Increasing Military Expenditure

Emerging Markets and Defense Modernization

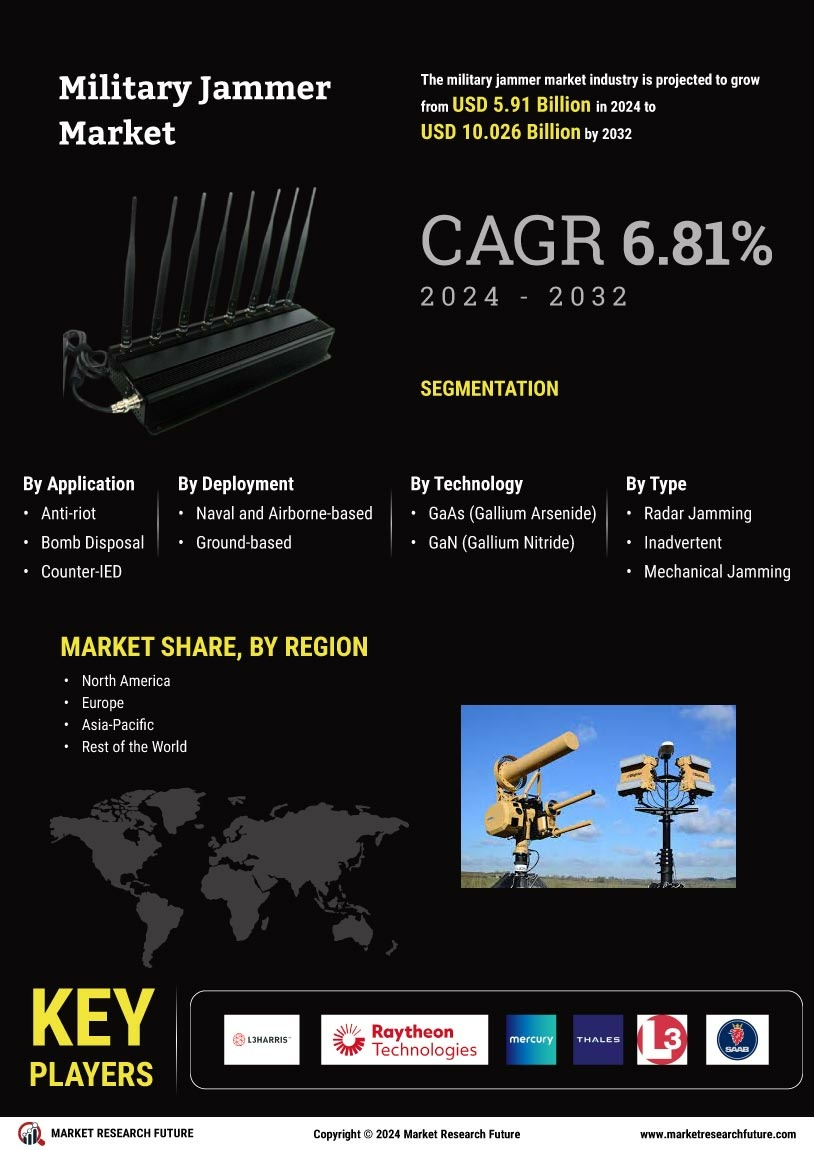

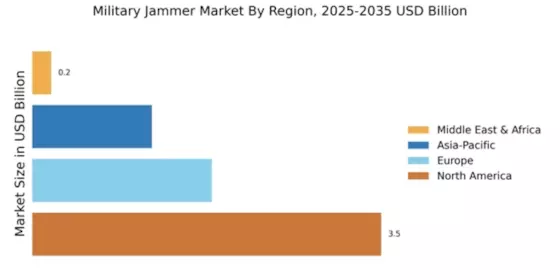

The Global Military Jammer Industry is benefiting from the defense modernization initiatives in emerging markets. Countries in Asia-Pacific and Latin America are increasingly investing in upgrading their military capabilities, including electronic warfare systems. This trend is driven by the need to address regional security challenges and enhance defense readiness. For example, nations such as India and Brazil are expanding their military budgets to incorporate advanced jamming technologies. As these emerging markets continue to modernize their defense forces, the demand for military jammers is projected to grow, contributing to the overall market expansion. The anticipated CAGR of 6.81% from 2025 to 2035 further underscores this trend.

Growing Demand for Cybersecurity Solutions

The Global Military Jammer Industry is witnessing a surge in demand for integrated cybersecurity solutions. As military operations become more reliant on digital communication, the risk of cyber threats increases. Jamming systems play a crucial role in safeguarding military communications against potential cyberattacks. The integration of jamming capabilities with cybersecurity measures provides a comprehensive defense strategy. This trend is particularly relevant as military forces recognize the need to protect sensitive information and maintain operational integrity. Consequently, the demand for advanced military jammers that can counter both electronic and cyber threats is expected to rise, driving market growth.

Geopolitical Tensions and Regional Conflicts

The Global Military Jammer Industry is also shaped by escalating geopolitical tensions and regional conflicts. Nations are increasingly aware of the need to protect their communication networks and military operations from adversaries. For instance, ongoing conflicts in areas such as Eastern Europe and the Middle East have heightened the focus on electronic warfare capabilities, including jamming systems. As countries strive to secure their operational environments, investments in military jammers are likely to surge. This heightened demand reflects a broader strategy to enhance national security and operational readiness, further contributing to the anticipated growth of the market.

Technological Advancements in Electronic Warfare

The Global Military Jammer Industry is significantly influenced by rapid technological advancements in electronic warfare. Innovations in jamming technologies, such as improved signal processing and miniaturization of equipment, enhance the effectiveness of military jammers. These advancements enable forces to disrupt enemy communications and radar systems more efficiently. For example, the integration of artificial intelligence in jamming systems allows for adaptive responses to various threats. As military forces seek to leverage cutting-edge technologies, the demand for sophisticated jamming solutions is expected to rise, thereby propelling the market forward. This trend underscores the importance of continuous research and development in the field.