Innovative Marketing Strategies

The soy food market is increasingly adopting innovative marketing strategies to attract a broader consumer base. Companies are leveraging social media platforms and influencer partnerships to promote the benefits of soy products, targeting health-conscious individuals and environmentally aware consumers. This approach appears to resonate well, as engagement rates on social media campaigns related to soy foods have shown significant improvement. Furthermore, educational campaigns highlighting the versatility and culinary applications of soy products are gaining traction. As a result, the soy food market is likely to see an uptick in consumer interest and sales, as these marketing efforts effectively communicate the advantages of incorporating soy into daily diets.

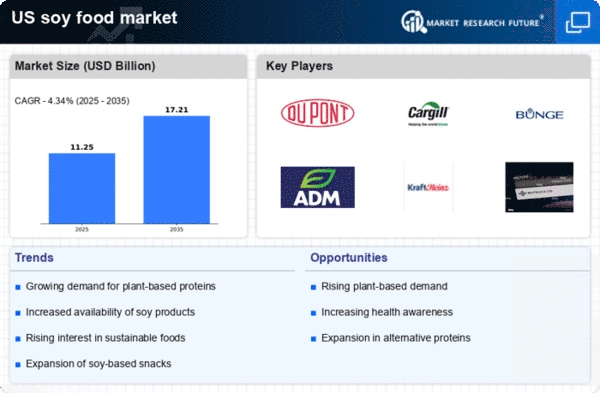

Rising Demand for Plant-Based Proteins

The soy food market is experiencing a notable increase in demand for plant-based proteins, driven by a growing consumer preference for healthier dietary options. As more individuals adopt vegetarian and vegan lifestyles, the market for soy products, such as tofu and soy milk, is expanding. According to recent data, the plant-based protein segment is projected to grow at a CAGR of approximately 8% through 2027. This shift towards plant-based diets is not only influenced by health considerations but also by environmental concerns, as consumers seek sustainable protein sources. The soy food market is thus positioned to benefit from this trend, as soybeans are recognized for their high protein content and versatility in various culinary applications.

Regulatory Support for Plant-Based Foods

The soy food market is experiencing favorable regulatory support that encourages the consumption of plant-based foods. Recent initiatives by government agencies aim to promote healthier eating habits, which include recommendations for increased intake of plant-based proteins. This regulatory backing is likely to enhance the visibility and acceptance of soy products among consumers. Additionally, subsidies for soybean farmers may lead to lower production costs, potentially resulting in more competitive pricing for soy food products. As a consequence, the soy food market stands to benefit from these supportive measures, which could stimulate growth and increase market penetration as consumers are encouraged to choose soy-based options.

Expansion of Retail and E-commerce Channels

The soy food market is benefiting from the expansion of retail and e-commerce channels, which facilitate greater accessibility to soy products. With the rise of online shopping, consumers can easily purchase a variety of soy-based items, from soy milk to edamame, from the comfort of their homes. This shift is particularly significant as e-commerce sales in the food sector have seen a substantial increase, with estimates suggesting a growth rate of over 15% annually. Additionally, traditional retail outlets are also expanding their offerings of soy products, catering to the increasing consumer demand. This enhanced availability is likely to contribute to the overall growth of the soy food market, as more consumers are exposed to the diverse range of soy-based options.

Increased Awareness of Nutritional Benefits

The soy food market is witnessing a surge in consumer awareness regarding the nutritional benefits of soy products. Research indicates that soy is a rich source of essential amino acids, vitamins, and minerals, which are crucial for maintaining a balanced diet. Furthermore, soy foods are often associated with various health benefits, including improved heart health and reduced risk of certain cancers. As consumers become more informed about these advantages, the demand for soy-based products is likely to rise. In fact, surveys show that approximately 60% of consumers are actively seeking foods that contribute to their overall health, thereby driving growth in the soy food market. This trend suggests a promising future for soy products as health-conscious consumers increasingly incorporate them into their diets.