Research Methodology on Virtual Fitness Market

The research methodology adopted in this report is discussed in detail in the following sections. To generate an accurate market understanding and accurate market projection, Market Research Future (MRFR) adopted a combination of primary, secondary and tertiary research techniques. An array of approaches and techniques have been employed, to generate a comprehensive and accurate analysis of the global virtual fitness market. The Study covers the dynamics and trends of the global market and provides accurate data for the forecast period of 2023-2030.

1. Primary Research

Primary research is conducted with experts in the fitness and fitness technology industry who are well-connected with industry leaders, providing access to data collected from leading companies and experts from the industry. Telephone interviews with marketing personnel, industry experts and opinion makers are conducted to get an insight into the current and future trends in the market. Numerous primary interviews are conducted with industry stakeholders, including technology experts, a market leader and key opinion leaders to develop an understanding of the global virtual fitness market.

2. Secondary research

This phase of the research process included secondary research of the global virtual fitness market based on publicly available information such as white papers, company websites, annual reports, financial reports, investor presentations and other secondary data sources. Additionally, the secondary research involved data gathering from the official and trade websites of the market participants. Secondary research allowed us to size and segment the global virtual fitness market and to comprehend the recorded growth pattern of the market.

3. Tertiary research

Tertiary research was conducted to further validate the collected data and assumptions obtained from primary and secondary sources. The collected data are also cross-checked with a combination of various sources, including industry executives, technology experts, and other official sources. With the help of this research, we were able to deduce and assess the current position of the virtual fitness market and its future prospects.

4. Data Collection Tools

To analyse the global virtual fitness market, data was collected through a diverse set of tools and techniques. This involved conducting interviews with industry experts, such as fitness professionals and technology decision-makers. Additionally, structured questionnaires are developed to understand the market trends, industry applications, and adoption rate of the new technologies.

The primary research involved 60 + interviews to get an insight into the global virtual fitness market. Additionally, for the secondary research, we gathered information from multiple sources, such as press releases, company websites, financial reports, and other sources such as paid and freely available databases.

5. Data Validation

To validate the collected data, data is verified by speaking with a wide range of key informants with relevant expertise at the corporate level. Additionally, multiple efforts have been put in to ensure that the data collected is reliable, by using input from industry experts and by using expert opinions to validate the market estimation.

6. Market Estimation

The collected data is analyzed and validated by key financial and industry experts to derive a market-size estimate. For estimation, the market trends, technological developments, and product/ service information are studied. House of Quality (HOQ) is used to derive the market estimation of the global virtual fitness market by analyzing the current market trends and analyzing the historical data of the market.

7. Estimation Methodology

The market estimation is primarily done using Global Market Modeling (GMM). This method uses quantitative and qualitative input from the primary research partner and for which the market is estimated by referring to demand and supply side databases. The following assumptions were kept in mind:

* Historical growth patterns

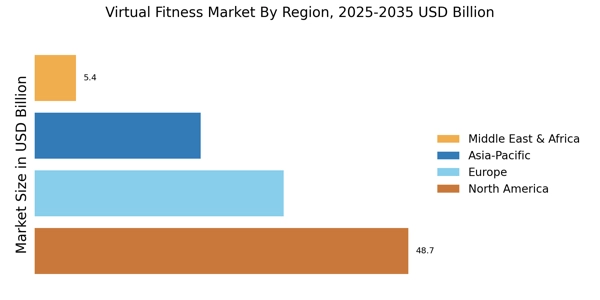

* Market trends observed from the year 2023 to 2030

* Regional growth patterns

* Expected macroeconomic and industry developments for the period 2023-2030

* Supply-demand side dynamics