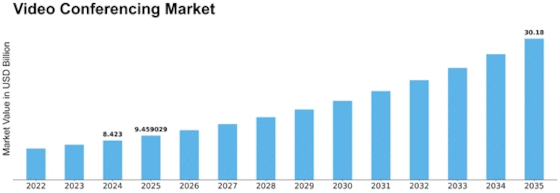

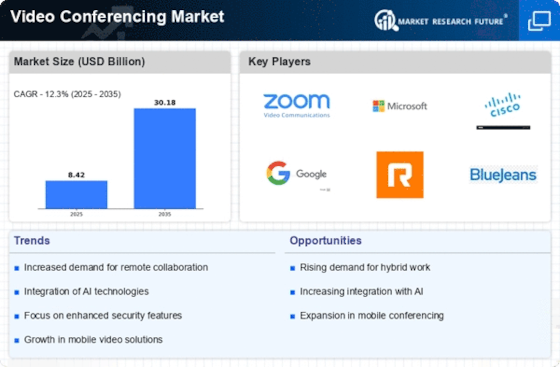

Video Conferencing Size

Video Conferencing Market Growth Projections and Opportunities

The market dynamics for Video Conferencing are highly influenced by the dynamic nature of communication technologies, changing patterns of work, and global demand for seamless collaboration solutions. The rapid acceptance of remote or hybrid work models is one major market driver shaping market dynamics in the Video Conferencing market. With flexible working arrangements being implemented by organizations, there has been a surge in demand for strong video conferencing solutions. Technological advancements play an important role in Video Conferencing's market dynamics. The consistent advancement of audiovisual technologies, cloud computing, and high-speed internet connectivity enhance video conferencing solutions' capabilities. High-definition video quality, immersive audio experiences, and real-time content sharing are some of the components that make modern video conferencing platforms attractive. Additionally, the increased need to enhance collaboration tools and integration of video conferencing into unified communications strategies has influenced the behavior of this market greatly. Businesses require all-inclusive communication services with voice, videos, messaging, and collaborations brought together on a single platform. Globalization, as well as international connectivity needs, contribute to Video Conferencing's market dynamics. In multinational companies like these that operate globally, having team partners and clients in different time zones makes it necessary to facilitate connections among them. With its ability to eliminate geographical barriers and enable real-time communication without traveling, video conferencing becomes essential in such cases where international business cooperation requires negotiations or interactions with customers. In this sense, globalization may be seen as meaning that international collaborations occur much more easily when they involve face-to-face meetings via teleconferences rather than traveling physically. The dynamism within the competitive landscape underpinning the growth pattern exhibited by the Video Conferencing sector is characterized by several vendors who seek to outwit each other through differentiation based on distinct characteristics such as friendly interfaces coupled with reliability. For example, interoperability with existing IT ecosystems and seamless integration with other collaboration tools are important factors in determining Video Conferencing's market dynamics. Typically, organizations use different communication and collaboration tools for project management, document sharing, and team collaboration. Security is an integral aspect of Video Conferencing dynamics, as companies may share sensitive information or hold private conversations during virtual meetings. Another factor to be considered in terms of the Video Conferencing market is the increasing emphasis on environmental sustainability that has been driving down carbon footprints.

Leave a Comment