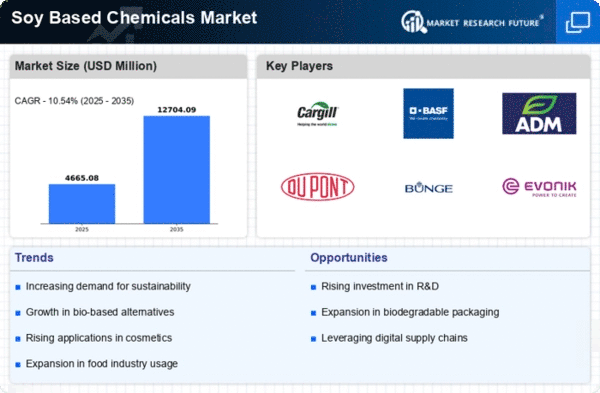

Market Growth Projections

The Global Soy Based Chemicals Market Industry is poised for substantial growth, with projections indicating a market value of 33.2 USD Billion in 2024 and an anticipated increase to 58.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.35% from 2025 to 2035, reflecting the increasing adoption of soy-based products across various sectors. The market dynamics are influenced by factors such as rising consumer demand for sustainable alternatives, supportive government policies, and technological advancements in production processes. These projections underscore the potential for soy-based chemicals to play a pivotal role in the transition towards a more sustainable economy.

Consumer Awareness and Preferences

Consumer awareness regarding the environmental impact of products is reshaping the Global Soy Based Chemicals Market Industry. As individuals become more discerning about their purchasing choices, there is a growing preference for products that are derived from renewable resources. This shift in consumer behavior is prompting manufacturers to reformulate products using soy-based chemicals, which are perceived as safer and more sustainable. The increasing demand for eco-friendly products is likely to drive market growth, as companies strive to align their offerings with consumer expectations. This trend not only enhances brand loyalty but also positions soy-based chemicals as a viable alternative in the competitive market landscape.

Government Initiatives and Support

Government initiatives play a crucial role in the expansion of the Global Soy Based Chemicals Market Industry. Policies promoting the use of bio-based materials are being implemented worldwide, encouraging manufacturers to adopt soy-based alternatives. For instance, subsidies and tax incentives for biofuel production have been introduced in several countries, fostering growth in the soy chemical sector. Such support not only enhances the economic viability of soy-based products but also aligns with global sustainability goals. As a result, the market is expected to witness a compound annual growth rate of 5.35% from 2025 to 2035, reflecting the positive impact of governmental policies on industry growth.

Rising Demand for Sustainable Products

The Global Soy Based Chemicals Market Industry experiences a notable surge in demand for sustainable and eco-friendly products. As consumers become increasingly aware of environmental issues, industries are shifting towards renewable resources. Soy-based chemicals, derived from soybeans, offer a biodegradable alternative to petroleum-based products. This transition is reflected in the projected market value of 33.2 USD Billion in 2024, indicating a robust growth trajectory. Companies are investing in soy-based formulations to meet regulatory standards and consumer preferences, thereby enhancing their market presence. The emphasis on sustainability is likely to drive innovation and expand the application of soy-based chemicals across various sectors.

Expanding Applications Across Industries

The versatility of soy-based chemicals is a driving force behind the growth of the Global Soy Based Chemicals Market Industry. These chemicals find applications in diverse sectors such as agriculture, automotive, and personal care. For instance, soy-based surfactants are increasingly used in cleaning products, while soy-based adhesives are gaining traction in the construction industry. This broad applicability not only enhances market penetration but also encourages cross-industry collaborations. As industries seek to replace conventional materials with sustainable alternatives, the demand for soy-based chemicals is expected to rise, contributing to the overall market growth and reinforcing its position in the global economy.

Technological Advancements in Production

Technological advancements are significantly influencing the Global Soy Based Chemicals Market Industry by enhancing production efficiency and product quality. Innovations in extraction and processing techniques have led to higher yields and lower production costs for soy-based chemicals. For example, advancements in enzymatic processes allow for the conversion of soy oil into various chemical derivatives with improved performance characteristics. This not only boosts the competitiveness of soy-based products against traditional petrochemicals but also expands their application range. As the industry evolves, these technological improvements are likely to attract more investments, further propelling the market towards its projected value of 58.9 USD Billion by 2035.