Growing Industrialization

The ongoing trend of industrialization in emerging economies is a significant driver for the Valves And Actuators Market. As countries develop their industrial sectors, there is a heightened demand for efficient fluid control systems, which rely heavily on valves and actuators. Industries such as chemicals, pharmaceuticals, and food processing are expanding rapidly, necessitating the installation of advanced valves and actuators to ensure optimal performance and safety. Recent data indicates that industrial output in these regions is expected to grow at a robust pace, further fueling the demand for these components. Additionally, as industries modernize their operations, the need for high-quality, reliable valves and actuators becomes increasingly critical. This trend suggests that the Valves And Actuators Market will continue to thrive as industrialization progresses.

Focus on Energy Efficiency

The emphasis on energy efficiency and sustainability is reshaping the Valves And Actuators Market. As organizations strive to reduce their carbon footprint and comply with stringent environmental regulations, the demand for energy-efficient valves and actuators is on the rise. These components are essential in optimizing energy consumption in various applications, including HVAC systems, industrial processes, and renewable energy projects. Recent statistics indicate that energy-efficient technologies can reduce energy consumption by up to 30%, making them attractive to businesses aiming to lower operational costs. Consequently, manufacturers are innovating to produce valves and actuators that not only meet performance standards but also contribute to energy savings. This trend is expected to drive the Valves And Actuators Market forward as companies prioritize sustainability in their operations.

Technological Advancements

Technological advancements in valve and actuator design and manufacturing are driving innovation within the Valves And Actuators Market. The integration of smart technologies, such as IoT and AI, is enhancing the functionality and efficiency of these components. Smart valves and actuators can provide real-time data, enabling predictive maintenance and improved operational control. This technological evolution is particularly relevant in sectors like oil and gas, where precision and reliability are paramount. Recent advancements have led to the development of more durable materials and designs that can withstand extreme conditions, further expanding the application range of valves and actuators. As industries increasingly adopt these advanced technologies, the Valves And Actuators Market is poised for growth, driven by the need for innovative solutions that enhance performance and reliability.

Rising Demand for Automation

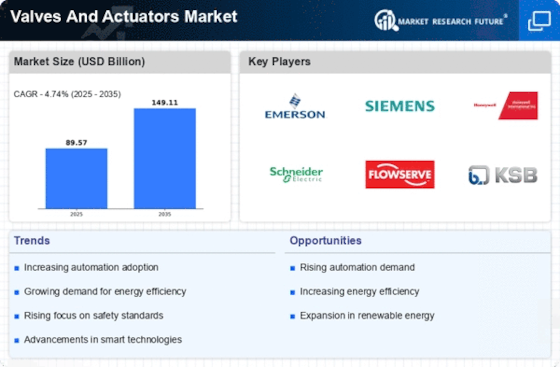

The increasing demand for automation across various industries is a primary driver for the Valves And Actuators Market. Automation enhances operational efficiency and reduces human error, leading to higher productivity. Industries such as manufacturing, oil and gas, and water treatment are increasingly adopting automated systems, which require advanced valves and actuators for seamless operation. According to recent data, the automation market is projected to grow significantly, with a compound annual growth rate (CAGR) of over 9% in the coming years. This growth directly correlates with the rising need for sophisticated valves and actuators, as they play a crucial role in controlling fluid flow and pressure in automated systems. As industries continue to embrace automation, the Valves And Actuators Market is likely to experience substantial growth.

Infrastructure Development Initiatives

Infrastructure development initiatives across various sectors are significantly influencing the Valves And Actuators Market. Governments and private entities are investing heavily in upgrading and expanding infrastructure, including water supply systems, transportation networks, and energy facilities. This investment creates a robust demand for valves and actuators, which are critical components in managing fluid and gas flow in these systems. For instance, the water and wastewater treatment sector is projected to require substantial upgrades, leading to an increased need for reliable valves and actuators. Recent reports suggest that infrastructure spending is expected to reach trillions of dollars in the next decade, further propelling the Valves And Actuators Market. As infrastructure projects continue to proliferate, the demand for high-quality valves and actuators will likely remain strong.