of environmentalists to make use of gas powered heaters in warehouses, for the Bitcoin miner operates as a heating unit for the warehouse.

Moreover, both parties benefit as the warehouse retains a pleasantly warm and noise-free atmosphere, which the workers can utilize.

With the increasing relations between IT services provider Cognizant and chip developer Qualcomm, the first ever 5G in Canada was launched in October of 2022. The 5G and MEC integration enables businesses to construct several virtual networks on the same physical equipment, which can support thousands of devices at once. The barn control and operation through means of 5G connectivity will allow the center to target goals that revolve around supply chain management, manufacturing, and autonomous mobile robots that are integrated into warehouse management.

Hutchinson’s visibility into their inventory drastically improved after Surgere developed a new application for them that utilizes RFID in June 2022; the app that Surgere built for them enables them to tag and trace the OEM containers, which entirely eliminates the risk of misplacing assets.