Research Methodology on Military Actuators Market

Introduction:

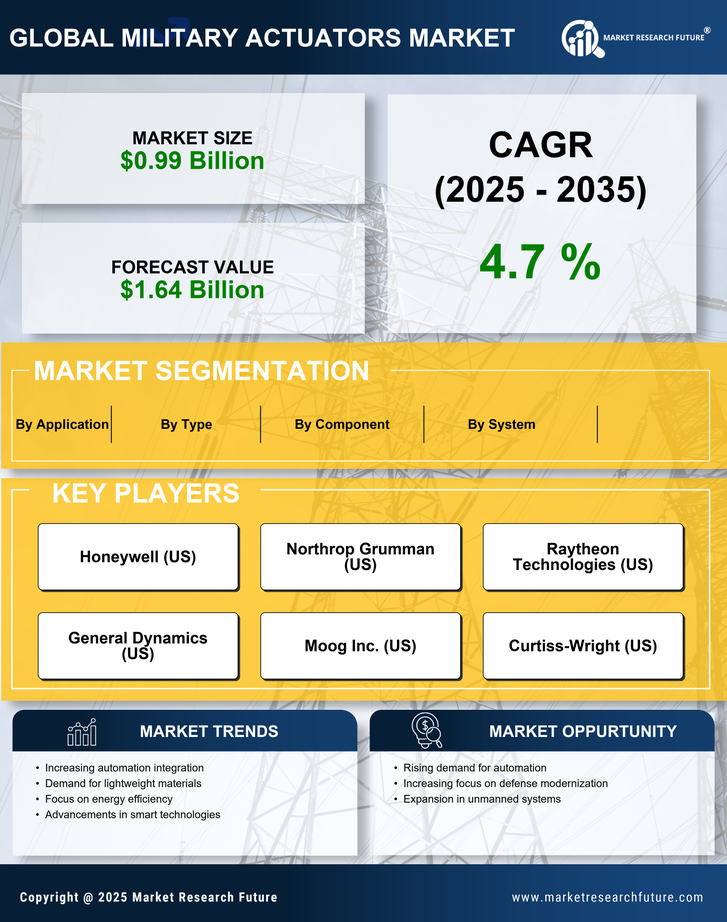

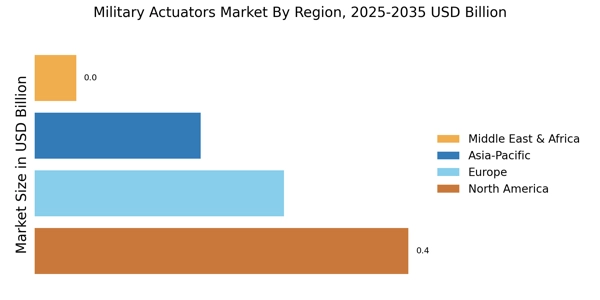

The research report titled “Global Military Actuators Market – Analysis and Forecast to 2030” studies the global Military Actuators market with extensive analysis of the key aspects of the market. The primary objective of this report is to provide stakeholders and readers with an in-depth understanding of the global military actuators market structure and its future financial, technological, and customer-focused prospects. The report studies the macroeconomic environment of the market and its influencing factors. It focuses on the market share of the leading major players with their key strategies and developments over the past years.

The research methodology adopted for this report provides an in-depth analysis of the global Military Actuators market utilizing secondary research, primary research, bottom-up approach, top-down approach, demand-side data triangulation, supply-side data triangulation, time-series analysis, and factor analyses.

Secondary Research

In the initial stages of research, secondary sources such as Hoovers, Bloomberg, and Market Research Future were explored. This was followed by exploring various searches in Google, databases such as Factiva, and industry reports. The research team then conducted an analysis of the various information gathered to arrive at a clear understanding of the market. The data collated during this stage is used as the base for further research.

Primary Research

The primary research includes interviewing professionals from the Military Actuators Industry, such as technology experts, industry experts, and marketing professionals. Survey forms and questionnaires were used as the primary sources for data collection. This was followed by telephonic and face-to-face interviews with market participants. The data obtained from primary research helps validate the existing data collected from secondary sources and further adds additional information that is not available from secondary sources.

Bottom-Up Approach

The Bottom-Up approach is used to estimate the global Military Actuators market by breaking it down into each of its individual markets and product segments and then estimating each one of them separately. Information about various political, economic, social, and technological factors and trends affecting the global Military Actuators market were considered while utilizing the Bottom-Up approach. The bottom-up approach further allows for a detailed estimation of each product segment.

Top-Down Approach

In the top-down approach, the global Military Actuators market is divided into various sectors in terms of market size, sales volume, revenue, and other key factors. Component analysis was also undertaken to arrive at the final figures of the global Military Actuators market. The top-down approach further helps in identifying the key segments in the global market.

Time-Series Analysis

Time-series analysis was used to estimate the global military actuators market for the years 2023 to 2030. The estimated figures were then extrapolated to arrive at the overall size of the global Military Actuators market.

Factor Analysis

In factor analysis, the various factors that influence the global Military Actuators market are identified. This is followed by studying the impact of these factors on the market. The study of factor analysis helps in predicting the future growth of the global Military Actuators market.

Demand-Side Data Triangulation

The demand-side data triangulation helps in estimating the demand-side landscape of the global Military Actuators market. The various demand-side data sources were interviews and surveys of customers. This helps in gaining information about the customer preferences which helps in product design and pricing.

Supply-Side Data Triangulation

The supply-side data triangulation helps in estimating the supply-side landscape of the global Military Actuators market. The various supply-side data sources include interviews and surveys of suppliers, manufacturers, and vendors. This helps in gaining information about the supplier preferences which helps in product design and pricing.

Conclusion:

The research methodology adopted in this report provides an in-depth understanding of the global Military Actuators Market. The secondary research, primary research through surveys and interviews, bottom-up and top-down approaches, time-series analysis, and demand-side and supply-side data triangulation help in forming an accurate picture of the global Military Actuators market.