North America : Market Leader in Repair Services

North America is poised to maintain its leadership in the Industrial Valves and Actuators Repair Services Market, holding a market size of $1.6B in 2025. Key growth drivers include the increasing demand for automation in manufacturing and stringent regulatory standards aimed at enhancing operational efficiency. The region's robust infrastructure and technological advancements further catalyze market expansion, making it a focal point for industry investments.

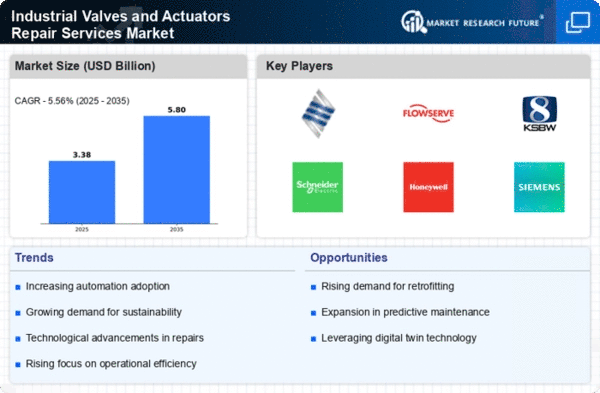

The competitive landscape is characterized by major players such as Emerson, Flowserve, and Honeywell, which dominate the market with innovative solutions and extensive service networks. The U.S. leads the charge, supported by a strong industrial base and a focus on sustainability. As companies increasingly prioritize maintenance and repair services, North America is set to leverage its technological edge to enhance service delivery and customer satisfaction.

Europe : Emerging Market with Growth Potential

Europe's Industrial Valves and Actuators Repair Services Market is projected to reach $0.9B by 2025, driven by the region's commitment to sustainability and energy efficiency. Regulatory frameworks, such as the EU's Green Deal, are pushing industries to adopt advanced repair services to minimize waste and enhance equipment longevity. This regulatory support is crucial for fostering innovation and meeting environmental standards across various sectors.

Leading countries like Germany and France are at the forefront, with companies such as KSB and Schneider Electric playing pivotal roles. The competitive landscape is evolving, with a focus on digital transformation and smart technologies. As industries adapt to new regulations and market demands, Europe is expected to see a surge in investment in repair services, enhancing overall market dynamics.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is witnessing significant growth in the Industrial Valves and Actuators Repair Services Market, projected to reach $0.7B by 2025. Key drivers include rapid industrialization, increasing investments in infrastructure, and a growing focus on maintenance services to enhance operational efficiency. Countries like China and India are leading this growth, supported by government initiatives aimed at boosting manufacturing capabilities and technological advancements.

The competitive landscape is becoming increasingly dynamic, with both local and international players vying for market share. Companies such as Siemens and Pentair are expanding their presence, leveraging innovative technologies to meet the rising demand for repair services. As the region continues to develop, the emphasis on quality and reliability in repair services will be paramount for sustaining growth and competitiveness.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region currently represents an untapped market in the Industrial Valves and Actuators Repair Services sector, with a market size of $0.0B in 2025. However, the region is gradually recognizing the importance of maintenance and repair services as industries expand. Key growth drivers include increasing investments in oil and gas, as well as infrastructure development, which are expected to create demand for repair services in the coming years.

Countries like the UAE and South Africa are beginning to invest in enhancing their industrial capabilities, with a focus on attracting foreign investment. The competitive landscape is still developing, with opportunities for both local and international players to establish a foothold. As the region's industrial base grows, the demand for reliable repair services will become increasingly critical for operational success.