Expansion of Commercial Applications

The expansion of commercial applications for drones is a significant driver of the drone analytics market. Industries such as real estate, insurance, and telecommunications are increasingly adopting drone technology for various purposes, including aerial photography, property assessments, and infrastructure inspections. The ability to gather and analyze data from unique perspectives enhances operational efficiency and reduces costs. As more businesses recognize the benefits of drone analytics, the market is expected to witness substantial growth. Reports suggest that the commercial drone market could reach a valuation of $30 billion by 2030, indicating a strong correlation with the growth of the drone analytics market. This expansion presents numerous opportunities for innovation and development within the sector.

Growing Demand for Data-Driven Decision Making

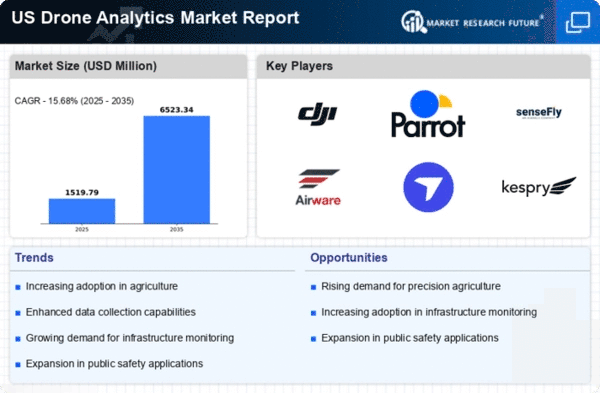

In an era where data-driven decision making is paramount, the drone analytics market is poised for growth. Organizations across various sectors, including construction, logistics, and agriculture, are increasingly relying on data analytics to enhance operational efficiency and reduce costs. Drones provide real-time data collection and analysis, enabling businesses to make informed decisions quickly. The ability to visualize data through drone analytics tools allows for better resource allocation and risk management. As companies continue to recognize the value of data in driving performance, the demand for drone analytics solutions is expected to rise significantly. This trend suggests a potential increase in market size, with estimates indicating a valuation of over $5 billion by 2030 in the drone analytics market.

Technological Advancements in Drone Capabilities

The drone analytics market is experiencing a surge due to rapid technological advancements in drone capabilities. Innovations such as enhanced sensors, improved battery life, and advanced imaging technologies are enabling drones to collect and analyze data more efficiently. For instance, drones equipped with LiDAR and multispectral sensors can provide high-resolution data for various applications, including agriculture and infrastructure monitoring. This evolution in technology is likely to drive the demand for drone analytics solutions, as businesses seek to leverage these capabilities for better decision-making. The market is projected to grow at a CAGR of approximately 25% from 2025 to 2030, indicating a robust expansion in the drone analytics market as organizations increasingly adopt these advanced tools.

Environmental Monitoring and Conservation Efforts

The growing emphasis on environmental monitoring and conservation is driving the drone analytics market. Drones are increasingly utilized for tasks such as wildlife tracking, habitat mapping, and pollution assessment. Their ability to cover large areas quickly and gather high-resolution data makes them invaluable for environmental scientists and conservationists. The integration of drone analytics in environmental studies allows for more effective monitoring of ecosystems and natural resources. As awareness of environmental issues continues to rise, funding for conservation projects is likely to increase, further propelling the demand for drone analytics solutions. This trend indicates a promising future for the drone analytics market, with potential growth opportunities in environmental applications.

Increased Investment in Infrastructure Development

The ongoing investment in infrastructure development across the United States is a key driver for the drone analytics market. As federal and state governments allocate substantial budgets for infrastructure projects, the need for efficient monitoring and management of these projects becomes critical. Drones equipped with analytics capabilities can provide real-time insights into construction progress, safety compliance, and resource utilization. This not only enhances project management but also helps in identifying potential issues before they escalate. The infrastructure sector is projected to grow by approximately 10% annually, which could lead to a corresponding increase in the adoption of drone analytics solutions. Consequently, the drone analytics market stands to benefit significantly from this trend.