Increased Demand for Remote Collaboration

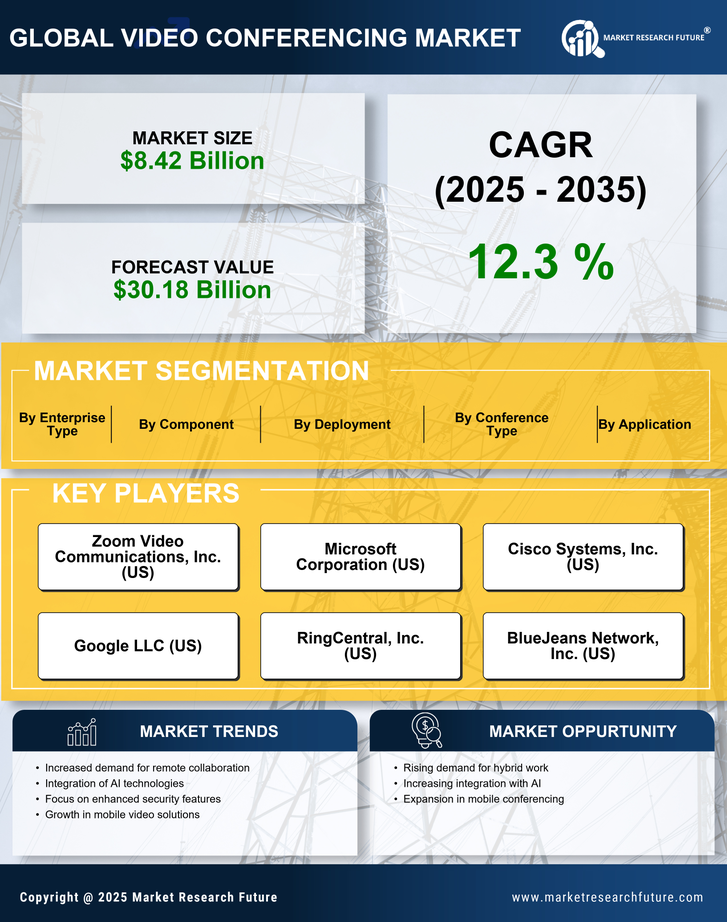

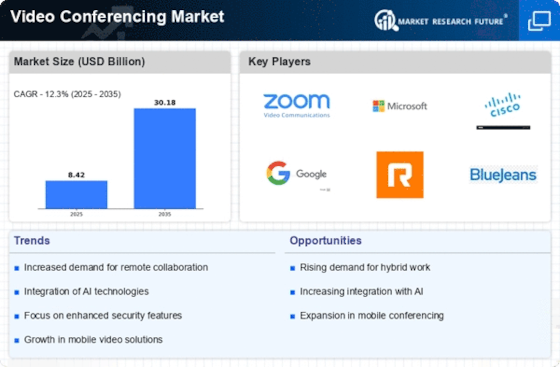

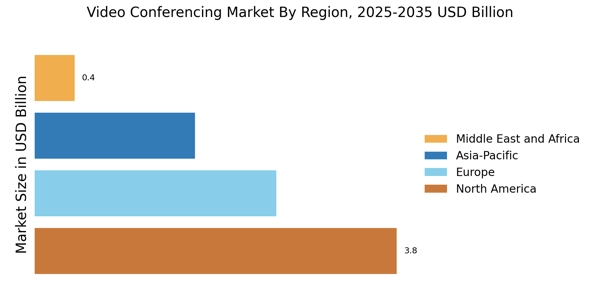

The Video Conferencing Market experiences heightened demand for remote collaboration tools as organizations seek to enhance productivity and communication. This trend is driven by the need for seamless interaction among distributed teams. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 12% over the next five years. Companies are increasingly adopting video conferencing solutions to facilitate meetings, training sessions, and client interactions, thereby reducing travel costs and time. The shift towards remote work has made video conferencing an essential component of daily operations, leading to a surge in the adoption of advanced features such as screen sharing, virtual backgrounds, and real-time collaboration tools. As businesses recognize the value of effective communication, the Video Conferencing Market is likely to witness sustained growth.

Expansion of E-Learning and Online Education

The expansion of e-learning and online education significantly impacts the Video Conferencing Market. Educational institutions are increasingly adopting video conferencing tools to facilitate remote learning, enabling students to attend classes from anywhere. This shift has led to a surge in demand for platforms that support interactive learning experiences, such as virtual classrooms and webinars. Data indicates that the e-learning market is expected to reach a valuation of over 300 billion dollars by 2025, further driving the need for effective video conferencing solutions. As educational institutions seek to enhance engagement and collaboration among students and instructors, the Video Conferencing Market is poised for substantial growth, catering to the evolving needs of the education sector.

Rising Importance of Global Business Operations

The rising importance of The Video Conferencing Industry. As companies expand their reach across borders, effective communication becomes paramount. Video conferencing solutions enable organizations to connect with clients, partners, and teams worldwide, fostering collaboration and innovation. The ability to conduct meetings in real-time, regardless of geographical location, enhances decision-making processes and accelerates project timelines. Market data suggests that businesses are increasingly investing in video conferencing technologies to support their global operations, with a projected increase in spending on communication tools. This trend underscores the critical role of video conferencing in facilitating international business interactions, thereby propelling the growth of the Video Conferencing Market.

Growing Focus on Employee Well-being and Work-Life Balance

The Video Conferencing Market is increasingly influenced by the growing focus on employee well-being and work-life balance. Organizations are recognizing the importance of mental health and job satisfaction, leading to the adoption of flexible work arrangements. Video conferencing tools facilitate this by enabling employees to participate in meetings from home or other locations, thus reducing commute times and stress. Research suggests that companies that prioritize employee well-being see higher productivity and lower turnover rates. As a result, the demand for video conferencing solutions that support flexible work environments is likely to rise. This trend not only enhances employee satisfaction but also contributes to the overall growth of the Video Conferencing Market.

Technological Advancements in Video Conferencing Solutions

Technological advancements play a pivotal role in shaping the Video Conferencing Market. Innovations such as high-definition video, artificial intelligence, and enhanced audio quality are transforming user experiences. The integration of features like virtual reality and augmented reality is also gaining traction, providing immersive meeting environments. Data indicates that the adoption of AI-driven tools for scheduling and transcription is on the rise, streamlining workflows and improving efficiency. Furthermore, the proliferation of mobile devices has made video conferencing more accessible, allowing users to connect from virtually anywhere. As technology continues to evolve, the Video Conferencing Market is expected to expand, catering to the diverse needs of businesses and individuals alike.