Health Consciousness

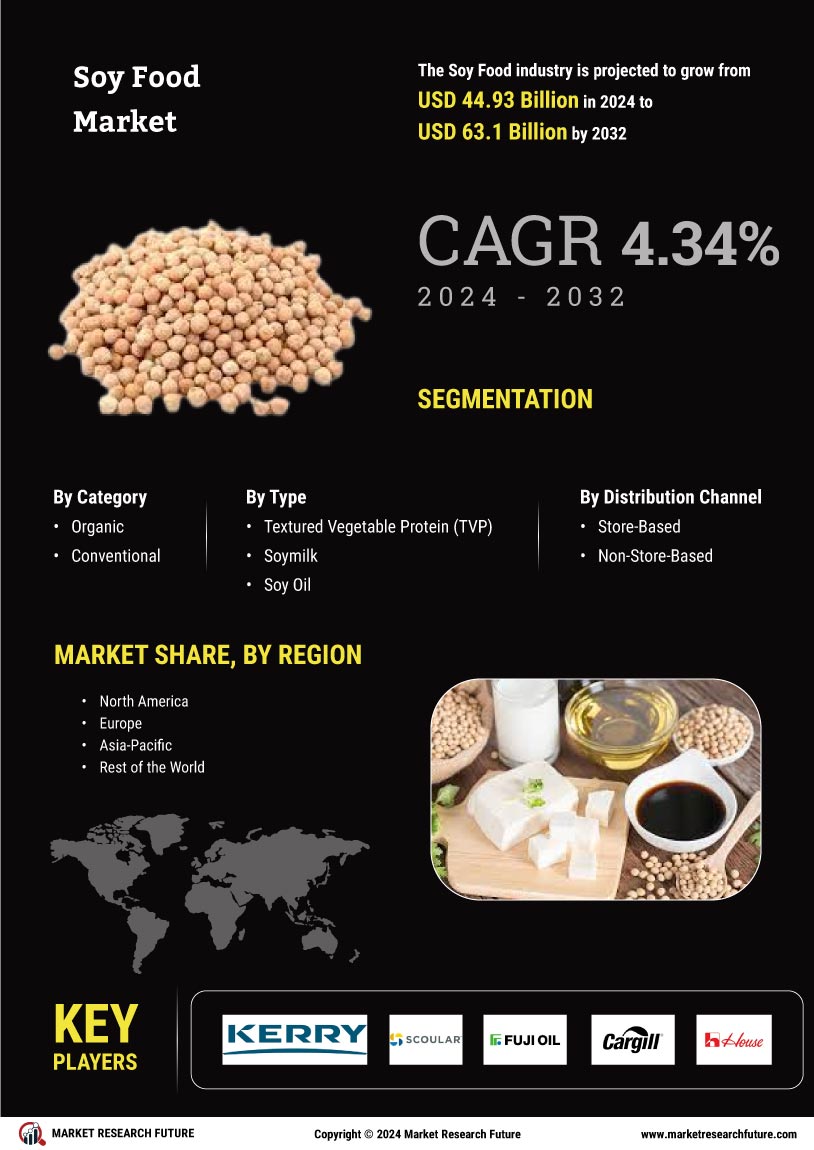

The increasing awareness of health and wellness among consumers appears to be a primary driver for The Global Soy Food Industry. As individuals seek healthier dietary options, soy foods, known for their high protein content and beneficial isoflavones, are gaining traction. Research indicates that soy consumption may contribute to lower cholesterol levels and improved heart health. In 2023, the market for soy-based products was valued at approximately 20 billion USD, reflecting a growing preference for plant-based proteins. This trend is likely to continue as more consumers prioritize nutrition and seek alternatives to animal-based products, thereby propelling the demand for soy foods.

Diverse Product Offerings

The expansion of product varieties within The Global Soy Food Industry is noteworthy. Manufacturers are innovating to create a wide range of soy-based products, including tofu, soy milk, tempeh, and soy protein isolates. This diversification caters to various consumer preferences and dietary needs, including lactose intolerance and veganism. In recent years, the introduction of flavored soy products and ready-to-eat meals has further enhanced market appeal. The availability of these diverse offerings is likely to attract a broader consumer base, thereby driving market growth. As of 2023, the soy milk segment alone accounted for over 30% of the total soy food market, underscoring the importance of product variety.

Global Trade and Export Opportunities

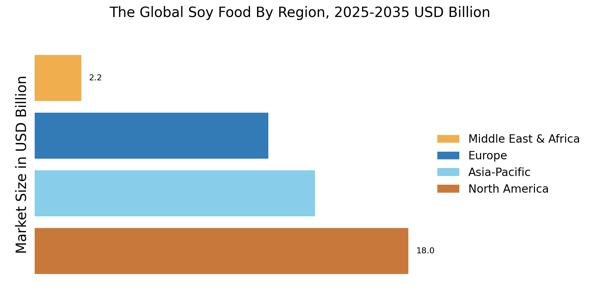

The Global Soy Food Industry is also influenced by trade dynamics and export opportunities. Countries that produce soybeans are increasingly looking to expand their markets internationally. The demand for soy products in regions such as Europe and Asia is on the rise, driven by changing dietary preferences and the need for protein-rich foods. In 2023, exports of soy products reached a record high, with significant contributions from major producing countries. This trend suggests that the market is likely to experience growth as international trade agreements facilitate the movement of soy foods across borders, thereby enhancing market accessibility and availability.

Rising Vegan and Vegetarian Populations

The increasing number of individuals adopting vegan and vegetarian lifestyles is a significant driver for The Global Soy Food Industry. As more people choose to eliminate animal products from their diets, the demand for plant-based protein sources, such as soy, is surging. This demographic shift is supported by a growing body of research highlighting the health benefits of plant-based diets. In 2023, it was estimated that approximately 8% of the population in developed countries identified as vegan, a figure that is expected to rise. This trend not only boosts the consumption of soy foods but also encourages innovation in product development to meet the needs of this expanding consumer segment.

Sustainability and Environmental Concerns

Sustainability has emerged as a crucial factor influencing consumer choices, particularly in the food sector. The Global Soy Food Industry is benefiting from a shift towards environmentally friendly food sources. Soy cultivation generally requires fewer resources compared to animal farming, which contributes to lower greenhouse gas emissions. As consumers become increasingly concerned about climate change and environmental degradation, the demand for plant-based foods, including soy products, is expected to rise. Reports suggest that the market for sustainable food products is projected to grow by 10% annually, indicating a robust future for soy foods as eco-conscious consumers seek sustainable dietary options.