Increased Focus on Cybersecurity

The military jammer market is also influenced by the heightened focus on cybersecurity within military operations. As cyber threats become more prevalent, the need for jamming technologies that can protect critical communication channels from interception and disruption is paramount. Military jammers are being developed to not only disrupt enemy signals but also to safeguard friendly communications from cyber intrusions. The US military's investment in cybersecurity measures is expected to drive the military jammer market, with projections indicating a growth rate of 4% through 2025. This focus on cybersecurity underscores the importance of jamming technologies in maintaining operational integrity and security.

Emerging Threats and Countermeasures

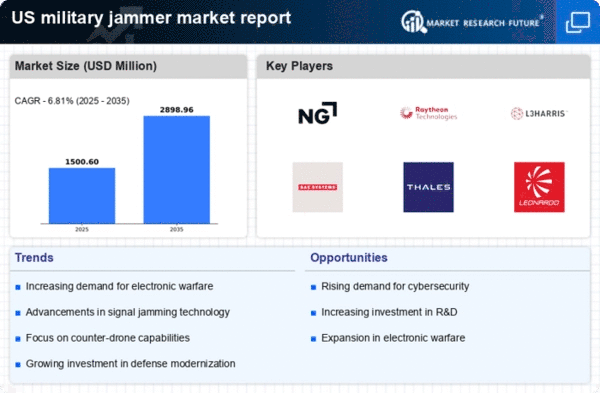

The military jammer market is experiencing growth due to the increasing complexity of modern warfare and the emergence of new threats. As adversaries develop advanced communication and navigation systems, the need for effective countermeasures becomes paramount. Military jammers play a crucial role in disrupting enemy communications, thereby enhancing operational effectiveness. The US Department of Defense has recognized this necessity, allocating substantial resources to develop and procure advanced jamming technologies. In 2025, the military jammer market is projected to reach approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 5%. This growth is driven by the imperative to maintain technological superiority in the face of evolving threats.

Integration of Electronic Warfare Systems

The integration of electronic warfare systems into military operations is a significant driver for the military jammer market. As military strategies evolve, the need for seamless integration of jamming capabilities with other electronic warfare assets becomes increasingly important. This integration allows for more effective targeting and disruption of enemy communications and radar systems. The military jammer market is expected to benefit from this trend, with the US military investing heavily in multi-domain operations that incorporate jamming as a core component. By 2025, the market is anticipated to grow by 6%, driven by the demand for sophisticated electronic warfare solutions that enhance situational awareness and operational effectiveness.

Growing Demand for Counter-Drone Technologies

The military jammer market is witnessing a surge in demand for counter-drone technologies, as the proliferation of unmanned aerial vehicles (UAVs) poses new challenges for military operations. Jamming systems are increasingly being utilized to neutralize hostile drones that threaten security and operational effectiveness. The US military is actively investing in technologies that can effectively disrupt drone communications and navigation systems. This focus on counter-drone capabilities is expected to propel the military jammer market, with growth projections indicating an increase of 7% by 2025. The integration of jamming technologies into counter-drone strategies highlights the evolving nature of modern warfare and the need for adaptive solutions.

Advancements in Miniaturization and Portability

Advancements in miniaturization and portability of jamming systems are significantly impacting the military jammer market. As technology progresses, smaller and more portable jamming devices are being developed, allowing for greater flexibility in deployment. This trend is particularly relevant for special operations forces that require lightweight and easily transportable equipment. The military jammer market is likely to see an increase in demand for these compact systems, as they can be rapidly deployed in various operational environments. By 2025, the market is projected to grow by 5%, driven by the need for versatile jamming solutions that can adapt to diverse mission requirements.